Media company Walt Disney (DIS) is set to release its Q4 FY24 results on November 14. Wall Street analysts expect the company to report earnings per share of $1.10, a 34% year-over-year increase. Also, revenue is expected to reach $22.48 billion, representing a 6% year-over-year increase, according to data from the TipRanks Forecast page.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Interestingly, Walt Disney has an encouraging earnings surprise history. The company missed earnings estimates just twice out of the previous nine quarters.

Encouraging Website Traffic Trend

Along with encouraging analysts’ estimates, Walt Disney’s website traffic data also suggests strong results for the company in Q4. It should be noted that investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

TipRanks’ website traffic screener shows that Disney’s traffic rose both sequentially and year-over-year in Q4. According to the tool, the number of visits to disneyplus.com increased 65.83% from the year-ago quarter and 21.08% sequentially. The rise in visits signals strong momentum in Disney’s streaming business and a robust content lineup.

Key Takeaways from TipRanks’ Bulls & Bears Tool

Building on the encouraging website data, bullish analysts from TipRanks’ Bulls Say, Bears Say tool, highlight that Disney’s strong content lineup is expected to fuel both subscriber growth and profitability. Also, they emphasize that Disney’s stock is currently trading at a discount compared to its peers and the S&P 500 (SPX), making it attractive for investors.

However, we should never forget about the bearish arguments. Some concerns among analysts include softening consumer demand and near-term headwinds in Disney’s Parks & Experiences segment. They expect weak operating income (OI) for this segment, impacted by global weather-related closures, pre-opening costs for new cruise ships, and cyclical softness in Shanghai.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 7.34% move in either direction.

Is Walt Disney a Good Stock to Buy?

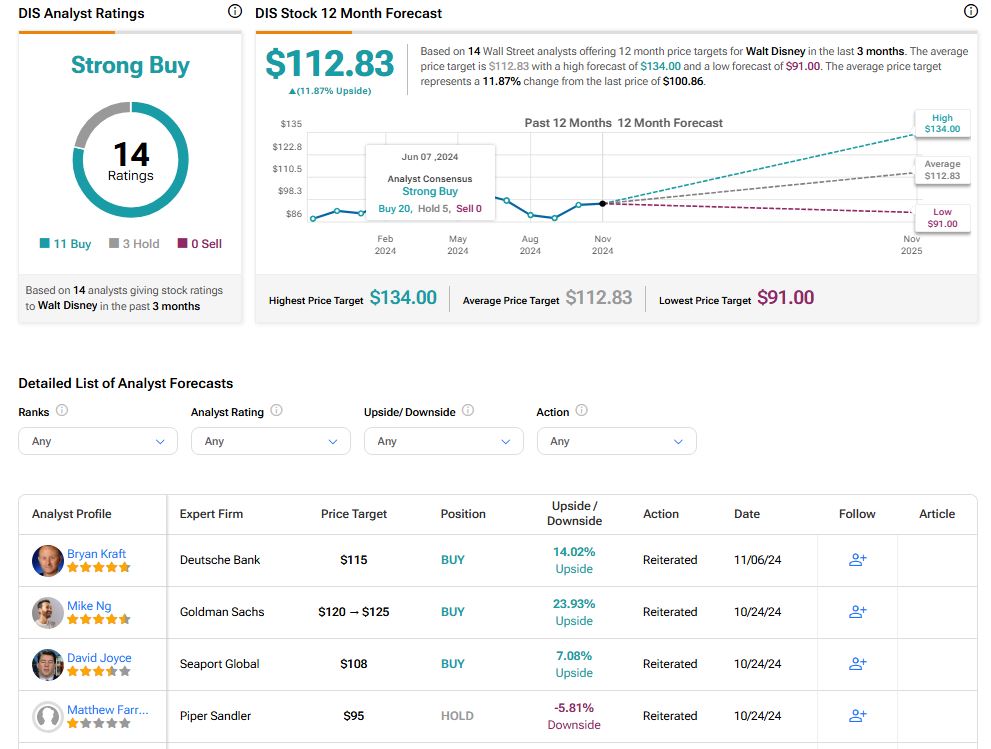

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 11 Buys and three Holds assigned in the past three months, as indicated by the graphic below. The average DIS stock price target is $112.83, implying upside potential of 11.87%.