With entertainment giant Warner Bros. Discovery (WBD) likely to end up sold to somebody soon, new reports came out suggesting just what the linear television arm of Warner’s operation is worth. And the bad news here is that it is likely less than some hoped. Investors were not pleased by the suggestion, as shares slipped over 2% in the closing minutes of Tuesday’s trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The suggestion came from Comcast (CMCSA), which recently did the same thing Warner was planning to do: spin off its linear channels. Comcast’s spin-off was known as Versant (VSNT), and Versant trading went live in when-issued trading. Reports note Versant traded at around $49 early Tuesday, and Monday’s trading was “extremely light at under 5,000 shares,” noted a Barron’s report.

Some believe, here, that Versant will function like a canary in a coal mine, giving Warner a certain amount of warning on what to expect when its own linear channels spin off. Given that Paramount Skydance (PSKY) wants to buy the whole setup, and Netflix (NFLX) only wants the studios and streaming, that may be reason enough to pivot to Paramount as Versant demonstrates the likely value—or lack thereof—of a big block of cable channels.

Supergirl’s TikTok Treatment

Meanwhile, Warner is gearing up for the release of Supergirl, which is the next major installment in the DC Universe. While some are looking to Clayface to serve as a minor DC horror franchise, Supergirl is clearly the next major tentpole release. And the marketing is focusing hard on, of all things, TikTok.

With the new partnership, Supergirl will be the first video that users in the United States see when opening the app, and 13 other territories from Argentina to Australia and beyond will get the same treatment. TikTok, for its part, is using this as a test case to demonstrate the impact of its reach on box office figures. If this goes well, then TikTok can take its case to other studios and offer similar treatment with potentially similar results.

Is WBD Stock a Good Buy?

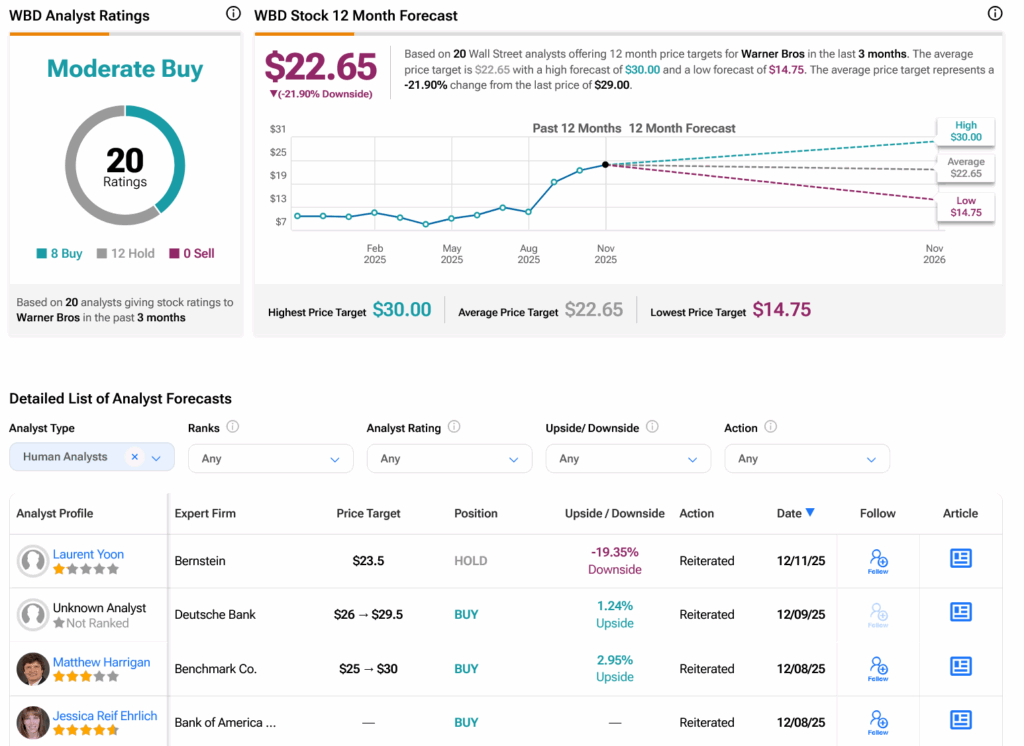

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on eight Buys and 12 Holds assigned in the past three months, as indicated by the graphic below. After a 161.76% rally in its share price over the past year, the average WBD price target of $22.65 per share implies 21.9% downside risk.