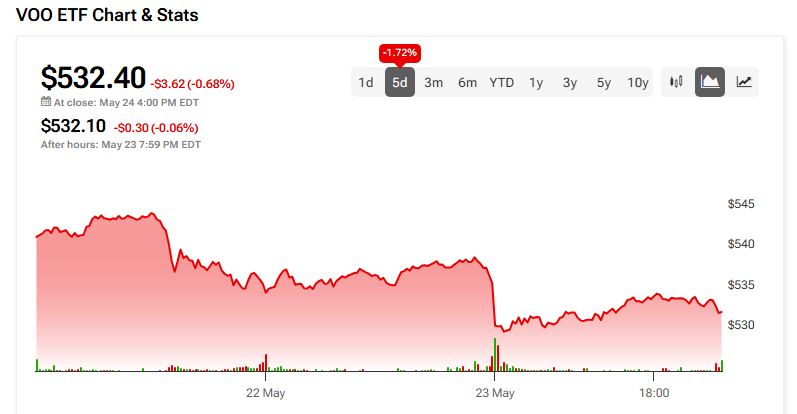

How is VOO stock faring? The Vanguard S&P 500 ETF is down 1.72% in the past five days but has gained 9.3% over the past year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of its holdings’ analyst ratings, VOO is a Moderate Buy. The Street’s average price target of $604.58 implies an upside of 13.56%.

Currently, VOO’s five holdings with the highest upside potential are Caesars Entertainment (CZR), Fair Isaac (FICO), Moderna (MRNA), Bio-Techne (TECH), and Fastenal Company (FAST).

Meanwhile, its five holdings with the greatest downside potential are Palantir Technologies (PLTR), Tesla (TSLA), Paycom (PAYC), GE Vernova Inc. (GEV), and Millrose Properties (MRP).

Revealingly, VOO ETF’s Smart Score is a seven, implying that this ETF will likely perform in line with the market.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.