Shares of electricity providers such as Vistra (NYSE:VST) and Constellation Energy (NASDAQ:CEG) have witnessed impressive gains this year. VST stock has risen over 128%, while CEG stock is up about 76% year-to-date. Despite these jumps, higher demand, particularly from the tech industry, could be a catalyst for future growth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Rising Demand from the Tech Industry

According to a recent Wall Street Journal report, the tech industry is driving demand for power-generating companies. As AI expands, there’s a growing need for new data centers. Major tech firms are actively seeking reliable electricity sources for these facilities, creating significant opportunities for power providers.

Among key developments, Amazon’s (NASDAQ:AMZN) AWS is nearing a deal to buy electricity directly from a nuclear power plant owned by Constellation Energy. Meanwhile, Vistra stock is in the spotlight for its behind-the-meter deals at nuclear and gas plants. This system allows users to generate and store their energy, reducing electricity expenses.

These developments highlight growing revenue opportunities for firms like CEG and VST.

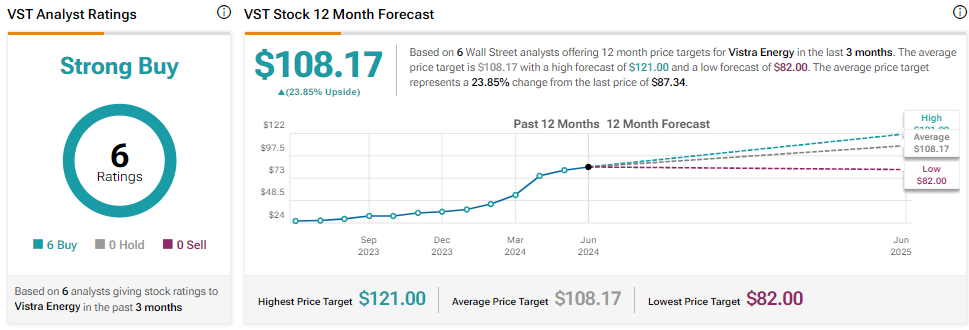

Is Vistra a Good Buy?

Wall Street is bullish about Vistra stock despite the significant growth in its value. The company’s management sees substantial power demand from potential data center expansion. Further, higher industrial activity will likely drive power demand, supporting VST’s share price.

With six unanimous Buy recommendations, Vistra stock has a Strong Buy consensus rating. The analysts’ price target on VST stock is $108.17, implying 23.85% upside potential from current levels.

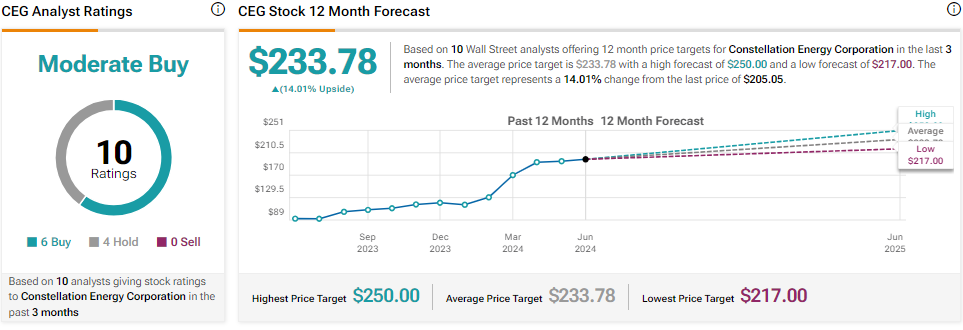

Is CEG Stock a Buy?

Constellation Energy’s management expects to grow its base earnings by at least 10% through the decade. The growing adoption of clean energy and rising demand for AI will likely drive this growth.

Wall Street is cautiously optimistic about CEG’s prospects. It has six Buy and four Hold recommendations for a Moderate Buy consensus rating. The analysts’ price target on CEG stock is $233.78, implying 14.01% upside potential from current levels.