Chinese e-commerce giant Alibaba (BABA) recently reported its Q2 FY26 earnings results, and Wall Street analysts remain bullish on the stock, projecting over 20% upside from current levels. The stock has already gained about 93% year-to-date. A renewed focus on AI and cloud, along with new AI product launches, has helped drive the rally and keep investor confidence strong.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

New Product Launch Adds to Momentum

Alibaba has also stepped into the AI wearable market with its new Quark smart glasses, now available in China. This marks the company’s first major move into AI-powered consumer hardware. The glasses are priced from 1,899 yuan (about $268) and look like regular black-frame eyewear rather than bulky headsets. They run on Alibaba’s own Qwen AI model, the same technology powering its upgraded chatbot launched earlier this month.

By designing both the hardware and AI model in-house, Alibaba appears to be aiming for deeper user engagement and tighter integration across its ecosystem.

Analysts’ Views on BABA Stock

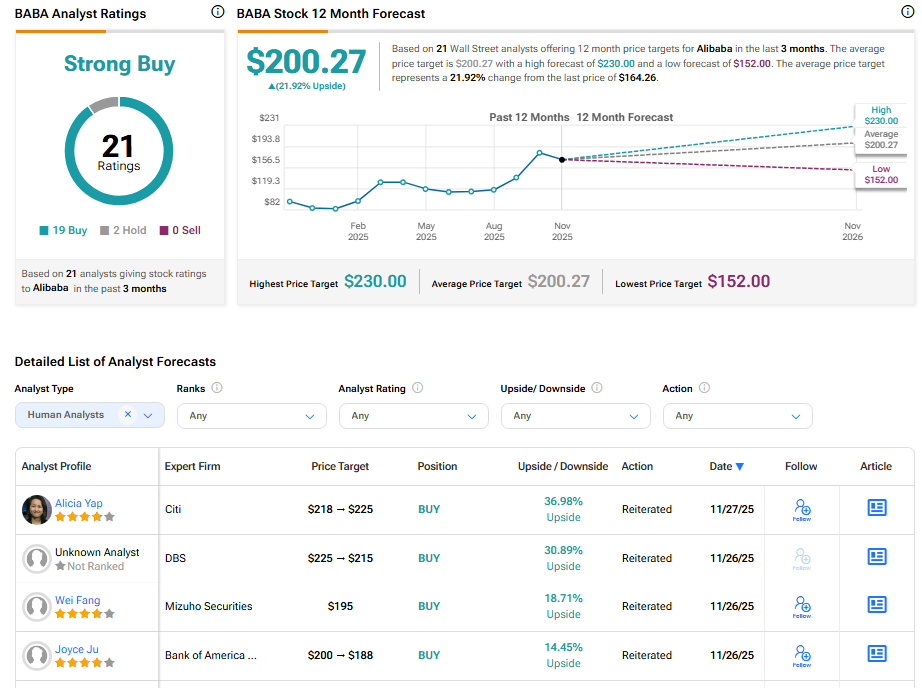

About 90% of Wall Street analysts remain bullish on Alibaba’s outlook, pointing to steady demand and improving platform activity. Still, some analysts have trimmed price targets after the recent Q2 FY26 results, noting softer near-term e-commerce growth and weaker margins as Alibaba increases spending to stay competitive.

After earnings, Top Bank of America analyst Joyce Ju reaffirmed her Buy rating but lowered her price target to $188 from $200. Ju said the cloud division was the strongest part of the quarter, and she expects cloud revenue to stay on a “fast growth track” as Alibaba rolls out new AI products. She also noted that quick commerce trends, including grocery and delivery, are improving.

However, Ju cautioned that growth in Alibaba’s core e-commerce business may slow in the December quarter. She expects customer management revenue (CMR), which includes merchant ads and fees, to cool as earlier price benefits fade. Because of this, she cut her earnings forecasts by 7% to 20% through FY28. Even so, Ju does not view this as a long-term concern and pointed out that user traffic and engagement across Alibaba platforms continue to rise.

Meanwhile, Bernstein also cut its price target on Alibaba to $190 from $200, but kept an Outperform rating on the stock. The firm said Alibaba’s Q2 results were solid and mostly matched expectations. While there is still debate about how much value AI will create for the company, Bernstein noted early success from Alibaba’s new Qwen app, which has already passed 10 million downloads within the first week of its relaunch and is showing strong user stickiness.

Is Alibaba Stock a Good Buy Right Now?

Analysts remain bullish about Alibaba’s stock trajectory. With 19 Buy ratings and two Hold ratings, BABA stock commands a Strong Buy consensus rating on TipRanks. Also, the average Alibaba price target of $200.27 implies about 21.92% upside potential from current levels.