Retail giant Walmart (WMT) is set to report earnings on November 19. Analysts expect modest bottom-line growth and steady top-line performance, even though projections indicate double-digit EPS growth in Fiscal 2025. While there are valid arguments both for and against investing in Walmart based on its fundamentals and valuation, I maintain a Buy rating ahead of its earnings report. Walmart is poised to gain market share amid shifting consumer trends, making it a solid pick for growth-biased portfolios—even with its stretched valuation after this year’s rally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In this article, I will review Walmart’s performance so far this year, provide insights into what to expect from Fiscal Q3, and take a closer look at why its valuation multiples appear so stretched.

Walmart’s 2024 Trajectory Shows Strong Performance

Walmart has proven to be a strong defensive pick for investors in 2024, benefiting from growing demand for safe, stable companies amid global macroeconomic instability, adding to my bullish stance on the stock. The company has surged nearly 61% year-to-date, reflecting its ability to consistently outperform expectations over the past several quarters.

Analyst Michael Baker of D.A. Davidson, for instance, attributes Walmart’s success to a shift in consumer behavior, with U.S. shoppers consolidating their purchases to Walmart, Costco (COST), and Amazon (AMZN)—three retailers that have gained market share this year. In a tough economy, consumers are prioritizing value and essentials over discretionary items, which has positioned Walmart, along with Costco and Amazon, as key winners. While these retailers still sell higher-margin products, they first attract customers with groceries and other necessities.

As a result of shifts in consumer spending, Walmart has reported strong earnings, including in its most recent quarter (Fiscal Q2), and raised its full-year guidance. The company now forecasts sales growth of 3.75% to 4.75%, up from the previous range of 3% to 4%, and operating income growth of 6.5% to 8%, compared to the prior forecast of 4% to 6%.

Near-Term Growth Likely to Be Modest

As we approach Walmart’s Fiscal Q3 earnings report, several factors should be highlighted. One key driver of sales growth is likely to be e-commerce. In the previous quarter, e-commerce sales rose 20% across all segments, with U.S. marketplace sales up 32%, highlighting the success of Walmart’s digital strategy.

Additionally, the growth of Walmart’s delivery and pickup services, which are expanding faster than in-store sales, highlights strong consumer demand for convenience and the company’s ability to capitalize on this trend. However, top-line growth is expected to be modest, with an estimated 4.3% year-over-year increase totaling $166.3 billion, which is somewhat cautious.

A potential weak spot in Walmart’s figures could come from its U.S. general merchandise business, even though food sales have remained strong in recent quarters. The company has mentioned improvements in general merchandise but has not highlighted any significant growth, suggesting ongoing challenges in non-food categories. While Walmart has not experienced a general decline in consumer spending, there is an implied risk of more conservative consumer behavior, which could affect discretionary spending, particularly in general merchandise.

Lastly, attention will also be focused on Walmart’s margins. In Fiscal Q2, the company achieved a 43 basis point expansion in consolidated gross margins, reaching 24.4%, driven by strong performances in both U.S. and international markets. However, Walmart’s management team has indicated that planned expenses in Q3 are more concentrated than in Q4, which could limit profitability in the near term. This may make it more difficult for the company to meet the high end of its Q3 guidance, which forecasts earnings of $0.51 to $0.52 per share—representing 3% year-over-year growth.

Is It Worth Buying WMT at its Current Valuation?

One of the main points of skepticism surrounding the bullish thesis for Walmart right now is its elevated valuation. With a forward P/E ratio of 34.4x, the stock is trading about 40% higher than its average over the past five years. This higher-than-usual multiple might raise a few eyebrows for some investors.

However, it’s important to consider the unique strengths that make Walmart an attractive long-term investment despite its high valuation. Perhaps the most valuable characteristic of Walmart stock is its low correlation with the broader stock market, driven by the cycle-agnostic nature of its business model. Walmart is a profitable legacy American brand with impressive long-term resilience. It consistently delivers solid earnings, meaning there are no immediate red flags that would cause a dramatic drop in its stock price—apart from broader market slumps.

In times of weakened consumer spending, Walmart’s position as a go-to destination for value-conscious shoppers becomes even more evident. This makes it perform well in both good and bad times, providing stability in volatile markets. For investors, buying Walmart means acquiring a company that “zigs while the rest of the market zags,” a characteristic that is increasingly appreciated in stocks like Walmart and Costco. This is reflected in Walmart’s five-year monthly beta of 0.53, indicating that its stock typically moves only half as much as the overall market, offering a level of stability not found in many other stocks.

Is WMT Stock a Good Buy?

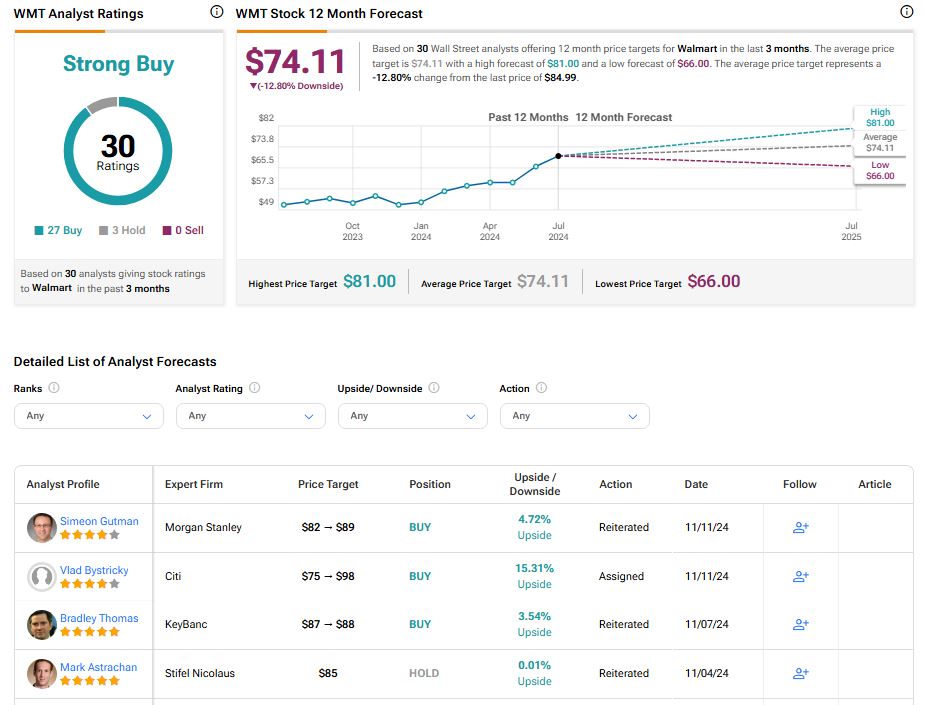

At TipRanks, WMT has a Wall Street consensus rating of “Strong Buy,” based on 30 analysts—27 of whom are bullish, while three maintain a neutral stance. However, the average price target is $74.11, suggesting a potential downside of 12.80%. This, for me, indicates some discomfort among analysts with Walmart’s current valuation.

Conclusion

I’m bullish on Walmart heading into Fiscal Q3. Despite low to moderate growth expectations, the company is well-positioned to gain market share while competitors struggle. Walmart has also made key moves to strengthen its position in the e-commerce era. Although this may not be a “buy Walmart while it’s underappreciated” moment, I still believe the stock is worth serious consideration—especially for its defensive characteristics.