European stocks are quietly enjoying a strong run of momentum. The two largest European ETFs, the Vanguard FTSE Europe ETF (NYSEARCA:VGK) and the iShares MSCI Eurozone ETF (BATS:EZU) are up 15.9% and 20.0%, respectively, over the past six months. However, there is still plenty of reason to consider gaining exposure to European stocks and ETFs, which I’m bullish on based on their renewed momentum, undemanding valuations, and attractive dividends.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This makes it a good time to compare VGK to EZU to determine which is the better Europe-focused ETF for investors, as we’ll delve into below.

What Are the VGK and EZU ETF’s Strategies?

VGK is an index fund from Vanguard that invests in the “FTSE Developed Europe All Cap Index, which measures the investment return of stocks issued by companies located in the major markets of Europe.”

The fund debuted in 2005, and it has $18.9 billion in assets under management (AUM), making it the largest Europe-focused ETF in the market.

Meanwhile, EZU, part of the iShares cohort of ETFs, debuted all the way back in 2000 and is also a popular choice with investors, as it has $7.5 billion in AUM.

EZU is an index fund that, according to iShares, “seeks to track the investment results of an index composed of large- and mid-capitalization equities from developed market countries that use the Euro as their official currency.”

iShares explains that EZU can be used by investors to gain “exposure to developed market countries using the Euro for currency” and that it gives investors “convenient access to a broad range of Eurozone stocks.” The ETF can be used by U.S. investors to “diversify internationally and express a view on the Eurozone.”

Why Is Investing in Europe an Attractive Idea Right Now?

It’s often discussed that the European market has underperformed the U.S. market for many years. However, European stocks look attractive overall for several reasons.

First and foremost, European stocks are cheap and far cheaper than their U.S. peers. For example, the S&P 500 (SPX) trades for 23.2 times earnings, while the average price-to-earnings multiple for VGK’s holdings is a significantly lower 14.7 times.

Furthermore, as a whole, European stocks offer higher dividend yields than U.S. stocks. For example, VGK yields 3.4%, more than double the S&P 500’s current yield of 1.4%.

Lastly, while they are cheaper and higher-yielding, European stocks seem to be turning a corner in terms of momentum and performance.

Goldman Sachs (NYSE:GS) coined the acronym “GRANOLAS” (reminiscent of the “FAANG” stocks, or, more recently, the Magnificent seven stocks in the U.S.) to hail a group of Europe’s “internationally exposed quality growth compounders.”

The GRANOLAS group is comprised of 11 stocks — ASML (NASDAQ:ASML), AstraZeneca (NASDAQ:AZN), GlaxoSmithKline (NYSE:GSK), L’Oreal (OTC:LRLCY), LVMH (OTC:LVMUY), Nestle (OTC:NSRGY), Novartis (NYSE:NVS), Novo Nordisk (NYSE:NVO), Roche (OTC:RHHBY), Sanofi (NASDAQ:SNY), and SAP (NYSE:SAP).

This cohort helped push Europe’s STOXX 600 index 12.3% higher over the past six months and hit a record high in March before U.S. and European markets both tumbled over geopolitical concerns and fears that interest rates would remain higher for longer.

And believe it or not, while the Magnificent Seven seems to get a lot more attention, Goldman Sachs found that the GRANOLAS had actually outperformed the Magnificent Seven over the past two years, with lower volatility than the Magnificent Seven.

What Stocks Do EZU and VGK Hold?

EZU offers investors ample diversification; it holds 224 stocks, and its top 10 holdings account for a very reasonable 29.8% of the fund. Below, you’ll find an overview of EZU’s top 10 holdings using TipRanks’ holdings tool.

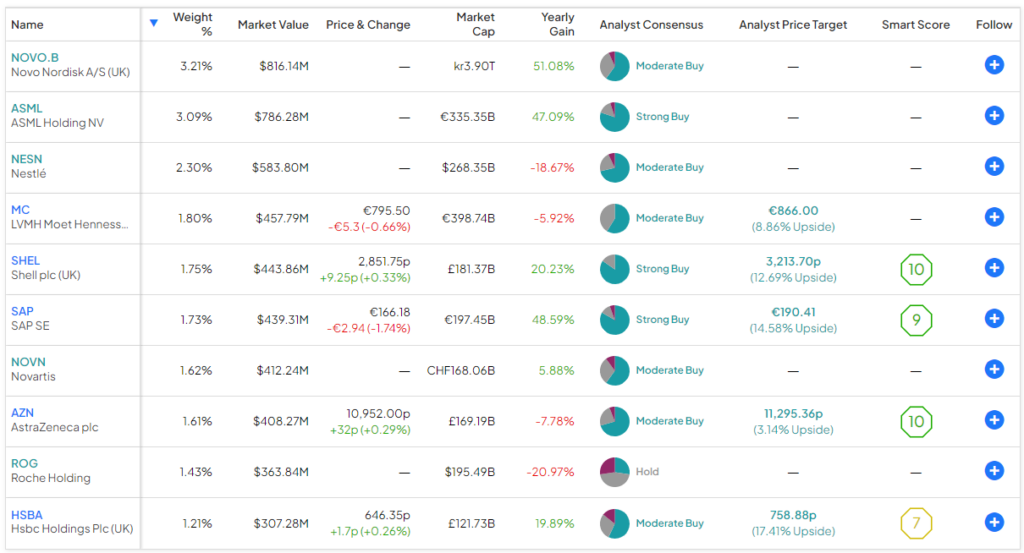

However, VGK offers even more diversification and less concentration — the Vanguard fund holds 1,279 stocks, and its top 10 holdings make up just 19.8% of the fund. Below, you’ll find an overview of VGK’s top 10 holdings.

While the two funds share a few top holdings in common, including ASML, LVMH Moet Hennessy, and SAP, overall, there is less overlap than one might expect, given that the funds are both focused on Europe. Note that VGK gives investors more exposure to the GRANOLAS — with eight of the GRANOLA stocks in its top 10 holdings versus four for EZU.

Performance Comparison

As of March 31, VGK has returned 5.7% on an annualized basis over the past three years and 8.0% on an annualized basis over the past five years. EZU has outperformed VGK by a very narrow margin, with a three-year annualized return of 5.9% and 8.6% over the past five years as of the same date. Over the past 10 years, the funds have identical 4.6% annualized returns.

While these returns have been lackluster, they also create the opportunity to invest in these stocks at fairly inexpensive levels today, and there is room for upside ahead.

Which ETF Has the Higher Dividend Yield?

Both of these ETFs are dividend payers with decent payouts, but VGK’s dividend yield of 3.4% easily trumps EZU’s yield of 2.5%.

Which ETF Is the Better Bargain?

One area that truly separates these two ETFs is their expense ratios. VGK charges a very low expense ratio of just 0.11%, meaning that an investor in the fund will pay just $11 on a $10,000 investment annually. This is a favorable expense ratio, to begin with, and it’s even more remarkable when considering that VGK is an ETF that invests in international stocks, and these types of ETFs usually come with considerably higher price tags.

Meanwhile, EZU charges an expense ratio of 0.51%. This means that an investor in EZU will pay $51 in fees on a $10,000 investment annually. This isn’t terrible for an international ETF, but there’s no escaping the fact that it’s nearly five times what VGK charges.

Assuming each ETF maintains its current expense ratio, the investor putting $10,000 into VGK will pay just $115 in fees over 10 years, while the investor in EZU will pay much more — $640 over the same time frame.

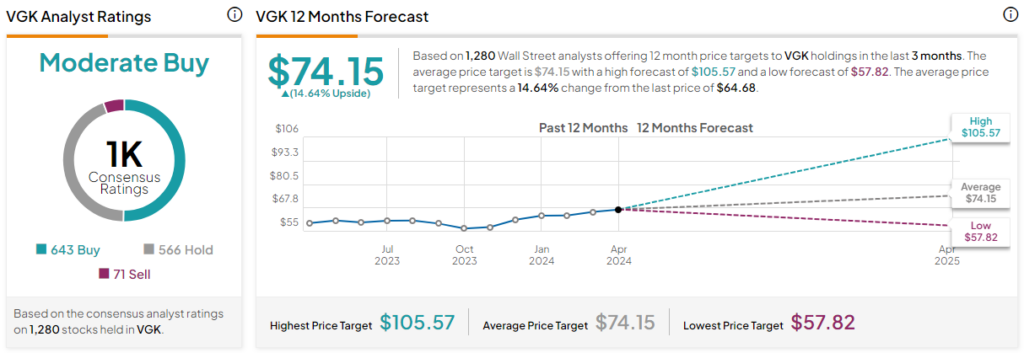

Is VGK Stock a Buy, According to Analysts?

Turning to Wall Street, VGK earns a Moderate Buy consensus rating based on 643 Buys, 566 Holds, and 71 Sell ratings assigned in the past three months. The average VGK stock price target of $74.15 implies 14.6% upside potential.

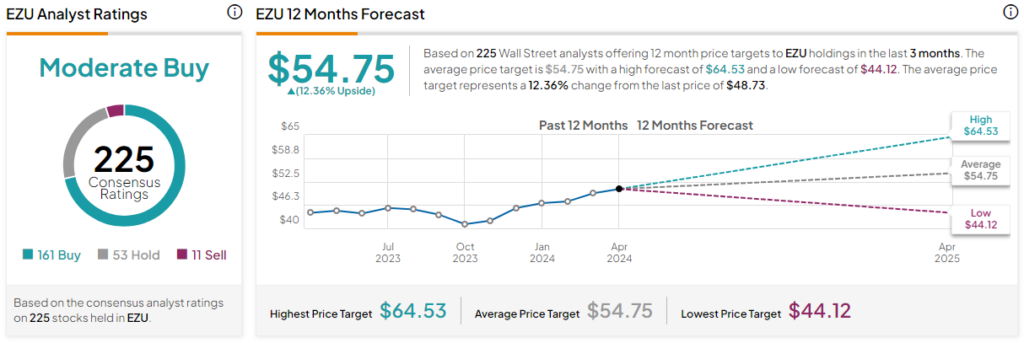

Is EZU Stock a Buy, According to Analysts?

Meanwhile, EZU earns a Moderate Buy consensus rating based on 161 Buys, 53 Holds, and 11 Sell ratings assigned in the past three months. The average EZU stock price target of $54.75 implies 12.4% upside potential.

Choosing a Winner

Both funds have performed similarly over the past 10 years, while EZU has narrowly outperformed VGK in recent years. However, VGK clearly looks like the superior choice based on its far lower expense ratio, higher dividend yield, and superior diversification.

I’m bullish on VGK overall, based on the attractive valuations for European stocks (not to mention the recent momentum they have gained) and the fund’s favorable expense ratio, strong diversification, and attractive 3.4% dividend yield. I also like the fact that VGK gives investors exposure to all of the high-powered GRANOLA stocks.