Shares of Vir Biotechnology (VIR) surged 14.8% on Wednesday after S&P Global announced plans to include the stock in S&P SmallCap 600 index, effective April 4.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based in San Francisco, CA, Vir Biotechnology provides technologies to treat and prevent infectious diseases. VIR stock has tanked 34.2% so far this year.

More Room for Upside?

The company is actively conducting trials on several infectious disease treatments, including chronic hepatitis B virus. Data from trials of VIR-2218 in combination with VIR-3434 are likely to be reported in the first half of this year itself.

Also, in the first quarter of 2022, Vir is likely to have reaped benefit from sales of sotrovimab, its monoclonal antibody drug against Omicron BA.2 variant. Though, the company faced a setback last week when FDA deemed the dosage ineffective against the variant, Vir along with its partner GlaxoSmithKline is working on data supporting higher dosage of sotrovimab.

Further, a Reuters article reported that Vir is in talks with the researchers to find a cure for long COVID, i.e., in cases where symptoms are lasting longer that three months.

Stock Rating

Following the news, H.C. Wainwright analyst Patrick Trucchio maintained a Buy rating on Vir but reduced the price target to $200 from $300. The new price target implies 671.9% upside potential from current levels.

The analyst is disappointed with the FDA’s update that limited the use of sotrovimab emergency use authorization (EUA) in some U.S. regions due to the BA.2 Omicron sub-variant.

“Dialogue between Vir and collaboration partner GlaxoSmithKline and the FDA continue and could include the potential for sotrovimab to retain its authorization at a higher dose of 1 gram (vs. the authorized dose of 500 mg), though at this time it is unknown when an update from the FDA on the higher dose is expected,” he added.

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on two Buys and two Holds. Vir Biotechnology’s average price target of $79.50 implies 206.8% upside potential to current levels.

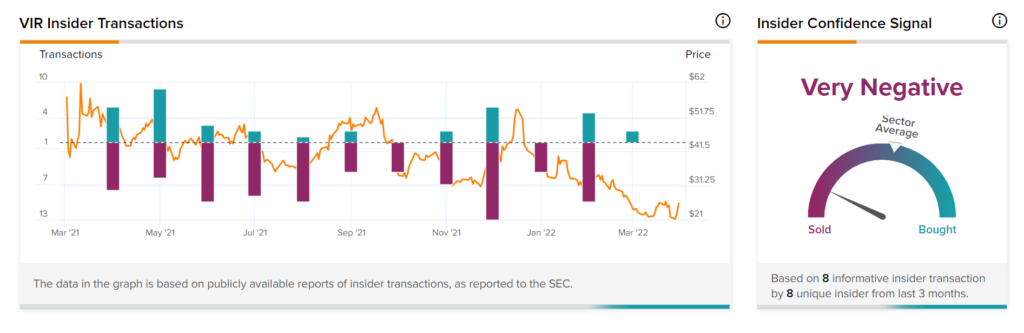

Insider Transactions

Based on the recent corporate insider activity, sentiments seem very negative. This means that over the past quarter there has been an increase in insiders selling their shares of VIR.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Citi’s India Divestment Plan Takes Shape

BioNTech’s Q4 Earnings Impress Investors

Will DTE and Lyft Partnership Benefit EV Drivers?