French media group Vivendi (VIVHY) has agreed to sell a stake of 10% in its Universal Music Group (UMG) unit to William Ackman-led Pershing Square Tontine (PSTH). The deal values the unit at 35 billion euros.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Vivendi expects to close the transaction in the coming weeks or by September 15 at the latest. The deal requires the approval of U.S. regulators. Furthermore, the transaction will require the support of PSTH shareholders.

Previously, Vivendi agreed to sell a 20% stake in UMG to a Tencent-led (TCEHY) consortium.

“The arrival of major American investors provides further evidence of UMG’s global success and attractiveness,” Vivendi said in the statement announcing the PSTH deal.

The UMG stake sale to PSTH and the Tencent-led group earlier comes as Vivendi works to take the business public. The company plans to host a shareholder meeting on June 22. At that meeting, the board will propose distributing 60% of UMG shares to Vivendi shareholders and the listing of that unit on the Euronext Amsterdam stock exchange. If everything goes well, UMG should go public in late September.

Vivendi has a diversified operation spanning media, content, and communication, with brands such as Dailymotion, Canal+, Havas Group, and Vivendi Village. The company aims to become carbon neutral by 2025. (See Vivendi stock chart on TipRanks)

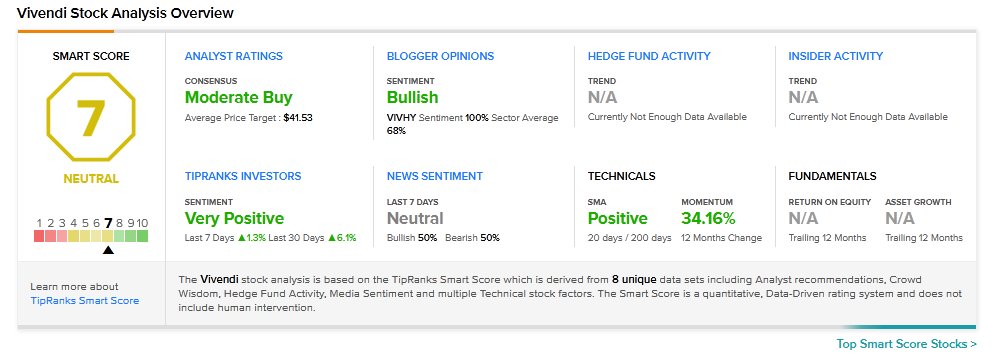

Kepler Capital analyst Conor O’Shea reiterated a Buy rating. Consensus among analysts is a Moderate Buy based on 1 Buy. The average Vivendi analyst price target of $41.53 implies 20.76% upside potential to current levels.

Vivendi scores a 7 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to perform in line with market averages.

Related News:

Boeing to Use Elbit’s Jamming Immunity System in F-15s

American Airlines to Cut 1% of July Flights Amid Operation Strains

Banco Bilbao Debuts First Bitcoin Trading Service in Switzerland