Automaker Volkswagen (OTC:VWAGY) (DE:VOW3) aims to launch a new EV production platform in China with local consumers in mind, according to Reuters.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The platform, dubbed the “A Main Platform,” will churn out entry-level vehicles. It will be tailored to young Chinese consumers’ preferences for batteries, electric motors, and digital experiences.

Further, the company will focus on sourcing local components and expects the platform to be ready in 2026. Volkswagen aims to launch over 10 EV models worldwide and is looking to lower the time to market for vehicles in China from four years to about two and a half years.

In the present environment of fierce competition, Volkswagen has been focused on optimizing costs. The company has poured over $1 billion into China and, earlier this year, teamed up with leading Chinese EV maker XPeng (NYSE:XPEV) to bolster its EV offerings.

Is Volkswagen a Good Stock to Buy Right Now?

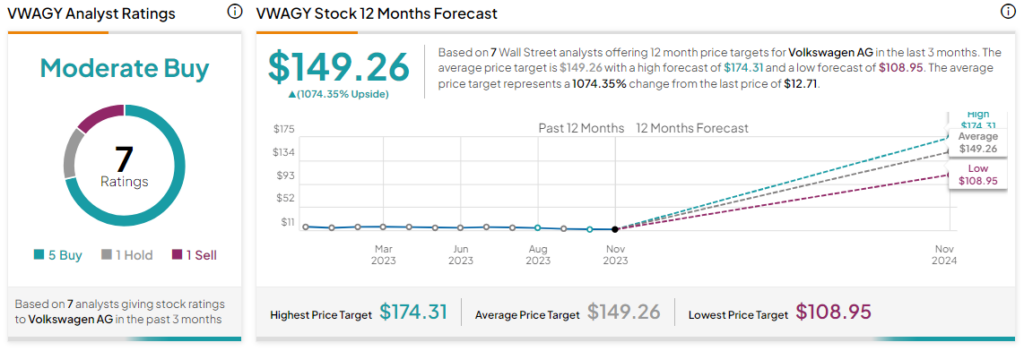

Overall, the Street has a Moderate Buy consensus rating on Volkswagen, and the average VWAGY price target of $149.26 implies a substantial potential upside in the stock. Shares of the company have gained nearly 6% over the past month.

Read full Disclosure