As President Donald Trump’s April 2 tariff deadline, termed “Liberation Day,” approaches, financial markets are bracing for possible swings. Analysts have shared worries about the size and effect of these tariffs, which are set to impact many industries and economies.

Analysts Sound the Alarm

Barclays’ global chairman of research, Ajay Rajadhyaksha, pointed out that the recent 25% tariff on foreign-made vehicles was more serious than the market first thought. He warned that April 2 could bring more surprises, saying, “I think we will be negatively surprised.” Due to these concerns, Barclays has lowered its S&P 500 (SPX) year-end target from 6,600 to 5,900. The firm is urging clients to take a more careful approach, expecting a possible slowdown in the economy.

Morgan Stanley’s chief economist, Chetan Ahya, stressed the unknowns surrounding the coming tariff moves. He said, “On April 2, we are expecting that the US will propose a plan for addressing fairness in trade ties. But our main worry remains that high levels of policy doubt hurt spending and trade – weakening the business cycle.”

Also, Goldman Sachs has raised the chance of a U.S. downturn to 35%, saying that strong tariff policies could shake business and household confidence, raising the risk of a slump.

At the same time, JPMorgan strategists added that growing trade worries could push Treasury yields lower as investors look for safer assets. “The bond market is pricing in lasting doubt, which could hold back risk-taking in stocks,” the firm said.

Impact on Crypto, Stocks, and Key Industries

The expected tariffs are set to shake up many areas of finance. For instance, Bitcoin recently slipped below $82,000 amid rising market uncertainty. Analysts warn that ongoing trade tensions could bring bigger price swings as investors reassess risk.

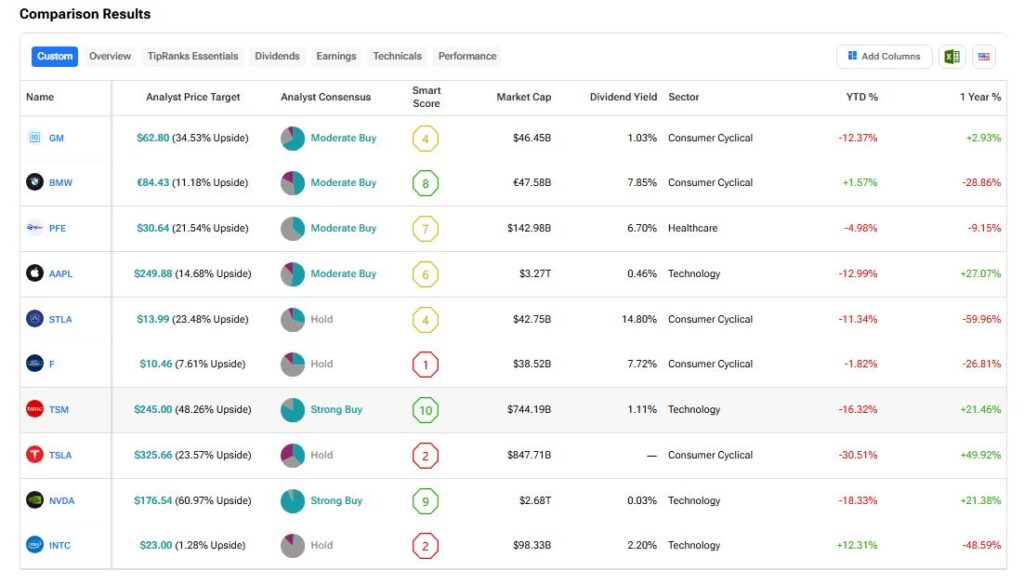

Shares of trade-sensitive firms, including Tesla (TSLA) and Apple (AAPL), may fall as higher import costs cut into profits. Chipmakers like Nvidia (NVDA) and Intel (INTC), which depend on global supply chains, might also come under selling pressure.

However, defensive sectors such as utilities and consumer staples could draw investors looking for steady options in a rough market.

As “Liberation Day” nears, markets remain on edge, with analysts and investors closely watching events to steer through the changing financial scene.

Tipranks’ Comparison Tool

Using Tipranks’ comparison tool, we’ve gathered some companies potentially impacted by Liberation Day. The list comprised car manufacturers, semiconductor companies, healthcare providers, etc.