Visa shares (V) closed higher on Monday, rising 0.83% to $340.16 before slipping slightly in pre-market trading. The stock move came as the payments giant revealed a new push into stablecoins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At SIBOS 2025, Visa announced a pilot program that lets financial institutions use USDC and EURC as cash equivalents to pre-fund cross-border payouts.

The move positions Visa at the center of a growing push to modernize treasury operations, where outdated rails still slow down payments. Chris Newkirk, president of commercial and money movement solutions at Visa, said, “Cross-border payments have been stuck in outdated systems for far too long.” He added that the stablecoin integration “lays the groundwork for money to move instantly across the world, giving businesses more choice in how they pay.”

Visa Pilot Lets Banks Use Stablecoins for Global Payouts

The pilot is aimed at banks, remittance providers, and other financial institutions that want faster and cheaper ways to handle liquidity. Instead of tying up fiat capital across multiple payment corridors, participants can now fund Visa Direct with stablecoins. For Visa, these tokens function as cash equivalents to initiate payouts.

Using stablecoins for pre-funding could unlock working capital and limit exposure to currency volatility. It also allows for real-time settlements during weekends and off-hours, when traditional systems typically shut down.

Visa says it has already settled more than $225 million in stablecoin volume. This is small compared to its $16 trillion in annual payments, but it signals where the company is headed. The pilot is only open to select partners today, with a wider rollout expected in 2026.

Stablecoins Gain Ground in Payments

The pilot comes as the stablecoin market grows to a $307 billion market cap, according to CoinMarketCap. With tokens like USDC and EURC increasingly seen as reliable payment instruments, the industry is moving past crypto speculation and into utility.

Remittance providers are showing particular interest. Stablecoins can cut costs for international transfers, reduce settlement times from days to minutes, and make global flows more predictable.

Competition Builds with Swift and Startups

Visa’s timing is not a coincidence. Just one day earlier, Swift announced its own blockchain-based settlement initiative with Consensys and more than 30 global banks. The goal is to bring 24/7 cross-border payments to financial institutions worldwide.

Startups are racing in as well. RedotPay, a stablecoin payments company, reached unicorn status last week after raising $47 million in a Coinbase (COIN) Ventures-led round. Stablecoin infrastructure firm Bastion also secured $14.6 million from backers including Sony (SONY), Samsung (SSNLF) Next, Andreessen Horowitz, and Hashed.

Together, these developments highlight the growing race to control the next generation of global payments infrastructure.

Is Visa a Good Stock to Buy?

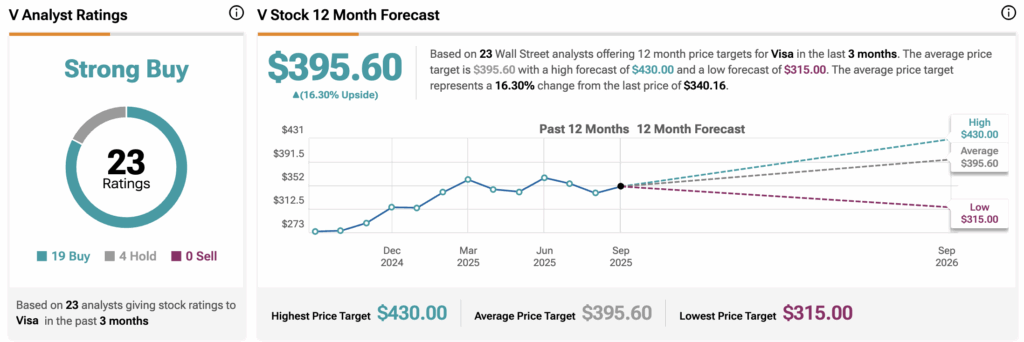

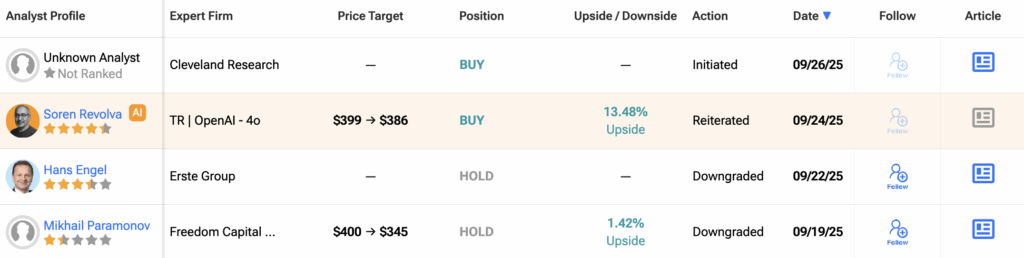

Wall Street remains bullish on Visa even as it experiments with stablecoins. Based on 23 analyst ratings over the past three months, the stock carries a Strong Buy consensus. 19 analysts recommend a Buy, while four suggest a Hold. None have issued a Sell rating.

The average 12-month V price target stands at $395.60, implying a potential 16.3% upside from Visa’s latest close.