Walmart (NYSE:WMT) seeks buyers for its recently shuttered healthcare centers business. According to a recent Fortune report, the retail giant is reportedly in talks with health insurance company Humana (NYSE:HUM) for a potential deal.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The outcome of the talks remains uncertain. Meanwhile, let’s understand why Walmart closed its healthcare centers business.

Closure of WMT’s Health Centers

In April, Walmart closed its health centers and virtual care business, citing an unsustainable operating model. The company pointed to a tough reimbursement environment and rising operating costs as the primary reasons for the closure.

Walmart Health was launched in 2019 to diversify its revenue model. However, the business struggled to achieve profitability, leading to the shutdown of all 51 centers across five states.

Ongoing Strength in Core Retail Operations

Despite setbacks in its healthcare venture, Walmart’s core retail operations remain strong. The retailer dominates the grocery sector, with its revenue and operating income registering solid growth in the first quarter of Fiscal 2025.

Walmart’s value pricing, growing e-commerce, and focus on merchandise augur well for growth.

Walmart is Diversifying Revenue Streams

While the company’s core retail business is performing well, its focus on diversifying its revenue model is a positive step. It’s worth noting that WMT’s advertising business is showing strength. In Q1 of Fiscal 2025, WMT’s global advertising revenue grew 24%, led by solid growth in the U.S. and international markets.

The company’s overall active advertiser counts increased by nearly 19%.

Analyst Lifts Price Target

The strength in its retail business and the addition of alternative growth channels led Deutsche Bank analyst Krisztina Katai to raise the price target on WMT stock to $77 from $71 on July 1. Katai maintained a Buy on WMT stock.

The analyst is bullish about WMT’s multi-year growth strategy. WMT’s growth will likely be driven by market share expansion, automation of the supply chain, and revenue diversification.

Katai has a 75% success rate on WMT stock. This means copying Katai’s trades and holding each position for one year would result in 75% of your transactions generating a profit. Further, the analyst’s recommendations on WMT stock generated an average return of 13.05% per trade.

Is Walmart a Buy, Sell, or Hold?

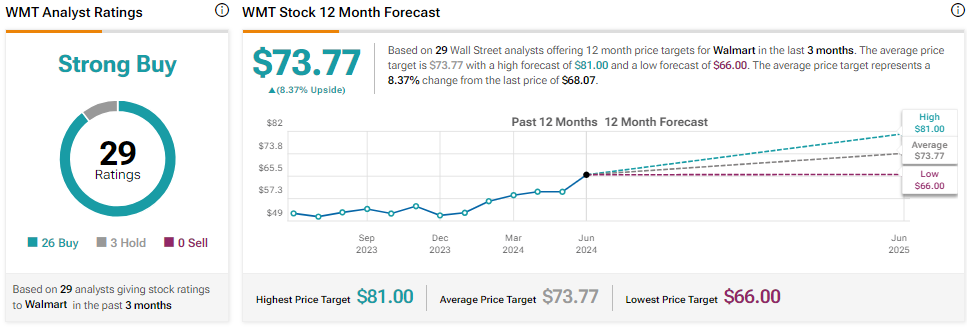

Wall Street is bullish about Walmart’s prospects. Including Katai, WMT stock has received 26 Buy ratings. Further, three analysts suggest Hold. Overall, Walmart stock has a Strong Buy consensus rating.

The price target for WMT stock is $73.77, implying 8.37% upside potential from current levels. Walmart stock is up about 30.4% year-to-date, outperforming the S&P 500’s (SPX) nearly 15% gain.