Growth ETFs (exchange-traded funds) invest in companies with above-average earnings and revenue growth rates. Also, they generally have higher price-to-earnings ratios. These ETFs typically focus on sectors like technology, healthcare, and consumer discretionary. Today, we highlight two such ETFs, Vanguard Growth Index Fund (VUG) and iShares Russell 1000 Growth (IWF). Both of these ETFs have a Strong Buy consensus rating and over 10% upside potential projected by analysts.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a closer look at these two ETFs.

The Vanguard Growth Index Fund

The Vanguard Growth Index Fund (VUG) is a popular choice for investors seeking exposure to large-cap U.S. growth stocks. This low-cost index fund tracks the CRSP US Large Cap Growth Index, which includes companies with above-average growth potential.

The VUG ETF has $143.52 billion in assets under management (AUM), with the top 10 holdings contributing 57.47% of the portfolio. Importantly, it has a low expense ratio of 0.04%. The VUG ETF has returned 26.9% year-to-date.

Overall, the ETF has a Strong Buy consensus rating. Of the 184 stocks held, 158 have Buys, 25 have a Hold, and one Sell rating. At $436.70, the average VUG ETF price target implies an 11.09% upside potential.

The iShares Russell 1000 Growth ETF

The iShares Russell 1000 Growth ETF (IWF) tracks the investment results of an index composed of large- and mid-cap U.S. equities with growth potential. The fund aims to capture the potential for capital appreciation by investing in companies with strong growth prospects.

It has $99.22 billion in AUM, with the top 10 holdings contributing 60.06% of the portfolio. Additionally, the ETF has an expense ratio of 0.19%. So far in 2024, IWF ETF has generated a return of 26.8%.

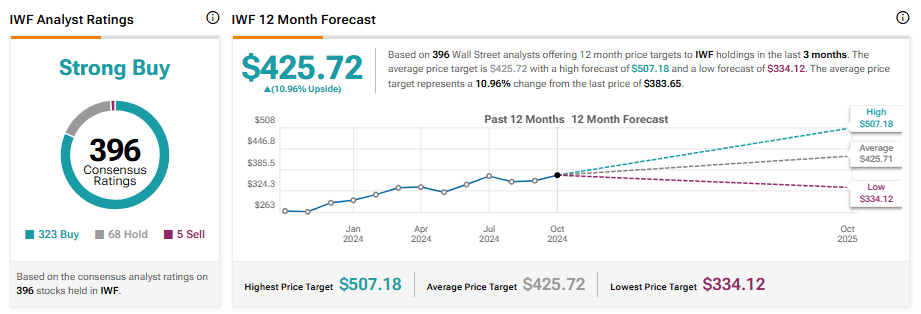

On TipRanks, IWF has a Strong Buy consensus rating based on 323 Buys, 68 Holds, and five Sells assigned in the last three months. At $425.72, the average IWF ETF price target implies a 10.96% upside potential.

Concluding Thoughts

ETFs offer several benefits to investors, such as exposure to large companies, along with cost-effective investment and long-term capital appreciation opportunities. Furthermore, these ETFs have better liquidity, allowing investors to buy and sell shares conveniently.

These benefits, along with the over 10% upside potential expected by analysts in VUG and IWF ETFs, make them worth considering by investors.