ViacomCBS Networks International (VCNI), a unit of ViacomCBS (VIAC), inked a deal to snap up Chilevision from WarnerMedia. The financial terms of the deal were not disclosed.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Chilevision’s library includes sports, entertainment, and news, with it boasting huge production capabilities. Through the acquisition, more diverse entertainment options across premium, pay, and free platforms will be available to consumers, the company said.

The combined entity will create an aligned commercial, content, and distribution strategy, strengthening and expanding VCNI’s presence in the Southern Cone of Latin America. As a result of the deal, VCNI’s global content offering will be complemented by Chilevision’s free-to-air (FTA) television network. (See ViacomCBS stock analysis on TipRanks)

The deal, which awaits regulatory approvals, is likely to be financed by ViacomCBS’s existing cash balances.

VCNI CEO Raffaele Annecchino said, “Latin America is one of the world’s fastest-growing streaming markets, and Chilevision will be a key driver of our accelerated streaming strategy in the region. Chilevision is an extraordinary addition to our existing business in Latin America and will fortify ViacomCBS’s position as a premier Spanish language content producer.”

On March 29, Credit Suisse analyst Douglas Mitchelson upgraded the stock to Hold from Sell and maintained a price target of $46 (7.2% upside potential).

Mitchelson previously expected investors, who invest based on fundamentals, to “steer clear” of the stock before it reached the current levels. Now, the analyst sees ViacomCBS as “positively biased” in the first half of this year based on the potential catalysts and considers the estimates for the ongoing year “reasonable” rather than “conservative.”

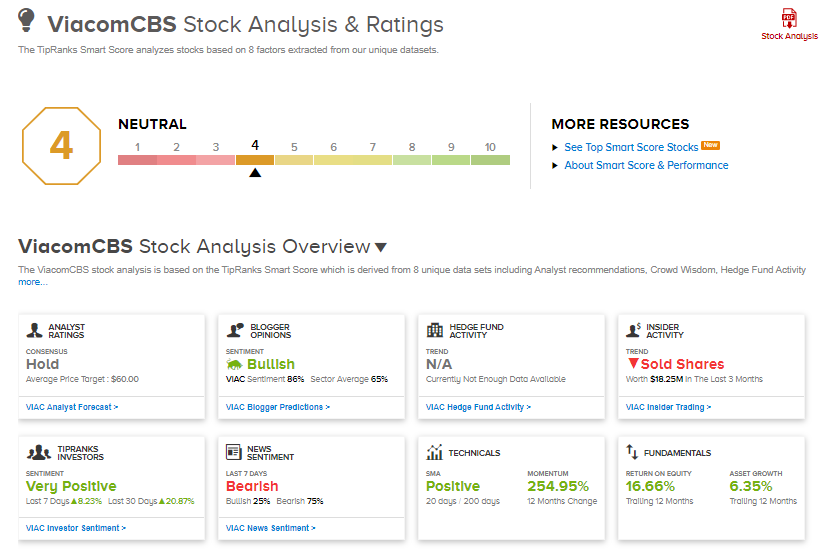

Overall, the stock has a Hold consensus rating based on 5 Buys, 10 Holds, and 7 Sells. The average analyst price target of $60 implies almost 40% upside potential from current levels. Shares have increased 50.8% over the past six months.

According to TipRanks’ Smart Score system, ViacomCBS gets a 4 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

Pioneer Natural To Buy DoublePoint Energy For $6.4B; Shares Fall Pre-Market

CarMax’s Quarterly Profit Beats Analysts’ Expectations; Shares Tank 7%

Q2 Holdings Inks Deal To Acquire ClickSWITCH; Shares Gain