Shares of biopharma company Viking Therapeutics (VKTX) rose as high as 5% during the first hour of trading on Monday. The company appears to be riding on the momentum of the successful trial for its new obesity drug, VK2735.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Viking’s Obesity Drug Shows Potential

Recently, Viking announced the results of the Phase 2 VENTURE clinical trial for the new obesity drug. According to the company, up to 97% of patients who participated in the study achieved at least 5% weight loss after using the drug.

VK2735 targets both the GLP-1 and GIP receptors — specialized proteins located on the surface of cells in the body. GLP-1 is a hormone that increases insulin secretion after meals, helping to lower blood sugar and reduce appetite.

GIP also boosts insulin secretion following food intake, which helps stabilize blood sugar levels—though its effect on appetite is less pronounced.

Big Pharma Race for Obesity Market Share

The rise in VKTX stock comes after American pharmaceutical giant Pfizer (PFE) ended its acquisition tussle for obesity-focused biotech startup Metsera (MTSR) by putting forward a performance-contingent $10 billion offer.

The offer topped its earlier bid, enabling it to clinch the deal ahead of rival Novo Nordisk (NVO), which also vied for the takeover. However, Novo Nordisk, a Danish pharmaceutical giant, is said to be on the hunt for other opportunities in the $70 billion obesity market.

Can Viking’s Obesity Drug Stand Out?

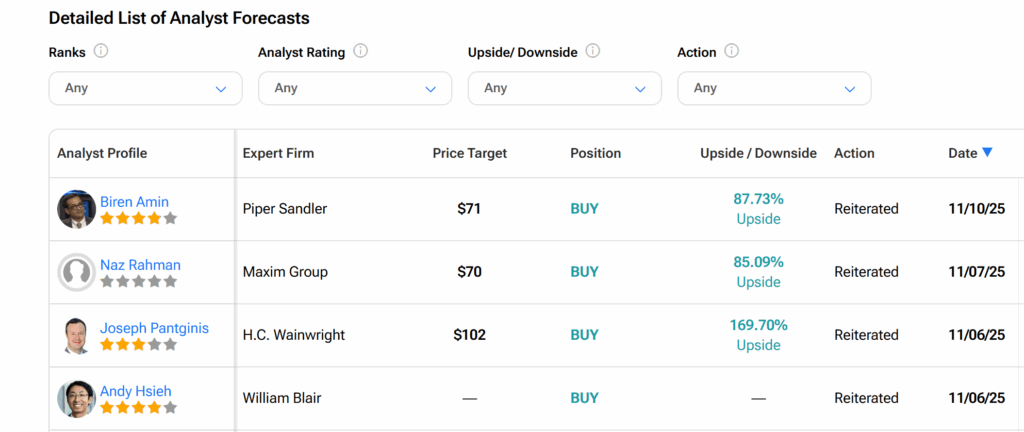

William Blair analyst Andy Hsieh, who recently reiterated his Buy rating on VKTX, believes that the trial results make Viking highly attractive to big pharma companies. Similarly, Maxim Group analyst Naz Rahman believes that Viking’s plan to offer the drug as both a pill and an injection could enhance its commercial competitiveness.

In addition, Canaccord analyst Edward Nash sees Viking’s new drug standing out on “multiple fronts”. This comes even as Viking’s recent third-quarter results show that its net losses are deepening due to higher expenditure on research and development.

Is VKTX Stock a Good Buy?

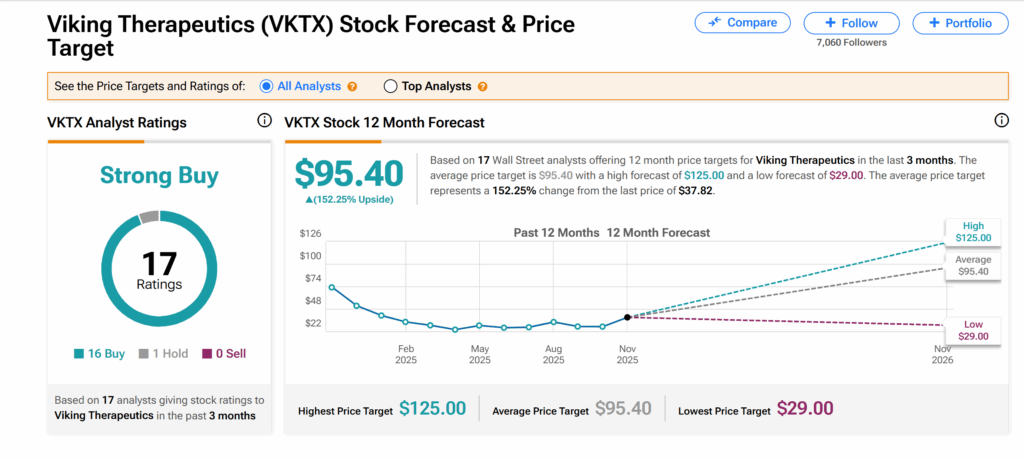

Across the board, Wall Street is currently bullish on Viking, showing confidence in its obesity drug development efforts. Viking’s shares currently enjoy a Strong Buy consensus rating, according to TipRanks.

This is based on 16 Buys and one Hold issued by analysts over the past three months. Moreover, at $95.40, the average VKTX price target indicates a massive 152% growth potential from the current level.