Shares of Verizon Communications (VZ) fell in pre-market trading after the company reported mixed third-quarter results. The telecommunication giant’s adjusted earnings declined by 2.5% year-over-year to $1.19 per share, which beat analysts’ consensus estimate of $1.18 per share.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

However, the company’s operating revenues remained flat in the third quarter at $33.3 billion. This fell short of analysts’ expectations of $33.6 billion.

Verizon’s Wireless Subscribers Continue to Grow in the Third Quarter

In the third quarter, Verizon’s wireless subscribers exceeded expectations, benefiting from its attractive promotional offers and bundled plans that combine 5G service with streaming platforms like Netflix (NFLX).

A key factor driving Verizon’s growth in wireless subscribers has been the increasing popularity of its customizable myPlan offering, which allows users to add streaming services like Hulu, and Max for an additional cost. As a result, the company added 239,000 net wireless phone subscribers during the third quarter, surpassing analysts’ expectations of 218,100. This is a notable improvement from its wireless subscriber additions of 148,000 in the previous June quarter.

However, during the third quarter, Verizon’s net additions of broadband subscribers dipped to 389,000, slightly down from 434,000 a year earlier, bringing its total broadband subscriber base to over 11.9 million.

VZ Reiterates Its FY24 Outlook

Looking ahead, management reiterated its FY24 outlook and now expects its wireless revenue to grow between 2% and 3.5%. Adjusted earnings are forecasted to be in the range of $4.50 to $4.70 per share. For reference, analysts were expecting an adjusted EPS of $4.57.

What Is the Target Price for Verizon?

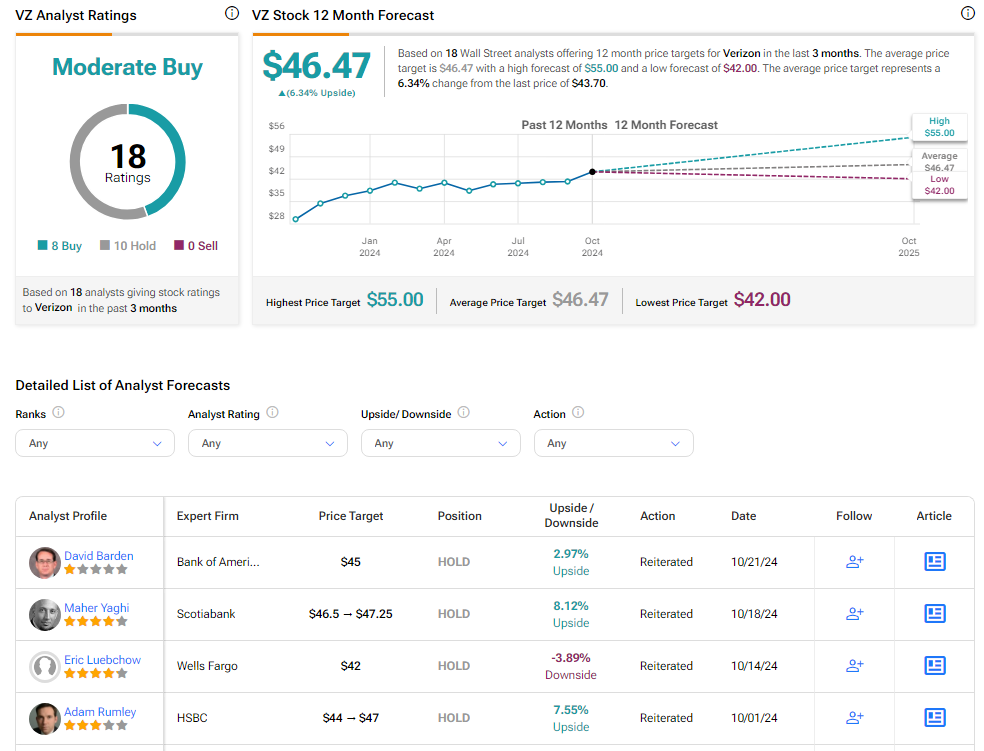

Analysts remain cautiously optimistic about VZ stock, with a Moderate Buy consensus rating based on eight Buys and 10 Holds. Over the past year, VZ has surged by more than 40%, and the average VZ price target of $46.47 implies an upside potential of 6.3% from current levels. These analyst ratings are likely to change following VZ’s results today.