Like many companies in the tech and energy sectors, the past few days have been a rollercoaster ride for Vistra Energy (VST) and its investors. The stock experienced a 30% drop off from January 24 to January 27, 2025, as the market spiraled in the wake of the news from Chinese AI startup DeepSeek. This unexpected selloff was driven by concerns that the demand for electricity from AI-driven data centers might not be as high as previously anticipated. Naturally, the news spooked investors, who quickly rotated their capital away from stocks heavily associated with AI, including Vistra.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Despite this recent turbulence, it’s important to take a step back and look at the bigger picture. Vistra had a stellar start to 2025, with its stock surging 23% year-to-date before the decline.

I know What You Did Last Quarter

In the third quarter of 2024, Vistra reported impressive financial results, with revenue growing 54% year-over-year to $6.29 billion and a net income of $1.84 billion. These results exceeded expectations and led the company to raise its full-year guidance for ongoing operations, adjusted EBITDA, and adjusted free cash flow. In addition, the acquisition of Energy Harbor early in 2024 was another big success, adding four nuclear-generation facilities and substantial energy storage capacity to Vistra’s portfolio. This move expanded Vistra’s zero-carbon energy capabilities and positioned it to benefit from the global push for decarbonization.

Vistra’s shift to renewable energy has been a key driver of its success. By investing heavily in solar, wind, and battery storage, the company has aligned itself with the growing demand for clean energy solutions. This strategic focus has reinforced Vistra’s role as a key player in the green energy transition and strengthened investor confidence.

What Does the Future Hold for Vistra?

While the recent selloff has undoubtedly been a setback, it’s not necessarily a sign that the company needs to change its strategy. Instead, it may be an opportunity for Vistra to double down on its strengths and continue to innovate in the renewable energy space. The market’s reaction to DeepSeek’s announcement may have been overblown, as some analysts have suggested, and the long-term demand for clean energy is likely to remain strong.

Vistra’s upcoming earnings report on February 26, 2025, will be key. Strong financial results or positive guidance could help to reinforce the stock’s momentum and restore investor confidence. In the meantime, Vistra should continue focusing on its core strengths, including its renewable energy investments and ability to capitalize on the growing demand for sustainable power solutions.

Is VST Stock a Buy?

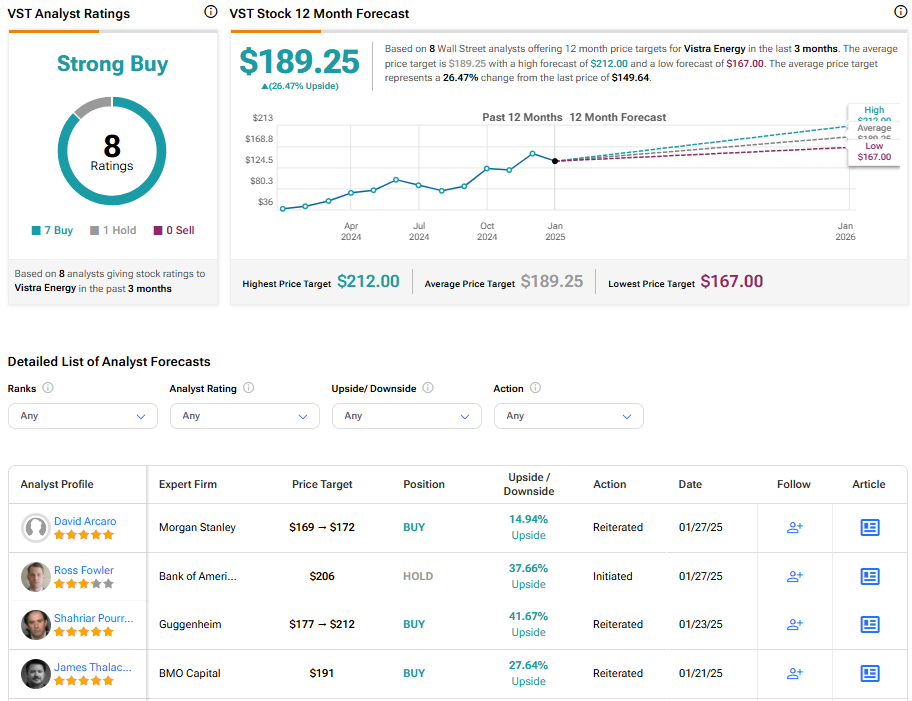

On Wall Street, Vistra is considered a Strong Buy. The average price target for VST stock is $189.25, implying a 26.47% upside potential.

Conclusion

While the recent market turbulence has been challenging, Vistra Energy remains well-positioned for long-term success. The company can navigate these short-term challenges and emerge even stronger by staying the course. Investors should keep an eye on Vistra’s upcoming earnings report and look for opportunities to capitalize on any potential pullbacks in the stock.