So back on Thursday, we came out with a look at the story so far on the sale of entertainment giant Warner Bros. Discovery (WBD). And in the interim, we found out something a little unexpected. When we pointed out that Netflix (NFLX) was likely to have an easier time getting through regulatory concerns because it would really only raise eyebrows at the Federal Trade Commission (FTC), we found out that those eyebrows are already starting to raise via White House officials. The news proved little help for Warner shares, which slipped fractionally in the closing minutes of Wednesday’s trading.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

A report from the New York Post revealed that Netflix posed “unique antitrust concerns,” a point we raised in our Thursday coverage. The one major problem that Netflix had was that it was the current leader in the streaming market, and by buying Warner, it would be adding what some reports call the fourth-largest streamer to its own arsenal.

Word from the White House—rather, an unnamed official therein—noted that Netflix buying Warner would result in “…one long slog…” which would “…touch off an investigation along the lines of those of Google (GOOG) and Amazon (AMZN).” The White House also seems to believe that Netflix owning Warner would “…stifle competition at some point,” a point which seems unlikely given the rest of the market. But with adjusted bids set to arrive, the question of who will walk away with Warner still remains.

Another Loss

Meanwhile, Warner lost another major name in its lineup, as the head of business affairs, Steve Spira, is set to resign. Given that Spira was a 40-year veteran of the studio, it is not exactly surprising. It is further not surprising given reports that Spira has nearly 20 grandchildren to his credit. But Spira’s career has been a strange one. Spira actually left Warner once before, back when AT&T (T) took it over. But he was brought back in 2022 by David Zaslav.

Spira looks to finish out the year—which has less than a month left to it anyway—and reports suggest his replacement will likely be pulled up from his own team. This is a reasonable enough assumption. However, it does come at an odd time, especially with multiple companies looking to buy Warner to begin with.

Is WBD Stock a Good Buy?

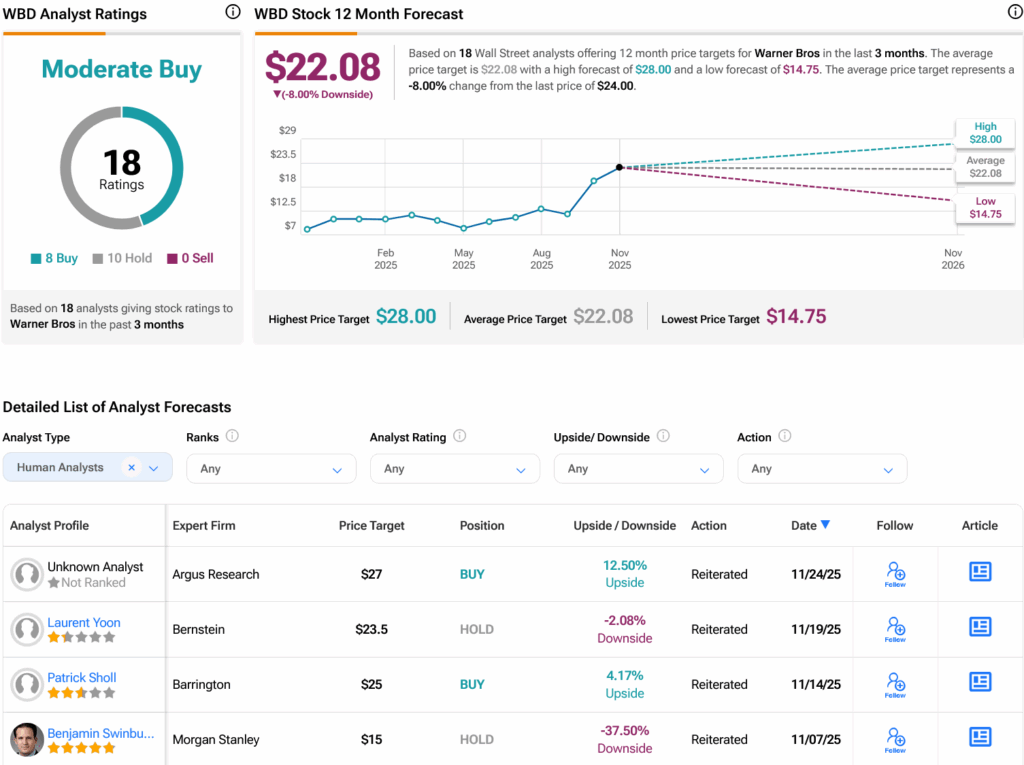

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on eight Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 127.27% rally in its share price over the past year, the average WBD price target of $22.08 per share implies 8% downside risk.