Shares of UK-based Games Workshop Group PLC (GB:GAW) soared higher today after its latest trading update signalled better-than-expected numbers in H1 FY24/25. Investors welcomed the news, pushing the stock up nearly 16% at the time of writing. So far this year, GAW shares have climbed 36.4%.

Games Workshop specializes in designing and producing miniature wargames, with its flagship product being the popular Warhammer 40,000.

Games Workshop Defies Forecasts

According to Games Workshop’s update, revenue for the six months ending in December is projected to surpass £260 million, up from £235.6 million in the first half of FY23/24. Additionally, pre-tax profit is expected to reach at least £120 million, marking a growth over the profit of £96.1 million in the same period last year.

The company also stated that its licensing revenue is expected to jump from £13 million last year to at least £30 million in the first half.

Jefferies Analysts Weigh in on GAW Update

Analysts Andrew Wade and Grace Gilberg from Jefferies attributed the higher sales to strong licensing revenue, driven by the September release of the video game Space Marines 2, which may have contributed approximately £20 million in the first half alone.

Meanwhile, the analysts also believe that core sales performance remained strong despite tough comparison metrics last year, which saw the launch of the 10th Edition of the Warhammer 40,000.

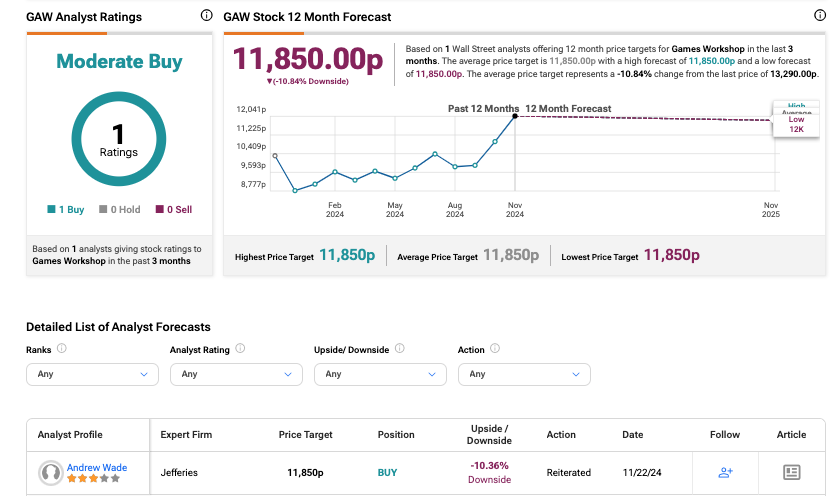

Following the update, Wade reiterated his Buy rating on GAW stock with a price target of 11,850p, suggesting a potential downside of 10.4% from the current trading level.

Is Games Workshop a Good Stock to Buy?

According to TipRanks, GAW stock has a Moderate Buy rating based on one Buy recommendation from Jefferies. The average Games Workshop share price target of 11,850p predicts a downside of about 11% from the current trading level.