Microsoft (MSFT) stock gained about 15% in 2025, slightly lagging the 16.4% rise in the S&P 500 Index (SPX). However, Wall Street is highly bullish on MSFT stock and views it as one of the key beneficiaries of the artificial intelligence (AI) wave. Notably, analysts are upbeat about the prospects of the company’s Azure cloud business and the demand for its AI-powered productivity tools.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Moreover, Microsoft is benefiting from its relationship with ChatGPT maker OpenAI. While there are concerns about MSFT’s elevated capital spending, most analysts are confident about the company’s ability to deliver the desired results from its massive investments to support AI-led demand.

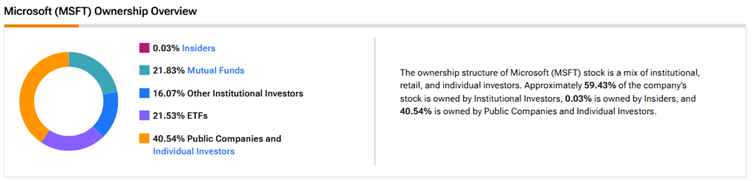

Now, according to TipRanks’ Ownership Tool, public companies and individual investors own 40.54% of Microsoft. They are followed by mutual funds, ETFs, other institutional investors, and insiders at 21.83%, 21.53%, 16.07%, and 0.03%, respectively.

Digging Deeper into Microsoft’s Ownership Structure

Looking closely at the top shareholders, Vanguard owns the highest stake in Microsoft at 8.17%, followed by Vanguard Index Funds with a 6.69% holding.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 3.14% stake in MSFT, while the Vanguard S&P 500 ETF (VOO) owns 2.53%.

Moving to mutual funds, Vanguard Index Funds holds about 6.69% of Microsoft. Meanwhile, Fidelity Concord Street Trust owns 1.75% of the company.

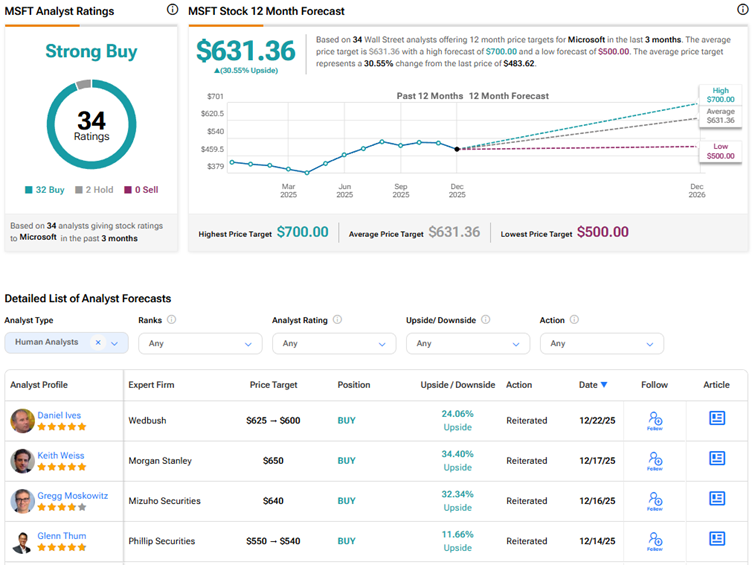

Is MSFT Stock a Buy, Sell, or Hold?

Currently, Wall Street has a Strong Buy consensus rating on Microsoft stock based on 32 Buys and two Hold recommendations. The average MSFT stock price target of $631.36 indicates 30.6% upside potential.