The Cboe Volatility Index (VIX), known as Wall Street’s fear gauge, is at an extremely rare “crisis Level” as stocks swing wildly between gains and losses.

The VIX is currently above 40, a level that signals “a crisis that demands an immediate policy response,” according to DataTrek Research. Analysts say the current elevated level of the fear gauge is indicative of a market panic and shows that the selling of stocks by investors is reaching a frantic pace.

The VIX, which is based on trading in options on the S&P 500 index, stood at the level of 30 only a few days ago. The index is now at its highest level since the outbreak of the Covid-19 pandemic five years ago, indicating that fear across Wall Street is worsening.

Big Swings

Approaching noon hour in New York on April 7, U.S. equities were swinging wildly between gains and losses as rumors circulated online that U.S. President Donald Trump planned to suspend import tariffs for 90 days. However, Trump then threatened publicly to add an additional tariff of 50% on China if Beijing doesn’t remove its retaliatory 34% duties immediately.

It’s not clear where the stock market goes from here or if the Trump administration will back down from some of its trade tariffs. Both the benchmark S&P 500 and the technology-laden Nasdaq Composite indices are now in a bear market defined as a drop of 20% or more. The VIX was also as high as it is now when the 2008 financial crisis occurred, and when the dotcom bubble burst in 2000.

Is the Vanguard S&P 500 ETF a Buy?

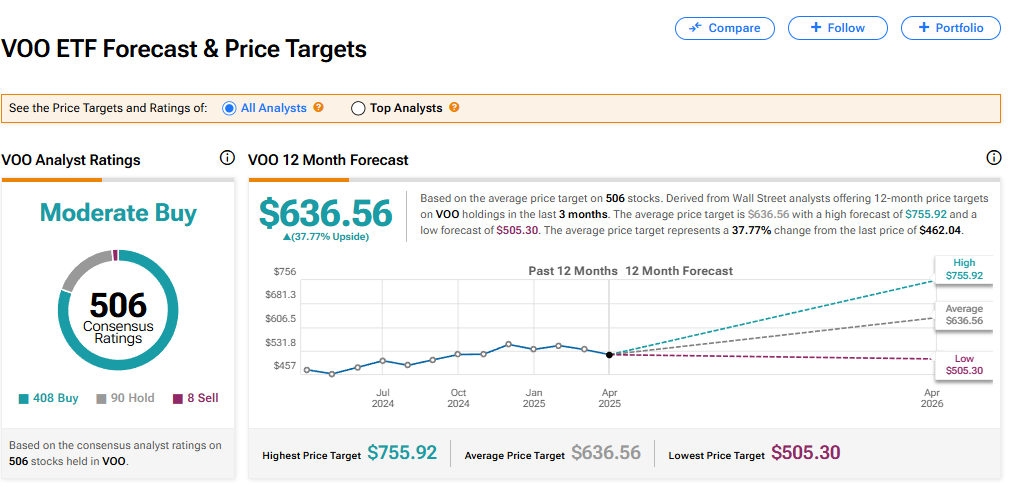

The Vanguard S&P 500 ETF (VOO), which tracks the movements of the benchmark U.S. stock index, has a consensus Moderate Buy rating among 506 Wall Street analysts. That rating is based on 408 Buy, 90 Hold, and eight Sell recommendations made in the last three months. The average VOO price target of $636.56 implies 37.77% upside from current levels.