After a bumper earnings season on Wall Street, analysts are sounding more bullish on JPMorgan (JPM) and Goldman Sachs (GS).

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

BofA’s Ebrahim Poonawala raised his price target on JPM to $300 from $280 and maintained a Buy rating on the shares. Beyond the company’s Q4 earnings beat and record annual profit, he cited commentary from CEO Jamie Dimon indicating he would be sticking around longer.

For shareholders, a smoother transition to a new leader will reduce the risk of a knee-jerk response in the stock to his departure, the analyst said.

GS analysts also raised their price target on JPM to $295 from $273 and kept a Buy rating on the shares, citing “better than expected” trajectory for Fiscal 2025 net interest income and expenses.

Meanwhile, five-star analyst Stephen Biggar at Argus Research raised the firm’s price target on JPM to $275 from $235 and kept a Buy rating on the shares, which lasted traded around $252.

The moves come after JPM reported profits for last year rose to $58 billion, the most ever for an American bank. On an analyst call the CFO, Jeremy Barnum, talked up share buybacks due to the amount of excess capital the bank is generating.

BofA Upgrades GS

Additionally, BofA raised its price target on GS to $675 from $650, while maintaining a Buy rating on the shares after its Q4 earnings beat, saying that it expects stronger trading revenues at the bank to continue. Argus Research’s Biggar also raised his target price on GS to $660 from $560.

GS profits doubled during the Fiscal fourth quarter to $4.1 billion, as its equities trading and investment banking divisions boomed. It delivered record net revenues in its equities business last year as quarterly trading revenues rose to $6.2 billion.

Is JPM Stock a Good Buy Now?

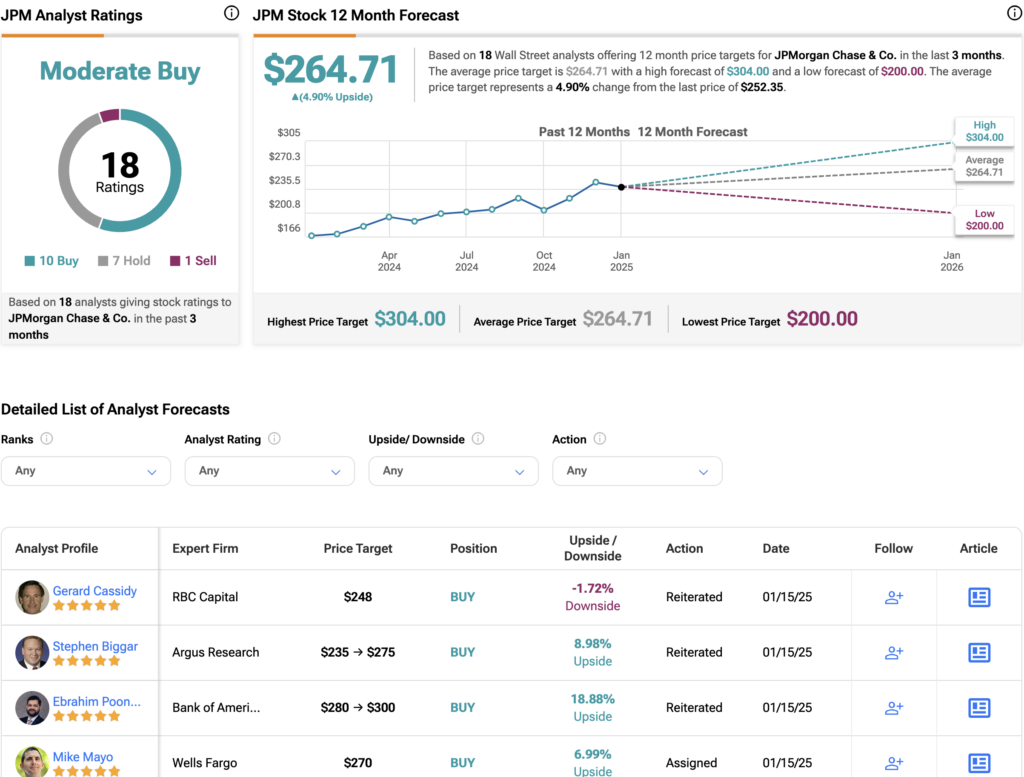

Wall Street has a Moderate Buy consensus rating based on 10 Buys, seven Holds, and one Sell. Over the past year, JPM has surged by more than 53%, and the average JPM price target of $264.71 implies an upside potential of 5% from current levels.