As the corporate world navigates through another busy earnings season, corporate insiders have been eager to add value to their personal portfolios.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

By analyzing the transactions executed by Senior Officers, Directors and Beneficial Owners of publicly traded companies, external investors without access to the type of material, non-public information that corporate insiders possess, can gain valuable insights into whether those who control the business are net buyers or sellers.

Peter Lynch, one of the greatest stock pickers of all time, said that “insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

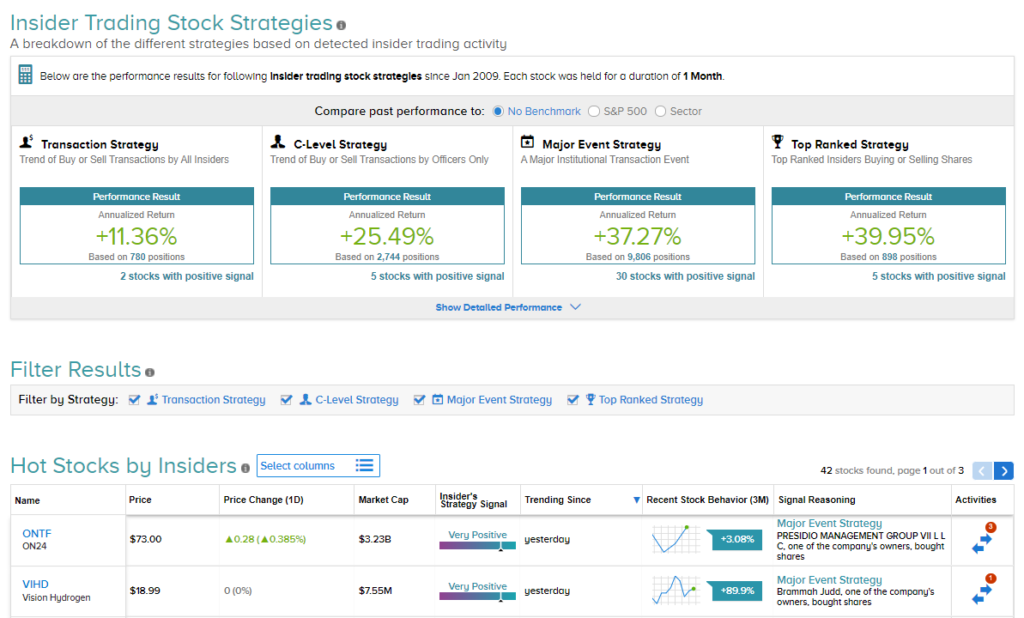

Here are some of the most notable recent Corporate Insider plays that have been identified using TipRanks’ Insider’s Hot Stocks tool.

Shares of Outlook Therapeutics (OTLK) have surged 187% over the past week as SEC filings indicate that a number of insiders within the company have acquired additional shares for their portfolios.

Syntone Ventures acquired an additional 3 million shares at an average price of $1 a share, taking its total stake in Outlook to over 12% of the company. Meanwhile, two days earlier, Director, Ghiath Sukhtian, increased his stake in the company to 20% with the acquisition of an additional 8.3 million shares.

Brookline Capital Markets analyst Kumaraguru Raja believes that OTLK shares still possess around 31% upside potential over the next 12 months as he maintained his $5 price target and Buy rating on the stock last week. Raja is a 5-star analyst on TipRanks and covers the healthcare sector.

Basewood Capital Management, a Director-by Deputization of Dime Community Bancshares (DCOM), increased its holdings in the company by an additional 293,871 shares to the value of almost $7.5 million. This brings Basewood’s total holding in the company to over $101 million, which equates to around 12%. DCOM is up around 7% since the start of the year.

Piper Sandler analyst Mark Fitzgibbon initiated coverage with a Buy rating on DCOM last week after the company completed its merger with Bridge Bancorp. His price target of $32 implies upside potential of around 23% from the most recent close of $25.96. Fitzgibbon believes that the merger will make the company a “significant player” in Long Island’s “large and attractive market.”

Flagship Ventures Fund increased its stake in Evelo Biosciences (EVLO) to 32%, with an additional $1.95 million investment in the clinical stage bio-tech company. Last month, Evelo announced the pricing of a 4.5 million share public offering to raise $67.5 million that will go towards the continued development of its treatments of dermatitis and psoriasis.

JMP Securities analyst Gobind Singh raised his price target on EVLO two weeks ago to $36 from $27 after meeting with the company’s management. Singh told investors that he sees Evelo as having the “best profile for mild-to-moderate atopic dermatitis” and that the trials for treatments of psoriasis and COVID-19 will provide the kind of results that justify his price target, which suggests 98% upside potential. EVLO shares have already gained 50% in value year-to-date.

Last week, a number of corporate insiders including Executive Vice Presidents and Chief Financial Officers of Brandywine Realty (BDN) exercised their rights to convert their options into shares to the value of almost $1.2 million. The largest of these transactions was by President and CEO, Gerard Sweeney, who exercised his option to buy 50,815 shares at $11.10, with the total value landing at $564,047.

Shares of BDN have gained over 7% in the past week following the release of its fourth quarter and full year 2020 results. The property company also announced a joint venture with a global institutional investor to construct a 570,000 square foot development that will cost $287 million and will begin in March 2021.

Analysts on the Street are cautiously optimistic, with a Moderate Buy consensus rating based on 3 Buys, 2 Holds and 1 Sell. The average analyst price target of $12.90 suggests upside potential of around 9% over the next 12 months.

Gilead Sciences (GILD) increased its stake in Arcus Biosciences (RCUS) to 19.5%, from approximately 13%, by purchasing an additional 5.65 million shares at an average price of $39. This brings Gilead’s total holding value in Arcus to almost $576 million. RCUS has gained around 60% in value since the year began, while GILD is up around 17% year-to-date.

“The proceeds from this financing will support and enable the acceleration of our development plans for our four clinical-stage molecules, including AB680, our small molecule CD73 inhibitor, for which we recently presented encouraging data in first-line metastatic pancreatic cancer,” said Arcus CEO Terry Rosen, Ph.D.

Meanwhile, Citigroup analyst Yigal Nochomovitz reiterated his Buy recommendation three weeks ago, raising his price target to $54 from $32, which implies upside potential of 30% from current levels. Nochomovitz told investors that he was encouraged by early results from the company’s pancreatic cancer combo treatment trials that exceeded benchmarks.