Shares of private spaceflight company Virgin Galactic (SPCE) are up in today’s trading as investors await its Q3 earnings results on November 6 after the market closes. Analysts are expecting earnings per share to come in at -$4.01 on revenue of $2.06 million. This equates to 28.4% and 19.1% year-over-year increases, respectively, according to TipRanks’ data.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

This is ideal because earnings per share should grow faster than revenue as this demonstrates a high degree of operating and financial leverage in the business. Indeed, according to TipRanks’ Bulls Say, Bears Say tool, bullish analysts point out that Virgin Galactic’s business model is highly leverageable due to its fixed cost structure. However, the bears question the business model’s viability.

In fact, bears point out that the company generates little to no revenue when compared to its massive cash burn rate. Furthermore, there are no revenue-generating flights expected until 2026 as Virgin Galactic develops its new fleet of spacecraft, which means there won’t be any meaningful revenue anytime soon.

Options Traders Anticipate a Large Move

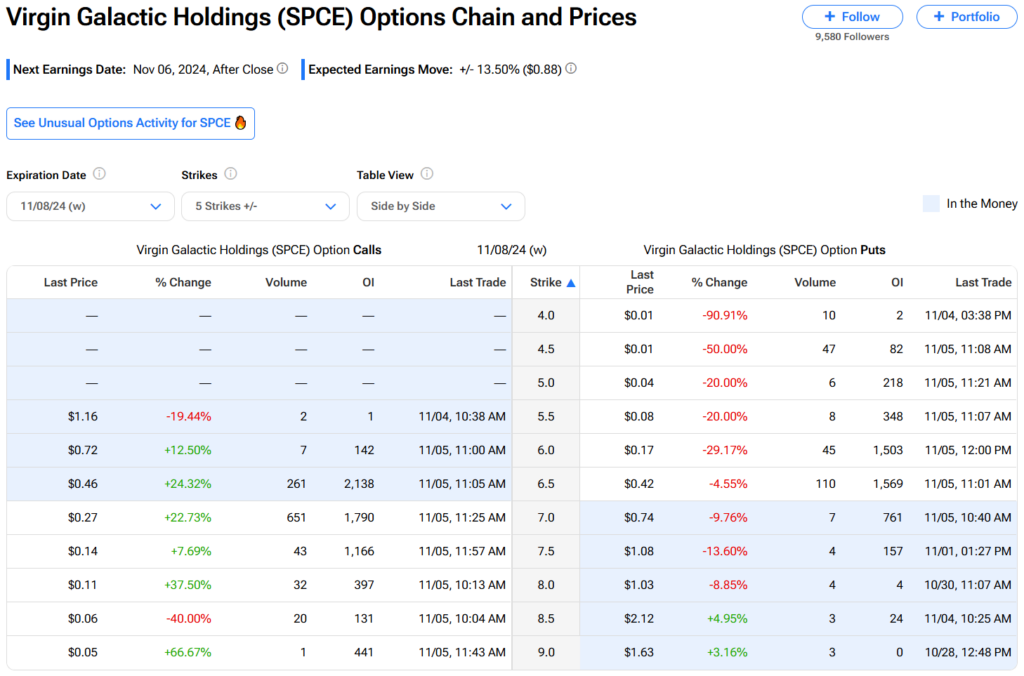

Using TipRanks’ Options tool, we can see that options traders are expecting a 13.5% move from SPCE stock in either direction right after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement.

It is worth noting that SPCE’s after-earnings price moves in the past 13 quarters have mostly been smaller than the 13.5% that is expected. This implies that current option prices might be overvalued.

Is SPCE Stock a Good Buy?

Turning to Wall Street, analysts have a Hold consensus rating on SPCE stock based on two Buys, three Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After an 81% decline in its share price over the past year, the average SPCE price target of $5.80 per share implies 11.45% downside risk.