We know from the last few weeks of developments that entertainment giant Warner Bros. Discovery (WBD) is an attractive property. And when Warner released its third quarter earnings, the reason behind all this interest became pretty clear. Warner investors, though, were less than compelled. Warner shares slipped modestly in the closing minutes of Thursday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The unquestioned winner of Warner’s third quarter was the Streaming & Studios segment, the part of Warner that will be Warner Bros. after the split, or someone else’s division after a purchase. Streaming & Studios brought in a hefty $1 billion in profit outright.

This contrasted poorly, however, with Global Linear Networks, the part of Warner that will be Discovery Global after the split, if it happens. It brought in a profit of $1.7 billion. Ultimately, Warner saw consolidated revenue at $1.4 billion, which was below forecasts, and finally yielded a net loss of $148 million, mostly due to $1.3 billion in “restructuring expenses,” among other things. The key takeaway here: Streaming & Studios in, Global Linear Networks on the decline.

You Won’t Believe What’s Coming Back

And just when we thought all the Warner news might have been, at best, a mixed bag, old familiar faces came back in for what should, hopefully, be an absolute win. Warner is bringing back Chris Columbus and Steven Spielberg to make Gremlins 3.

The return of the terrifying little critters was actually part of the third quarter earnings call, and even has a planned release date: November 19, 2027. When that day hits, it will be the first Gremlins installment released in 37 years. There is no word on the plot, or if it will be a straight horror like the original Gremlins, or a clever horror-comedy like its sequel Gremlins 2: The New Batch. Still though, both movies were good in their way, and a win like this should be helpful for Warner going forward. Theaters concerned about a lack of films coming in should likewise welcome a return to Gremlins-style fun.

Is WBD Stock a Good Buy?

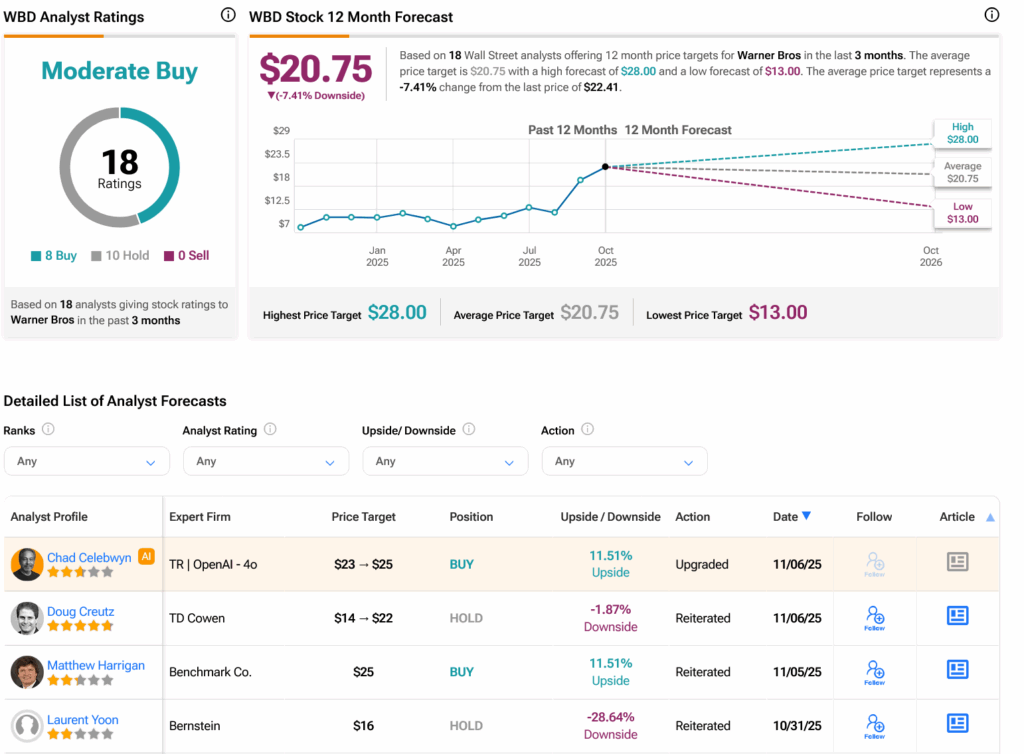

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on eight Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 142.9% rally in its share price over the past year, the average WBD price target of $20.75 per share implies 7.41% downside risk.