Mutual funds allow investors to diversify their portfolios, thereby reducing risk when compared to individual stocks. They also provide higher liquidity through easy buying and selling, coupled with low minimum investment requirements. Today, we have focused on Vanguard mutual funds that are designed to track the benchmark index, the S&P 500 Index (SPX). According to analysts, VSMPX and VTSAX have the potential to earn over 10% in the next twelve months.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a closer look at the two funds.

Vanguard Total Stock Market Index Fund Institutional Plus Shares (VSMPX)

The VSMPX mutual fund aims to track the performance of the entire U.S. stock market. It allows investors to gain exposure across various industries, providing potential for long-term growth and diversification in their portfolios. Also, it has a low expense ratio of 0.03%, making it a cost-effective option. Interestingly, VSMPX has generated a return of 26% over the past year.

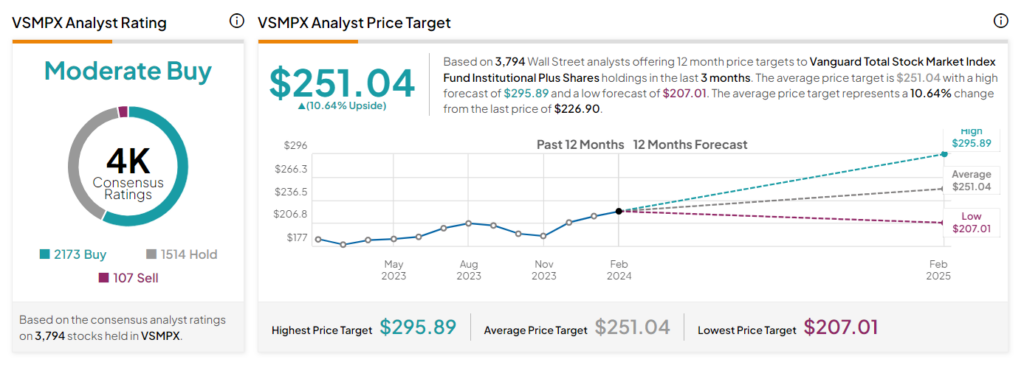

Overall, VSMPX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the total stocks held, 2,173 have Buys, 1,514 have a Hold rating, and 107 have a Sell rating. The average VSMPX price target of $251.04 implies a 10.6% upside potential from the current levels.

Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

The VTSAX mutual fund is ideal for those looking for long-term growth and exposure to the entire U.S. stock market. Its low expense ratio of 0.04% is encouraging. The VMVIX fund has returned about 26% over the past year.

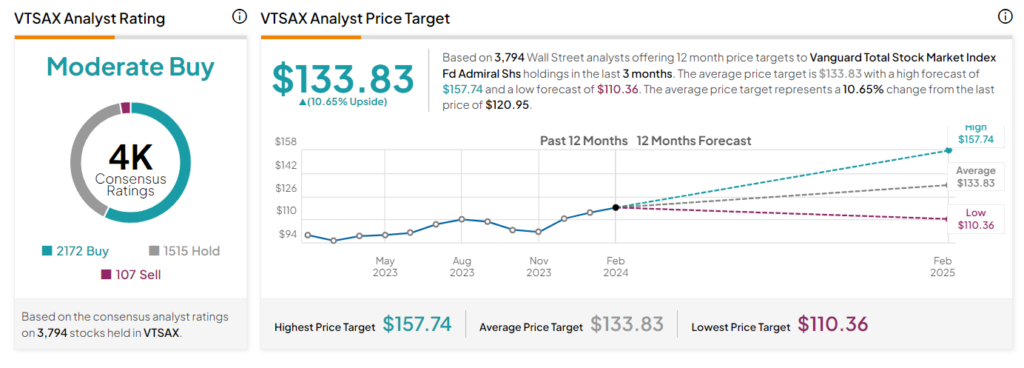

On TipRanks, VTSAX has a Moderate Buy consensus rating. This is based on 2,172 stocks with a Buy rating, 1,515 stocks with a Hold rating, and 107 with a Sell rating. The average VTSAX mutual fund price target of $133.83 implies a 10.65% upside potential from the current levels.

Concluding Note

Both VSMPX and VTSAX mutual funds offer a blend of potential growth and stability, making them a suitable option for investors seeking long-term capital appreciation. However, it would be prudent to conduct thorough research before investing in both of these mutual funds.