Artificial intelligence hype throughout this year fueled fears of a bubble bursting. Yet, AI startups have raked in $150 billion in new funding this year, according to data from PitchBook.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The record figure suggests some of Wall Street’s biggest and most popular startups might be building out their defenses against a possible market downturn in the next year. The number rose by about 63% from $92 billion raised in 2021, driven by mouth-watering rounds by heavyweight AI startups such as OpenAI (PC:OPAIQ) and Anthropic (PC:ANTPQ).

Investors Pump Funds into AI Startups

For instance, in late October, OpenAI raised $40 billion in a funding round backed by Japanese conglomerate SoftBank (SFTBY), with contributions from others, including Microsoft (MSFT). The round put the startup’s valuation at $300 billion and marked one of the largest private investments in history.

OpenAI is now reportedly making plans to go public in late 2026 or early 2027 at a valuation of $1 trillion to fuel its artificial general intelligence ambitions. Notably, Meta (META) earlier this year also made a $14 billion bet in data-labeling startup Scale AI, and Perplexity AI — which is seen as a possible challenger to search giant Google (GOOGL) — hit a $20 billion valuation in September after a new funding round.

AI Bubble Fears Remain

Despite these developments, concerns remain about unprecedented capital expenditure on AI infrastructure. While AI chip leader Nvidia’s (NVDA) recent blockbuster third-quarter 2025 earnings results boosted investor sentiment, the fears returned after cloud company and software giant Oracle’s (ORCL) Q2 2026 sales fell short of Wall Street’s expectations.

This is despite Oracle growing its sales by 14% from a year ago. SoftBank CEO Masayoshi Son’s $15 billion stock sell-off, including his entire stake in Nvidia, did not help matters either.

Why Do Investors’ Concerns Stick?

The pressure comes amid the high cost of developing, running, and maintaining AI workloads and infrastructure. For instance, while OpenAI continues to improve its margin, the startup remains unprofitable. This is despite more than doubling its revenue, which is expected to reach $12.5 billion by the end of this year.

According to HSBC analyst Nicolas Cote Colisson, OpenAI may need $207 billion in new funding by 2030. This comes even as the startup’s compute costs have been projected at over $1 trillion.

What’s Next in 2026?

Nonetheless, beyond hedging against risks, some observers see these startups positioning for acquisition opportunities should investor sentiment turn sour in 2026. Recent fundraising efforts by venture capital firms further suggest that highly valued AI startups will continue drawing capital into the new year.

What Are the Best AI Stocks to Buy in 2026?

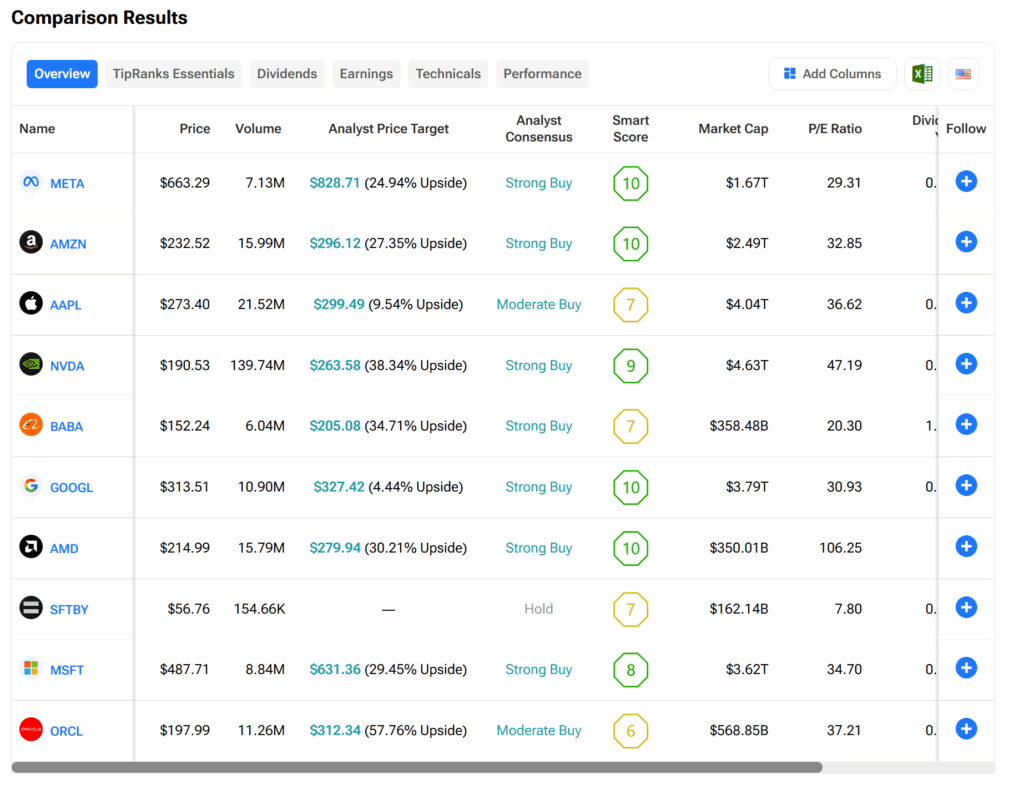

Using the TipRanks Stock Comparison tool, investors can rely on Wall Street analysts’ ratings to determine which AI stocks, including those mentioned in this article, are currently worth buying. Kindly refer to the image below.