Green & Smart Mobility JSC (GSM), the ride-hailing business launched by Vietnamese billionaire Pham Nhat Vuong in 2023, is planning an overseas initial public offering (IPO) for the future.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to Vingroup, the Vietnamese conglomerate that is the parent company of GSM and Nasdaq-listed electric vehicle maker VinFast (VFS), while advisors have suggested the international debut could value GSM at about $20 billion, consultation on the move remains ongoing.

Will GSM Go Public in Hong Kong?

In a statement, GSM confirmed the plan, but noted that the IPO will not happen in 2026, as the scheduled date for the offering or exchange of choice has not been determined. However, Reuters, which first broke the story, reported plans to go public in Hong Kong in 2027, citing insider sources.

Since launching in 2023, GSM, which is known locally as Xanh SM and operates an all-electric fleet supplied by VinFast, has emerged as a key rival to Vietnamese firm Grab (GRAB), which is also listed on Nasdaq. It has achieved a significant market share of the domestic market and is seeking to overtake Grab in the ride-hailing business.

GSM Pushes into Southeast Asia

An IPO will help GSM further drive its expansion, even as the ride-hailing firm is working to introduce its services into Laos, Indonesia, and the Philippines. The firm also plans to enter the Indian market.

VinFast debuted on Nasdaq in 2023 and, as of early Tuesday, has a market capitalization of $7.93 billion. The automobile manufacturer serves as a key client for VinFast’s electric cars.

IPO Activity Picks Up in 2025

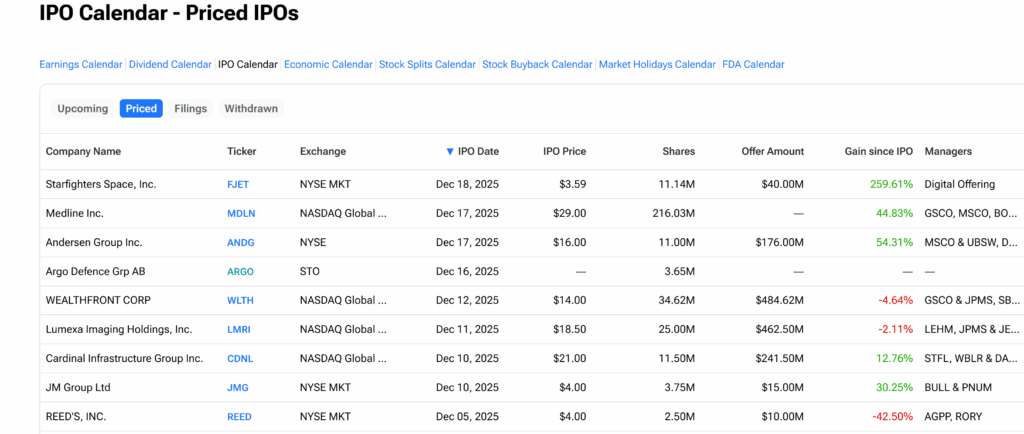

GSM’s plans come as stabilisation returned to the global IPO market this year, with U.S. exchanges hosting several public debuts, including medical supply firm Medline’s (MDLN) recent table-topping $6 billion IPO on Nasdaq.

However, frequent and irregular bouts of volatility forced many companies to delay listings or rethink their valuation ambitions, according to EY’s Global IPO Trends 2025.

Which Companies Went Public This Year?

Using the TipRanks IPO Calendar, investors can check out businesses that had their IPOs this year and how their stocks have been priced since their debut.