Large parts of the software ecosystem are running headfirst into Wall Street’s instinct to revert to form. That’s showing up in IPO activity, which increasingly reflects the investment bankers’ all-time favorite: go big or go home. The IPO window isn’t technically shut, but the price of admission has skyrocketed, turning “going public” into an elusive mirage to many companies.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The unwritten rule in boardrooms today is that a company needs to be approaching $1 billion in revenue, with clear visibility to profitability, to command the attention of the large institutional heavyweights.

In my previous column, I argued we’re entering the “Liquidity Era of M&A,” and this is the supply-side catalyst: the public markets have become an exclusive club for companies with global scale, pushing businesses that would have listed easily five years ago to find their luster elsewhere.

The 50x Anomaly

Allow me to take you a few years back to the heady summer of 2021. I recall sitting down in our 5th Avenue offices with a colleague, a Managing Director whose main job was taking tech companies public. We were preparing for an IPO pitch, reviewing comparable valuations, and the numbers were defying gravity, to say the least.

I’m paraphrasing, but privately, he jokingly commented that “a 50x forward revenue multiple is insanity.”It can’t last. But what do I know… I’ve been only doing this for 15 years.” I nodded in agreement. But the music kept playing, until it finally stopped.

To understand how drastically the requirements have changed, look at SentinelOne (S), which listed that summer.

I remember that deal vividly. Leading the investment banking effort for UBS (UBS) in Israel at the time, I spent months building that relationship from scratch. To win the mandate, I had to mobilize the entire firm, aligning our US tech & ECM specialists, our own internal IT division to validate their product, and even some of our global executives to secure our seat at the table.

The hard work paid off. We won a Bookrunner role on what became the largest cybersecurity IPO in history (a title it still holds). We raised $1.2 billion at a $9 billion valuation, with demand so strong we raised the price range several times, eventually opening at $46/share. 2x was our starting point.

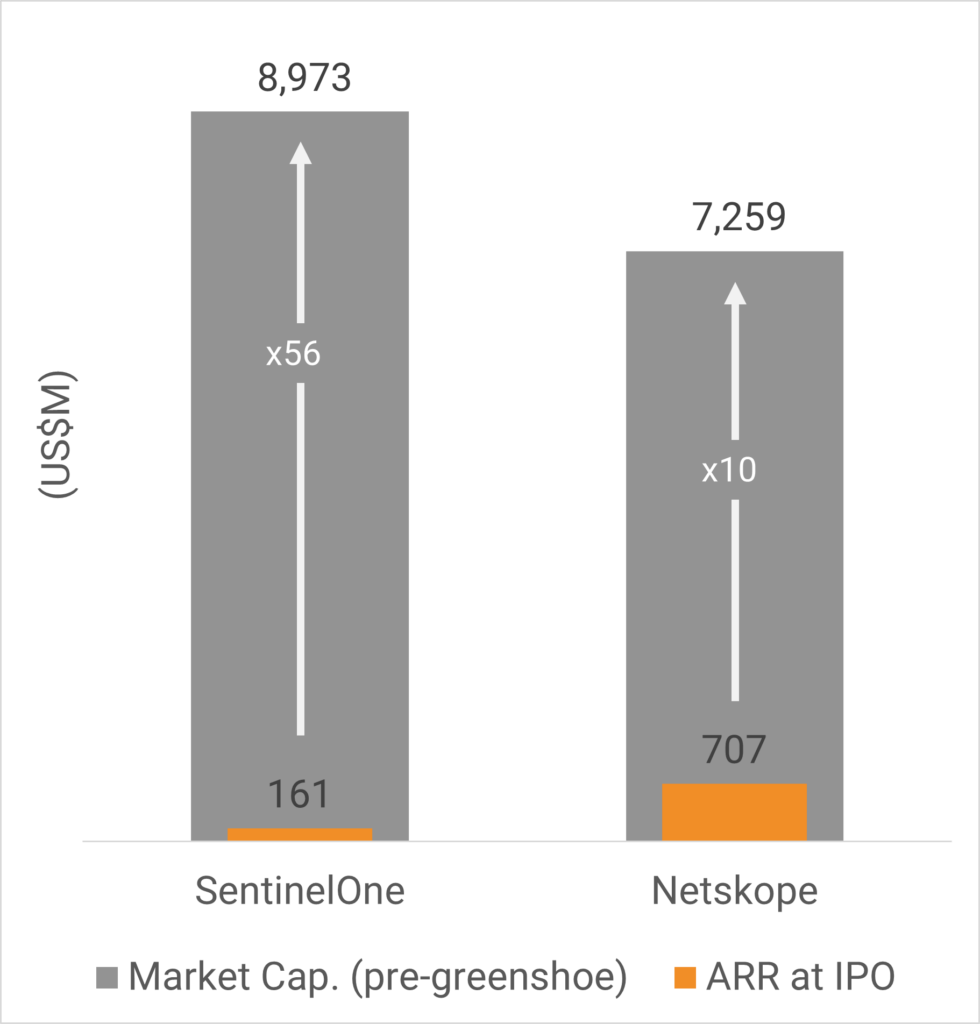

At the time of IPO, SentinelOne was generating roughly $161 million in ARR and was valued at a staggering 56x ARR. Investors didn’t care about the burn; they paid for the triple-digit growth.

The New Mathematical Reality

Fast forward to late 2025. Today, taking a company public with $160 million in revenue and high burn is practically a non-starter (unless it’s an AI infra play, but that’s for another time).

Let’s take a look at Netskope (NTSK), another blue-chip cyber player that went public with a valuation 20% lower than SentinelOne’s debut, at $7.3 billion. But the engine required to achieve that valuation was much larger.

According to data reported by Bloomberg at the time of the listing, Netskope generated $707 million in ARR, roughly 4.4x larger than the scale of SentinelOne at its debut. Yet, despite being 4x larger, it commanded the same headline valuation. The multiple collapsed from SentinelOne’s heady 56x to a grounded 10x. Both are established platforms, but the market math has fundamentally changed.

Pressure from the Cap Table

Unlike the 2021 cohort, top-performing companies today aren’t burning cash like there’s no tomorrow. They are materially more sustainable and even profitable. They could eventually list, but the bar for entry has risen. The public market isn’t closed, but it has become a platform for those with a billion-dollar scale.

For CEOs of companies founded over 10 years ago, the landscape has changed. The pressure isn’t coming from the balance sheet; it is coming from the Cap Table.

They have likely received investments from funds nearing the end of their lifecycle. Those funds’ LPs (Limited Partners who invested in the funds) are demanding returns, actual cash distributions (DPI), not Excel markups. This dynamic creates the supply side of the M&A wave.

The Return to Scale

Private investors are now being pressed to turn paper value into real cash through M&A. At the same time, public investors are no longer underwriting experiments—they’re reserving IPO demand for companies that are already proven, durable, and operating at true scale, clearing a new billion-dollar threshold before they even get considered.

The result is a clean separation between private risk and public reward: the era of the stock market as a venture casino is over, and the IPO market has returned to its original purpose—funding companies that are already built to last and simply need capital to grow even larger.