Retail giant Walmart (WMT) is set to announce its fiscal Q2 FY25 results on August 15. Wall Street analysts expect the company to report revenues of $168.56 billion, up about 4% year-over-year. Meanwhile, they expect earnings of $0.65 per share for Q2, up 6.6% from the year-ago quarter.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Interestingly, WMT has a solid earnings surprise history. The company exceeded earnings estimates in eight out of the previous nine quarters.

Factors to Consider Ahead of Q2

Walmart is expected to deliver another strong quarter, fueled by ongoing innovation, including advanced technology to enhance customer experience and outpace competitors.

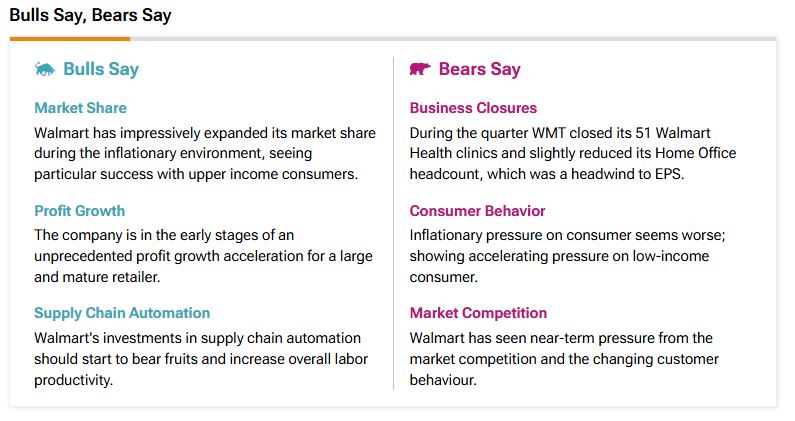

Also, TipRanks’ Bulls Say, Bears Say tool pictured below shows optimism about Walmart’s performance, highlighting its impressive market share expansion amid inflation. They believe the company is on the brink of exceptional profit growth. Further, investments in supply chain automation are expected to boost labor productivity and deliver positive results.

However, it’s important to keep the bearish arguments in mind. Bears are concerned about Walmart due to rising inflationary pressures on low-income consumers and increased market competition, leading to short-term challenges.

Encouraging Website Traffic Trend

Investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

Of late, Walmart has achieved robust e-commerce sales, highlighting its efforts to improve digital capabilities. In Q1 FY25, WMT’s e-commerce sales rose 21%, driven by a growing marketplace.

In line with this, TipRanks’ Website Traffic tool reveals that total estimated visits to walmart.com increased by 15.12% year-over-year in Q2.

Options Traders Anticipate a 5.59% Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 5.59% move in either direction.

Stock Price Performance

Walmart’s stock has grown about 30% this year and hit a new peak last month. It has also outperformed the S&P 500’s (SPX) 19% gain over the past year.

Additionally, Walmart remains a strong performer in delivering shareholder value. The company increased its quarterly dividend by 9% earlier this year as part of its ongoing strategy to return value to shareholders.

Is WMT a Good Stock to Buy Now?

Overall, the Street has a Strong Buy consensus rating on Walmart, alongside an average price target of $74.11. However, analysts’ views on the company could see changes after the company reports its earnings today.