In this piece, I evaluated two telecom stocks, Verizon Communications (VZ) and AT&T (T), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a neutral view of Verizon and a bullish view of AT&T.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Both companies offer wireless, wireline communications, and internet services/products to businesses and consumers. Verizon stock has jumped 11% year-to-date and 25% over the last 12 months, while AT&T shares are up 20% year-to-date and 38% over the last year.

With AT&T up so much more than Verizon, it may come as a surprise that AT&T is trading at a discount to Verizon. We’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and that of their industry.

For comparison, the telecom services and carriers industry is trading at a P/E of 14.5x. Over the last three years, the industry has averaged a loss, so it has no comparable three-year-average P/E.

Verizon Communications (NYSE:VZ)

At a P/E of 15x, Verizon is trading roughly in line with its industry. Thus, a neutral view seems appropriate in light of the company’s recent earnings results.

In the second quarter, Verizon posted adjusted earnings of $1.15 per share, in line with the consensus, on $32.8 billion in revenue versus expectations of $33.05 billion. That revenue miss initially cost the company in the form of a stock price drop this past week, although Verizon shares quickly recovered some of their losses.

Verizon highlighted one key trend that spooked the markets at first. Customers aren’t buying new devices as often, which offset its revenue growth in other areas. Total device upgrades fell about 13% year-over-year, management said on the earnings call.

Further, net income fell 1.2% year-over-year to $4.6 billion, while the firm’s profit margin was flat at 14%. GAAP (generally accepted accounting principles) earnings ticked down from $1.10 per share to $1.09 per share.

Wireless Service revenue rose 3.5% year over year to $19.8 billion, with retail postpaid phone net additions of 148,000 and retail postpaid net additions of 340,000. Verizon also reported 391,000 net broadband additions, the eighth straight quarter with over 375,000 adds.

Another concerning area in the latest earnings report was Business revenue, which fell 2.4% year-over-year to $7.3 billion. However, Business Wireless Service revenue rose 2.4% year-over-year on the back of strong net additions.

In fact, rising Wireless Service revenues generally are good news for Verizon despite falling equipment sales. However, the overall earnings report was mixed at best, calling for a neutral rating. I’d prefer to see either a significant improvement in earnings and revenue numbers or a lower valuation before becoming more constructive on Verizon shares.

What Is the Price Target for VZ Stock?

Verizon Communications has a Moderate Buy consensus rating based on seven Buys, seven Holds, and zero Sell ratings assigned over the last three months. At $45.68, the average Verizon stock price target implies upside potential of 14.1%.

AT&T (NYSE:T)

At a P/E of 11x, AT&T is trading at a significant discount to its industry and to Verizon. Thus, a bullish view seems appropriate.

In the second-quarter earnings report, AT&T reported adjusted earnings of 57 cents per share on $29.8 billion in revenue versus the consensus numbers of 57 cents per share on $29.98 billion in revenue. These headline numbers are not great, so you have to dig deeper to discover the reasons for my bullish rating.

AT&T impressed investors with its subscriber growth and free cash flow, both of which topped estimates. The company reported 419,000 paying wireless phone subscribers, smashing FactSet expectations of 284,000.

AT&T offers low-priced unlimited plans that helped it attract budget-conscious consumers as T-Mobile (TMUS) and Verizon put up some difficult competition. The low prices also helped AT&T retain customers, as its phone-churn rate came in at 0.7%, the second-lowest ever reported for a second quarter.

The company’s free cash flow rose more than 9% to reach $4.6 billion, surpassing the LSEG estimate of $4.22 billion. However, AT&T’s Mobility Equipment revenue tumbled 8% year over year — far more than Verizon’s. Equipment revenue missed LSEG expectations of $29.9 billion, coming in at $29.8 billion.

Overall, these earnings results were excellent once you look past those headline earnings and revenue numbers, and AT&T’s valuation makes it worth considering as well.

What Is the Price Target for T Stock?

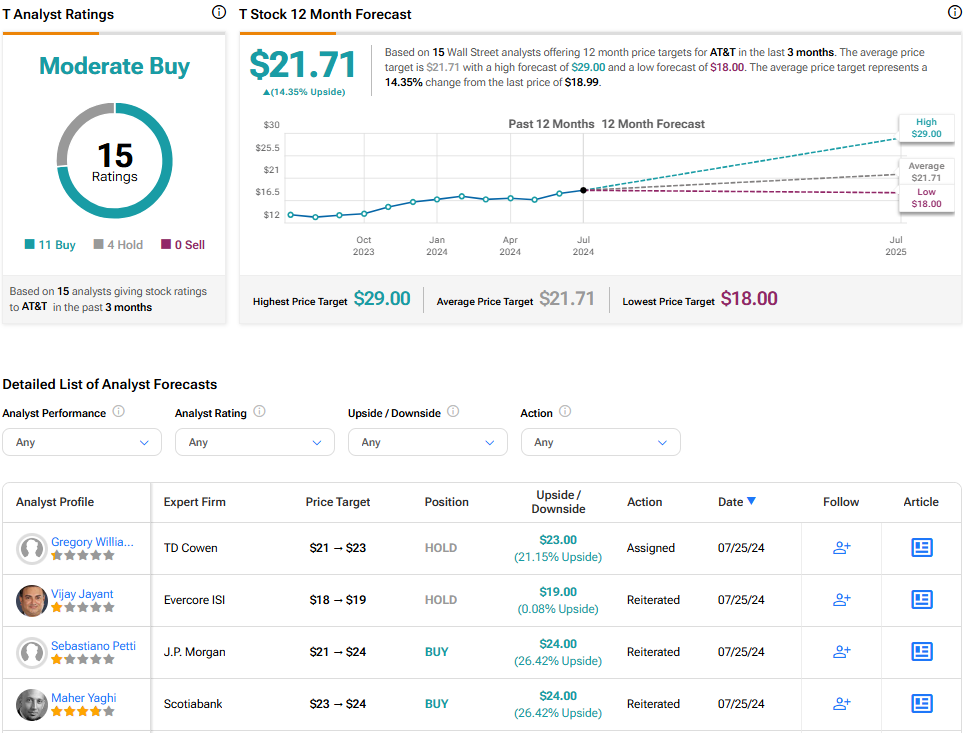

AT&T has a Moderate Buy consensus rating based on 11 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $21.71, the average AT&T stock price target implies upside potential of 14.35%.

Conclusion: Neutral on VZ, Bullish on T

Both Verizon Communications and AT&T are stalwart telecom companies worthy of a place in a blue-chip stock portfolio. While some of their earnings results weren’t stellar (for example, Verizon’s weaker-than-expected phone upgrades), that’s less of a concern for a second quarter. All eyes will be on what those numbers look like during the all-important holiday shopping quarter.

At the end of the day, Verizon’s valuation looks fair at current levels, especially considering its mixed earnings results, while AT&T’s could rise further. It continues to trade at the lower end of its normalized P/E range of about 11x to 20x, while Verizon is trading toward the higher end of its range between about 11x and 15x.