Artificial intelligence (AI) spending remains robust, benefiting many companies that offer innovative products to support the generative AI boom. Yet, the ability to capitalize on AI-driven growth varies widely across companies. Using TipRanks’ Stock Comparison Tool, we placed Vertiv Holdings (VRT) and BigBear.ai Holdings (BBAI) against each other to determine the AI stock that has higher upside potential, according to Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vertiv Holdings (NYSE:VRT) Stock

Vertiv offers power, cooling, and IT infrastructure solutions for applications in data centers, communication networks, and commercial and industrial facilities. The company is gaining from the robust demand for its data center infrastructure amid the ongoing AI boom.

The company’s better-than-expected Q2 revenue and earnings, along with a backlog of $8.5 billion, reflect strong demand from growing data centers and continued market penetration. While there are concerns about the impact of tariffs on near-term margins, Vertiv has been taking countermeasures to mitigate this headwind.

Is VRT a Good Stock to Buy?

On August 15, the U.S. Department of Commerce expanded the scope of Section 232 tariffs to include 407 additional products containing steel and aluminum, including air conditioners and related appliances. RBC Capital analyst Deane Dray believes that companies like Vertiv, Eaton (ETN), and nVent Electric (NVT) in the electrical original equipment space could also face greater tariff cost headwinds, though he doesn’t expect to see a wave of guidance cuts.

Dray expects the additional tariff costs to be manageable via targeted pricing, further supply chain shifts, and alternative sourcing. The 5-star analyst reiterated a Buy rating on VRT shares with a price target of $162 and sees the possibility of the stock re-rating higher as the only data center pure-play. Dray highlighted that Vertiv has an outsized 80% revenue exposure to the lucrative data center market, which is the highest among its electrical equipment peer group.

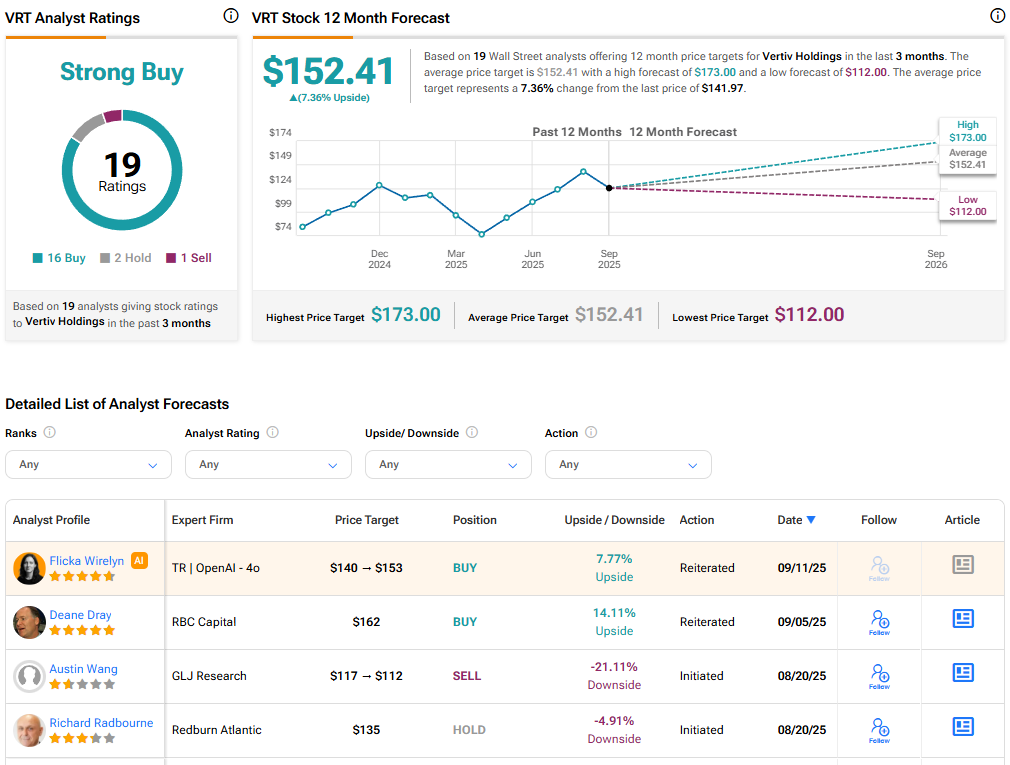

Currently, Wall Street has a Strong Buy consensus rating on Vertiv Holdings stock based on 16 Buys, two Holds, and one Sell recommendation. The average VRT stock price target of $152.41 indicates 7.4% upside potential. VRT stock has risen more than 24% so far this year.

BigBear.ai Holdings (NYSE:BBAI) Stock

BigBear.ai offers AI-powered decision intelligence solutions. The company reported underwhelming second-quarter results and lowered its full-year revenue outlook, citing disruptions in federal contracts due to cost-cutting/efficiency efforts. BBAI’s performance was in stark contrast to another defense-focused data analytics company, Palantir Technologies (PLTR), which reported stellar Q2 results, with its quarterly revenue crossing the $1 billion mark for the first time.

Despite the unimpressive results, BBAI stock has risen 40% year-to-date, as investors are optimistic about the long-term growth potential of the AI company, having exposure to the defense business.

Is BBAI Stock a Buy, Sell, or Hold?

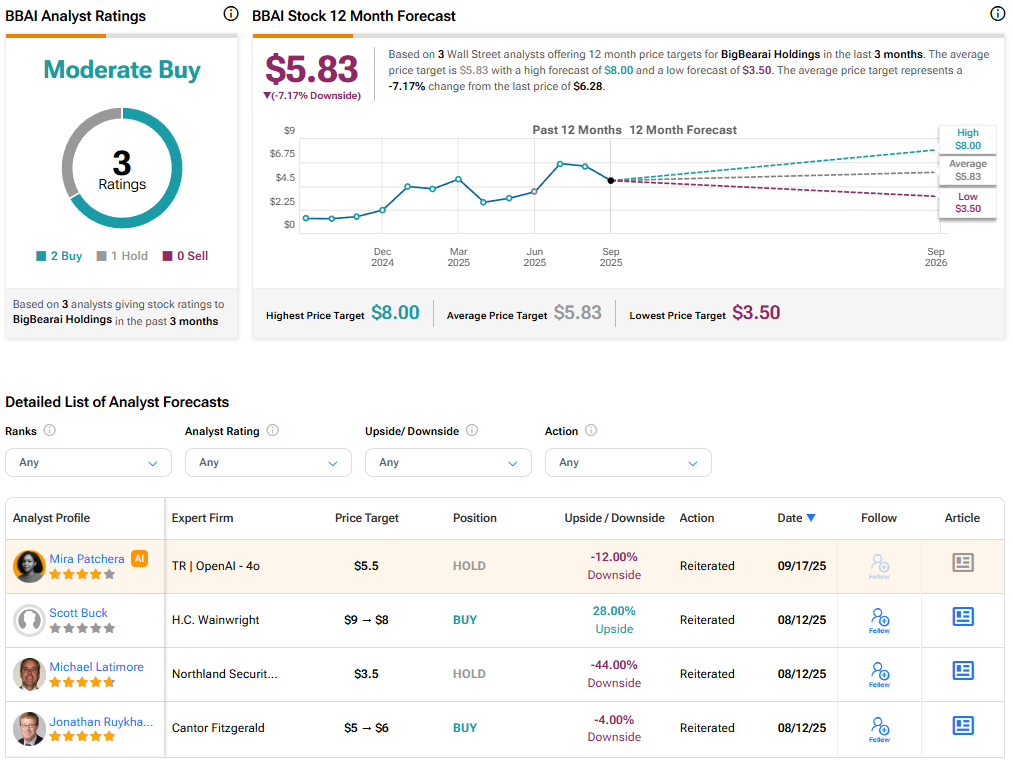

Last month, H.C. Wainwright analyst Scott Buck reaffirmed a Buy rating on BBAI stock but slightly lowered his price target to $8 from $9. Buck contended that while BBAI’s Q2 results were weak, it was not surprising, given that peers in the defense space also experienced program delays. The analyst expects improvement in revenue visibility as the company progresses into 2026.

In the longer term, Buck believes that BigBear.ai is well-positioned to benefit from the One Big Beautiful Bill, which involves increased investment in areas aligned with the company’s core competencies.

With two Buys and one Hold recommendation, Wall Street has a Moderate Buy consensus rating on BigBear.ai Holdings stock. The average BBAI stock price target of $5.83 indicates a possible downside of 7.2% from current levels.

Conclusion

Wall Street is highly bullish on Vertiv Holdings but cautiously optimistic on BigBear.ai. Analysts see continued upside in VRT stock, but downside risk in BBAI stock from current levels. The solid fundamentals of VRT and growing data center-related demand support analysts’ optimism about Vertiv Holdings despite concerns over tariff-related pressures.