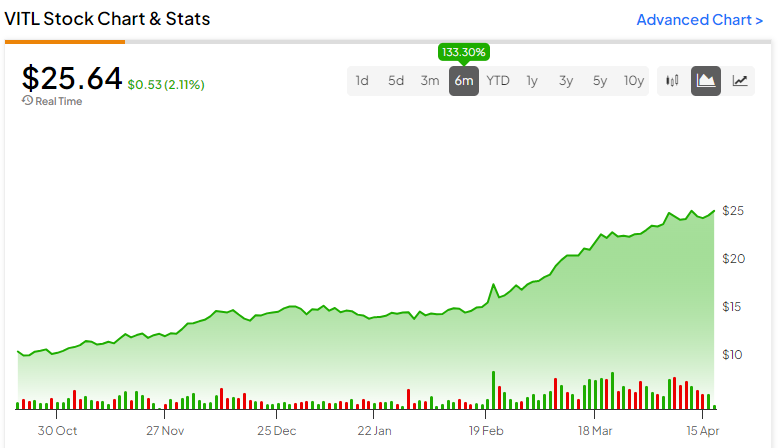

Vital Farms (NYSE:VITL), an eggs and dairy farming company, seems to offer a compelling investment opportunity in the growing trend of quality nutrition, with consumers increasingly prioritizing ethical sourcing and sustainable practices in their food choices. Vital Farms has successfully capitalized on this trend, rapidly growing its revenues and profit margins. While the stock’s valuation seems rich following a 133% rally over the past six months, I believe in its long-term prospects. Thus, I am bullish on VITL stock.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Meeting Rising Demand for Quality Nutrition and Ethical Sourcing

The main catalyst fueling Vital Farms’ investment case is the ongoing rise in demand for quality nutrition and ethical sources due to heightened consumer awareness concerning the quality of their food choices.

By offering pasture-raised eggs sourced from small, family-owned farms, Vital Farms not only meets this demand for quality but also aligns with the values of health-conscious consumers seeking transparency and ethical sourcing in their food products. This approach contrasts with conventional egg farming methods, where hens are typically confined to cages or indoor facilities.

As consumers increasingly choose free-range eggs over those sourced from caged chickens, Vital Farms has successfully expanded its distribution network. Their range of products, which extends beyond shell eggs to include hard-boiled eggs and liquid whole eggs, is now available in 24,000 retailers across the nation.

Besides Vital Farms seizing the opportunity presented by the growing demand for organically produced free-range eggs, my optimism extends to the broader egg industry. I believe that the overall egg industry will continue to see robust dollar-based growth, driven by the fact that eggs are being increasingly seen as a premium source of essential nutrients, including protein and a wide range of vitamins.

While the shell eggs market is expected to grow at a decent compound annual growth (CAGR) of 2.8% through 2028, producers are awakening to their considerable pricing leverage within what is traditionally viewed as a commoditized industry. This is even more valid for companies like Vital Farms due to their ethically driven practices, allowing them to command a premium price point.

Rapid Growth Across the Board, Strong Profitability

The growing demand for free-range eggs, combined with Vital Farms’ strong pricing power, has resulted in the company posting rapid growth across the board and enjoying strong profitability.

Specifically, the company has grown its revenues at a compound annual growth rate of 34.6% over the past five years. This momentum remains very strong, with FY2023 revenues growing by 30.3%, or 28.0% when excluding the extra 53rd week in the year.

Also, to illustrate that Vital Farms is benefiting equally from the pricing power and the strong demand for its free-range eggs, just take a look at its most recent Q4 results’ revenue growth mix. In particular, Vital Farms’ revenue growth for the quarter was driven by volume-related growth of $13.4 million and price-driven increases of $12.4 million.

In the meantime, increased production and pricing have allowed the company to retain industry-leading margins as well. Over the past five years, Vital Farms has managed to maintain a gross margin that hovers between 25% and 35%. This stands out favorably against its key competitors, who experience significant fluctuations in their gross margins. Furthermore, their figures often hint at narrow profitability, particularly due to the commoditized nature of eggs.

Strong top-line growth and industry-leading margins have resulted in Vital Farms recording improving profitability at a rapid pace. Its adjusted EBITDA grew by 198% to $48.3 million last year, while free cash flow reached a record of $39.4 million, a significant improvement from negative $18.7 million in Fiscal 2022.

Is Vital Farms’ Valuation Inflated?

Despite Vital Farms’ strong top and bottom line growth, the stock’s massive rally over the past six months could suggest that the stock’s valuation is inflated. Note that management continues to expect strong growth moving forward, with revenues projected to grow by at least 17% to $552 million this year. Also, adjusted EBITDA is expected to be at least $57 million, implying a year-over-year growth rate of at least 18%.

Nevertheless, these estimates imply that the stock is currently trading at a rich valuation of about 18x its projected adjusted EBITDA. This implies a notable premium, especially given that, even by management’s estimates, the company’s adjusted EBITDA margin should land close to 10% of revenues, which suggests a thin margin of safety. From a pure earnings perspective, Wall Street expects EPS growth of 19.7% to $0.71 for the year. Again, however, this estimate suggests a rich forward P/E of 35.6x.

While I would usually pass on an egg company trading at 35.6x forward earnings, I am willing to take a flyer on this one and assign a bullish rating. I believe that investors who have already contributed to the ongoing rally see that increased production volumes, strong pricing, and Vital Farms building a brand in a commoditized space can allow it to grow its earnings quite rapidly. In turn, this should allow the stock to grow into its valuation easily.

This scenario has risks, of course, but it seems like a fair assumption, given the company’s stellar track record thus far.

Is Vital Farms Stock a Buy, According to Analysts?

Despite my optimistic outlook, Vital Farms’ significant rally has raised some concerns among Wall Street analysts. The stock features a Moderate Buy consensus rating based on six Buys and three Holds assigned in the past three months. However, at $22.33, the average Vital Farms stock price target implies 12.9% downside potential.

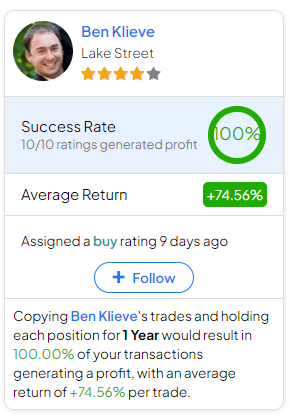

If you’re wondering which analyst you should follow if you want to buy and sell VITL stock, the most profitable analyst covering the stock (on a one-year timeframe) is Ben Klieve of Lake Street, with an average return of 74.56% per rating and a 100% success rate. Click on the image below to learn more.

The Takeaway

To sum up, I see Vital Farms as a compelling investment opportunity for those who want to capitalize on the growing demand for quality nutrition and ethically sourced food. With its focus on pasture-raised eggs sourced from family-owned farms and its overall commitment to transparency and sustainability, the company seems to be winning the trust of consumers. This is evident in its rapidly growing revenues and ability to raise prices without hampering its sales volumes.

Further, while concerns about the stock’s valuation following a significant rally are valid, I believe that Vital Farms’ ongoing momentum and potential for strong earnings growth should allow the company to grow into its valuation. In any case, Vital Farms should likely only be considered by investors willing to embrace its long-term story, as valuation headwinds could impact short-term returns.