As we move into 2026, Visa stock (V) is caught in a strange tug-of-war between old-school market anxiety and a massive, quiet explosion in digital utility. On the surface, the start of the year looks rough for the payments giant. Visa shares finished the first session of 2026 down 1.2%, landing at $346.48. This dip came as the broader S&P 500 (SPX) managed a slight gain, leaving investors to chew on an SEC filing showing CEO Ryan McInerney’s plan to sell over 10,000 shares. To the traditional trader watching the 200-day moving average at $344, Visa looks like a company bracing for a holiday spending hangover.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, if you look past the ticker symbol and into the actual pipes of the network, a different story is emerging. While the stock sits near technical support levels, the volume of crypto-native Visa cards is on an absolute tear. Data from Dune Analytics reveals that net spending across six major blockchain-partnered cards grew from a quiet $14.6 million in January 2025 to a massive $91.3 million by December. That is a 525% increase in a single year, proving that while “digital gold” might be struggling to hit new price highs, “digital cash” is finally becoming a reality for millions of people.

The Death of the HODL Narrative

The real takeaway from 2025 isn’t just that people are spending more crypto; it’s who is facilitating that spend. We are seeing a historic shift away from centralized exchanges toward decentralized finance (DeFi) tools. EtherFi has completely run away with the lead, processing $55.4 million in spending, while competitors like Cypher and GnosisPay follow in its wake. This tells us that users are no longer waiting for a moon mission to cash out. Instead, they are using their portfolios as functional bank accounts, swiping at the grocery store with the same ease as a standard debit card.

This massive surge in adoption is exactly what Polygon researcher @obchakevich_ highlighted when they noted: “These figures demonstrate not only the fast adoption of crypto cards among users but also the strategic importance of crypto and stablecoins for Visa’s global payment ecosystem.”

They went on to say that the increase in volume proves crypto is a “fully-fledged tool for everyday financial transactions.”

Why the Stock Isn’t Celebrating Yet

Even with record crypto adoption, Visa stock remains stuck. Investors are focused on traditional metrics like cross-border fees, which have slowed to 12% growth. There is also anxiety surrounding the 2026 U.S. midterm elections. If new regulations target digital assets, it could stall the momentum Visa has built with its new stablecoin teams.

The real test for Visa in 2026 is whether it can turn this technical utility into consistent profit. While the price of Bitcoin and the price of Visa stock face short-term pressure, the massive increase in card usage shows the infrastructure is already working.

Is Visa Stock a Good Buy?

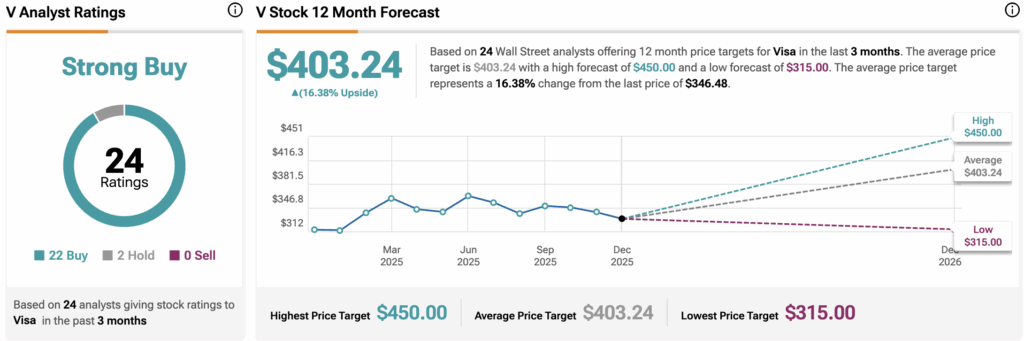

Turning to TipRanks, Visa shares remain a Strong Buy based on analysts’ consensus. This breaks down to 22 Buys and two Holds assigned by 24 Wall Street analysts over the past three months. Moreover, the average 12-month V price target of $403.24 suggests a 16.4% upside potential from the current price level.