Rivian Automotive (RIVN) has $1 billion more to its name after achieving a financial milestone that triggered a payment from its German partner, Volkswagen (VWAPY). Impressively, the electric vehicle maker delivered its second consecutive quarter of gross profits, which is no small feat for an EV manufacturer.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This unlocked the milestone for Rivian, and its Volkswagen partnership rolls on. However, it’s not time to pop the champagne just yet. While Rivian’s improved production efficiency could make it a viable business, it still has a long way to go before becoming a difference-maker in the competitive automotive industry. This leaves me cautiously neutral on RIVN stock.

Strategic $5.8Bn Alliance Between Rivian and Volkswagen

For those who aren’t aware, the Rivian-Volkswagen joint venture launched in November 2024 and is worth $5.8 billion. The deal gives Rivian much-needed access to capital, and Volkswagen is a key to Rivian’s electrical architecture and software technology, which has eluded Volkswagen in the past. The German automaker hopes its cars will feature similar software updates and upgrades that are synonymous with futuristic EV cars like the ones made by industry leaders such as Tesla (TSLA) and BYD.

The joint venture’s idea is to combine the strengths of both partners to create cutting-edge software and electronics architectures and scale EV platforms and their adoption. Seeing Rivian’s technology being included in cars made by competitors indicates that Rivian is taking a far more dominant position than other EV newcomers.

Breaking Down Rivian’s Financial Position

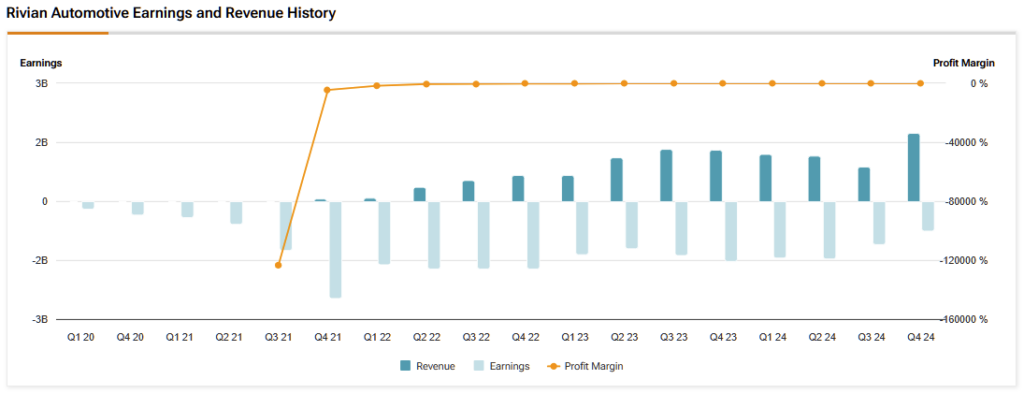

To be clear, Rivian is not close to net company profitability. Its cars now cost less to produce than what they sell for, otherwise known as “gross profit.” This figure doesn’t account for all the other business expenses, like selling, general, and administrative. However, it’s still a significant win for Rivian. In its first quarter of 2025, the company achieved $206 million in gross profit.

Meanwhile, adjusted EBITDA losses remained high, at $329 million. For the full fiscal year, Rivian expects adjusted EBITDA losses between $1.7 billion and $1.9 billion. Sadly, Rivian remains immature in this respect, as it is still investing heavily in its affordable R2 SUVs, which are set to launch in 2026. In this vein, Volkswagen’s financial support is critically welcomed, although the company does have $7.2 billion in cash and short-term investments.

The Product Portfolio Leading Rivian’s Market Charge

As things stand in 2025, Rivian sells its proprietary R1T pickup and R1S SUV. Both vehicles are premium all-electric adventure EVs that are rapidly growing in popularity. Yes, there is plenty of competition out there, but the demand is growing. The R1S SUV was the top electric SUV in the U.S., with a starting price of over $50,000. Now that Rivian has demonstrated an ability to profit from its vehicles, the next step is to scale.

Moreover, government policy worldwide is shifting away from combustion to electric vehicles, leading to heftier prices for petrolheads as government spending subsidises EV adopters.

Rivian expects to deliver 43,000 vehicles (at the midpoint) in 2025, barring any additional tariff impacts. Notably, this was a cut from previous guidance due to macroeconomic factors. This caused some weakness in Rivian’s stock. The company also hopes to rival Tesla in autonomy after launching the second generation of “Rivian Autonomy.”

Scaling and Competition Remain Significant Hurdles

The bullish thesis for Rivian stock is not perfect. The plucky EV maker still needs to scale production successfully to achieve sustainable operations. Moreover, the electric vehicle market is rather competitive. It’s not just Tesla selling EVs anymore. Over a dozen genuine competitors have appeared over the past decade with RIVN being just one of many potential winners (or losers) over the long-term.

Established automakers like Kia, Toyota, and Ford are all advancing EV production and marketing. Then we also have newer entrants like Polestar, which notably sells an electric SUV. The elephant in the room is the global trade environment. Due to its relative immaturity in operations, Rivian is particularly vulnerable to the impacts of sluggish global trade, despite manufacturing all its vehicles in the U.S.

What is the Target Price for Rivian Automotive?

On Wall Street, RIVN has a consensus Hold rating, with seven Buy, 14 Hold, and four Sell ratings in the past three months. RIVN’s average price target of $13.88 implies a ~5% potential upside in the next twelve months.

Earlier this week, Canaccord Genuity analyst George Gianarikas slapped a Buy rating on RIVN with a price target of $23. Impressed by Rivian’s quarterly results, Gianarikas believes that Rivian has a “unique opportunity to establish itself as a major player in the EV industry, especially as other manufacturers scale back their commitments.” However, not everyone is as bullish. John Murphy from Bank of America is bearish on RIVN stock with an accompanying price target of $10.

Rivian’s Balancing Act in the EV Market

In summary, Rivian’s partnership with Volkswagen is starting to deliver tangible benefits, providing crucial capital just in time for the upcoming R2 launch. At the same time, its electric SUV is carving out a place in the niche market, and the company is now turning a profit on individual vehicle sales. However, significant challenges remain.

Rivian has not achieved overall profitability and still depends heavily on external funding. As it scales, competitive pressure will only intensify. And despite its U.S.-based manufacturing, Rivian remains vulnerable to broader economic headwinds, particularly as a maker of luxury vehicles, which could be hit hard by even a mild recession in the coming years.

For investors, the key is weighing Rivian’s significant growth potential against these real risks. For now, that adds up to cautious optimism and a neutral rating on RIVN stock.