Investors seeking a cost-effective and diversified way to invest in the market could consider exchange-traded funds (ETFs). Among the several ETF providers, Vanguard is known for its commitment to offering a wide range of index funds at a minimal cost. Today, we have focused on two Vanguard ETFs – VUG and VHT – with more than 10% upside potential projected by analysts over the next twelve months.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a look at what Wall Street thinks about these two ETFs.

Vanguard Growth ETF (VUG)

The VUG ETF seeks to track the performance of the CRSP U.S. Large Cap Growth Index, which measures the investment return of large-capitalization growth stocks. VUG has $121.32 billion in assets under management (AUM), with the top 10 holdings contributing 57% of the portfolio. Importantly, it has a low expense ratio of 0.04%. The VUG ETF has returned 19.2% in the past six months.

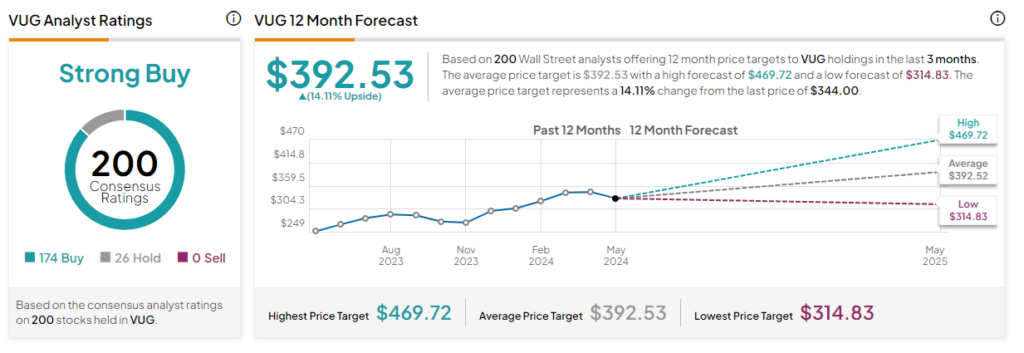

Overall, the VUG ETF has a Strong Buy consensus rating. Of the 200 stocks held, 173 have Buys and 27 have a Hold rating. The analysts’ average price target on the VUG ETF of $392.75 implies a 14.17% upside potential from the current levels.

Vanguard Health Care ETF (VHT)

The VHT ETF tracks the performance of the MSCI US Investable Market Index, which includes stocks of large, mid-size, and small U.S. companies within the healthcare sector. It has $17.49 billion in AUM, with the top 10 holdings contributing 48.62% of the portfolio. Meanwhile, the expense ratio of 0.1% is encouraging. Interestingly, the VHT ETF has generated a return of 14.55% over the past six months.

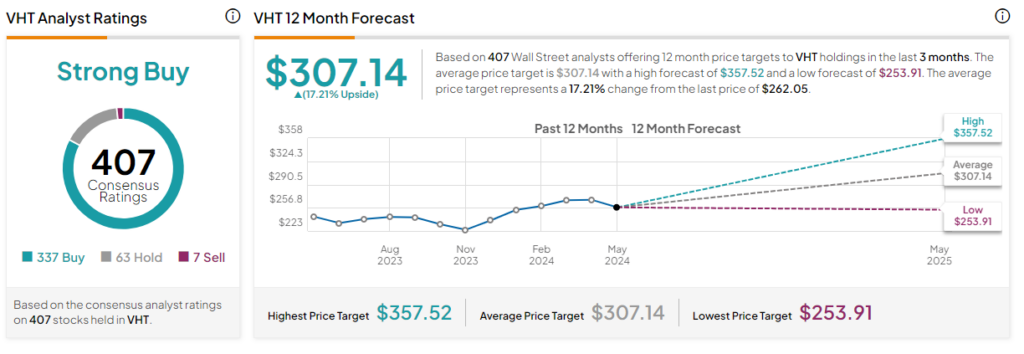

On TipRanks, VHT has a Strong Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 407 stocks held, 337 have Buys, 63 have a Hold rating, and seven stocks have a Sell rating. The analysts’ average price target on the VHT ETF of $307.14 implies a 17.21% upside potential from the current levels.

Concluding Thoughts

The Vanguard ETFs are a low-cost, diversified, and transparent way to participate in the market. Furthermore, these ETFs have better liquidity, allowing investors to buy and sell shares conveniently without sacrificing returns.