Banks on Wall Street are delaying high-risk financing deals as investors grow more nervous amid the market turmoil caused by President Trump’s new tariffs. In the past few days, two major leveraged loan deals were delayed: one was tied to HIG Capital’s purchase of Converge Technology Solutions (TSE:CTS), and another was for a dividend payout to ITG Communications’ owner, Oaktree Capital. Both deals were supposed to close last week, but investor interest dried up. However, these are not the only deals on hold, as six others had already been pulled earlier this year due to similar concerns.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Leveraged loan prices dropped sharply, with the biggest two-day decline in five years, according to Morningstar’s LSTA index. The average loan is now priced at 95 cents on the dollar, the lowest since November 2023. Banks usually sell the loans they agree to provide before a deal closes, but with debt markets freezing up, they risk being stuck with the debt themselves, which is called “hung debt.” This might happen with ABC Technologies’ $900 million loan and $1.3 billion bond deal for its planned buyout of TI Fluid Systems (LSE:TIFS), which hasn’t attracted enough investors.

A separate $2.35 billion loan-and-bond package for the acquisition of Patterson Companies (PDCO) is also facing headwinds. And it is not just buyouts that are being affected. Indeed, the broader credit market is also feeling the pressure from Trump’s tariff plans, which have raised fears of a recession and pushed investors away from risky assets. For example, CEC Entertainment — the parent company of Chuck E. Cheese — has had trouble refinancing $660 million in junk debt. Another big refinancing plan that was worth more than $5 billion from Finastra Group Holdings also collapsed.

Which Bank Stock Is the Better Buy?

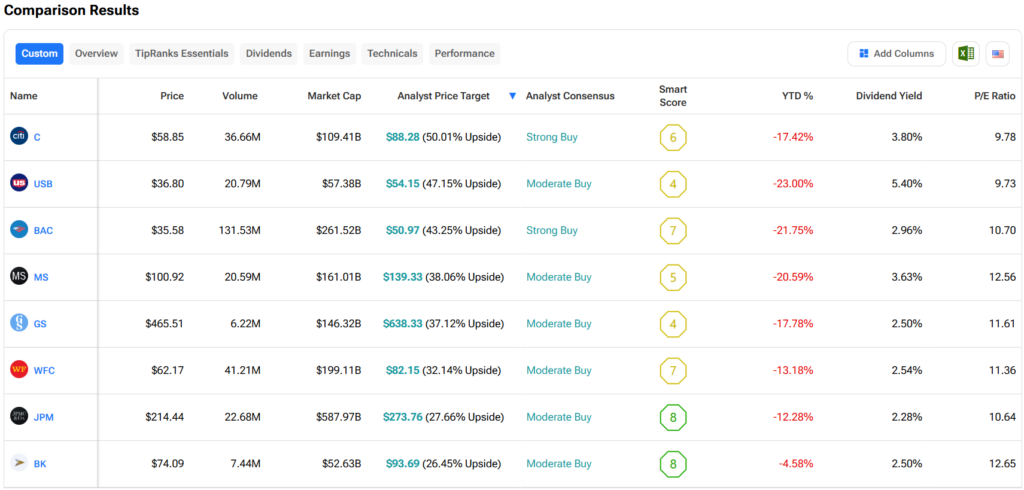

Turning to Wall Street, out of the bank stocks pictured below, analysts think that Citigroup stock (C) has the most room to run. In fact, Citigroup’s average price target of $88.28 per share implies 50% upside potential. On the other hand, analysts expect the least from BK stock, as its average price target of $93.69 equates to a gain of 26.5%.