Visa (V) and Mastercard (MA) are close to a new court deal with U.S. stores over credit card swipe fees. This is according to a report by The Wall Street Journal. The talks come after nearly twenty years of legal fight and after a judge rejected a prior proposal in 2024. The case is about how much stores pay each time a shopper uses a credit card and about how much choice stores have over which cards they take.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What Visa and Mastercard Are Offering

First, the new plan would cut average credit card fees by about 0.1 percentage point over several years. Today, these fees often sit near 2% to 2.5% of each sale. The cut looks small on one sale, yet it adds up when you spread it across many transactions. In 2023, banks and other firms that issue Visa and Mastercard cards generated about $72 billion from these swipe fees, so even a small cut can move large sums.

Next, the card brands would relax a key rule that shapes how stores take cards. Right now, if a store accepts one type of Visa credit card, it must accept all Visa credit cards. Under the new plan, stores could split credit cards into clear groups, such as rewards cards, no rewards cards, and business cards, and then pick which group to accept. As a result, a store may accept a basic card with a low cost and decline a premium travel card that has a higher fee.

In addition, the talks cover rules on surcharges. These rules set how and when a store can add a small extra fee when a shopper pays with a credit card. So stores that face tight margins may use this tool more often.

What This Could Mean for Card Users and Stocks

For card users, the key change would be what happens at the point of sale. Some stores may stop taking high-fee rewards cards or may steer you to debit, cash, or basic credit instead. Some stores may also add more surcharges for credit card use. Over time, banks may reduce or eliminate some card perks if their fee income declines.

For investors, the fee cut appears modest as a percentage of each payment, and card use continues to grow. Even so, the talks indicate that card fees will remain a focus for courts and large stores, so swipe economics may face slow but steady pressure.

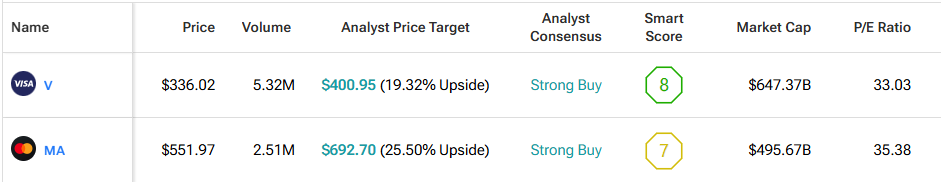

With TipRanks’ Comparison Tool, we set Visa and Mastercard side by side so you can see how each stock holds up. This helps investors check key facts on both names and judge each stock’s strength with ease.