Palantir (NASDAQ:PLTR) has gone from flying under the radar to becoming one of the biggest – if not the biggest – beneficiaries of the AI boom.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

But this isn’t just a case of riding the trend. AI has transformed Palantir at its core. Once written off by Wall Street as a defense-heavy consultancy, the company is now proving it’s anything but. Its software platforms, built for complex data environments, are finding a fast-growing audience in the commercial world.

And the numbers speak for themselves. In its Q1 2025 earnings report last week, Palantir posted $884 million in revenue, up 39% from the year before. Its U.S. commercial business hit a $1 billion run rate with 71% annual growth, up from 64% the year prior. The company’s Artificial Intelligence Platform (AIP) continues to drive demand, with U.S. commercial total contract value (TCV) soaring 183% to $810 million.

With momentum clearly on its side, Palantir is raising the bar, guiding for Q2 revenue between $934 and $938 million and full-year revenue in the range of $3.890 to $3.902 billion – well above the Street’s estimate of $3.75 billion.

Still, not everyone is sold on the stock at these levels. Top investor Victor Dergunov calls it anything but a “Nvidia moment.”

“Despite strong earnings and guidance, Palantir’s valuation is extremely high, limiting near-term upside and increasing vulnerability to corrections,” explains the 5-star investor, who is among the top 4% of TipRanks’ stock pros.

To be clear, Dergunov is bullish on the company’s long-term dominance. But he’s been vocal for a while about the risks tied to PLTR’s “hyper-elevated” valuation. With a market cap of $277 billion and trailing-12-month sales of just $2.87 billion, Palantir is trading at nearly 100x TTM sales. Even under an optimistic 2026 forecast, its forward P/E could still hover around 150x – a lofty price tag that could cap near-term gains.

“This dynamic also makes the stock more vulnerable to a considerable correction, as the ultra-high valuation could lead to increased selling pressure as we advance,” the investor added.

Dergunov believes that a strong dip buying opportunity would be around the $50 to $65 levels. Meanwhile, despite being a “remarkable business with enormous potential,” the top investor is assigning PLTR shares a Hold (i.e. Neutral) rating. (To watch Dergunov’s track record, click here)

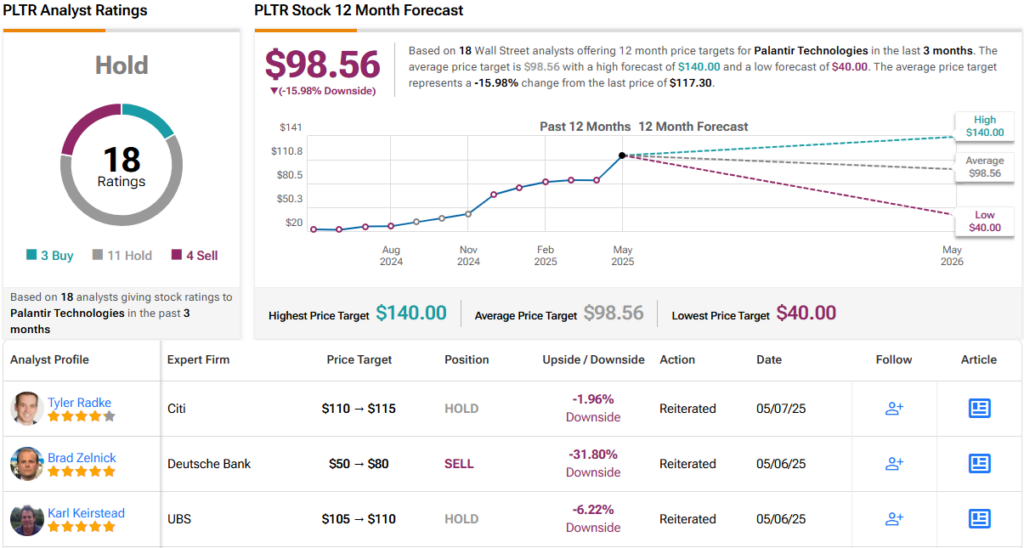

That cautious stance echoes across Wall Street. Of the 18 analyst ratings, 11 say Hold, with just 3 Buys and 4 Sells in the mix, cementing a consensus Hold. The average price target stands at $98.56, suggesting a potential downside of around 16% over the next 12 months. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.