W. R. Berkley on Dec. 31 said it expects to book a pre-tax net profit of $105 million in Q420 from the sale of an office complex located in New York City.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In addition, W. R. Berkley (WRB) anticipates an increase of $52 million in pre-tax stockholders’ equity as a result of the sale.

The sale is part of the insurance holding company’s long-term strategy of investing towards continuous long-term value creation to shareholders despite a low interest environment.

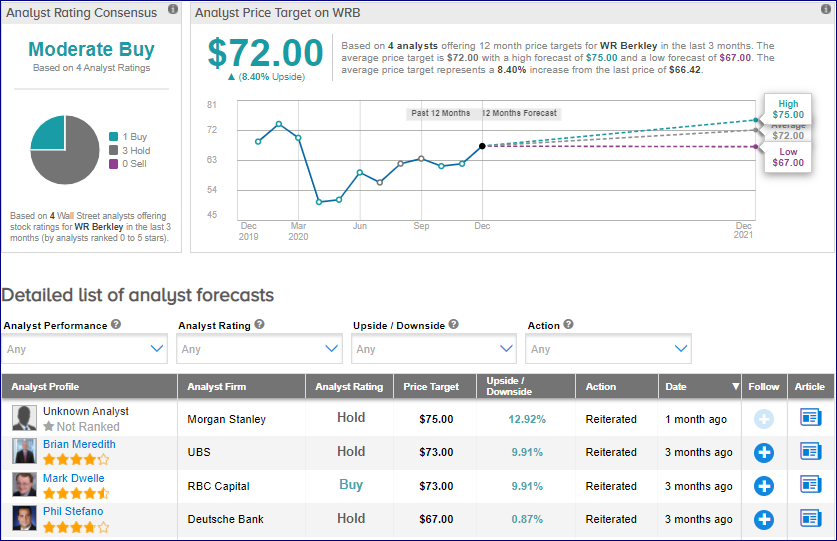

On Nov. 24, Morgan Stanley reiterated a Hold rating on the stock with a price target of $75 (almost 13% upside potential).

Morgan Stanley expects W.R. Berkley to post EPS of $0.82 in Q420.

Overall, the rest of the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 1 Buy and 3 Holds. (See WRB stock analysis on TipRanks)

The average price target stands at $72 and implies 8.4% upside potential to current levels.

Related News:

Bristol Myers Says CVR Expires Due To Pending FDA Approval; Street Sees 20% Upside

Verizon Settles Price Dispute With Hearst Television – Report

Delta Air Lines Continues to Expect Positive Cash Flow By Spring