Vertiv (NYSE:VRT) dropped in pre-market trading after its Q4 revenues and Q1 guidance fell short of estimates. The provider of critical infrastructure and services for data centers expects Q1 adjusted earnings between $0.32 and $0.36 per share on net sales of $1.58 million to $1.62 million. The company’s Q1 adjusted EPS estimate is below the Street’s forecast of $0.37 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For FY24, Vertiv projects revenues in the range of $7.52 billion to $7.65 billion, with adjusted earnings estimated to be between $2.20 and $2.26 per share. For reference, Wall Street estimates suggest adjusted earnings of $2.24 per share.

In Q4, the company posted revenues of $1.87 billion, a gain of 13% year-over-year. Still, this fell short of Street estimates of $1.88 billion. On the other hand, the firm reported earnings of $0.60 per share compared to $0.07 per share in the same period last year, which exceeded consensus estimates of $0.53 per share.

Is VRT a Good Stock to Buy?

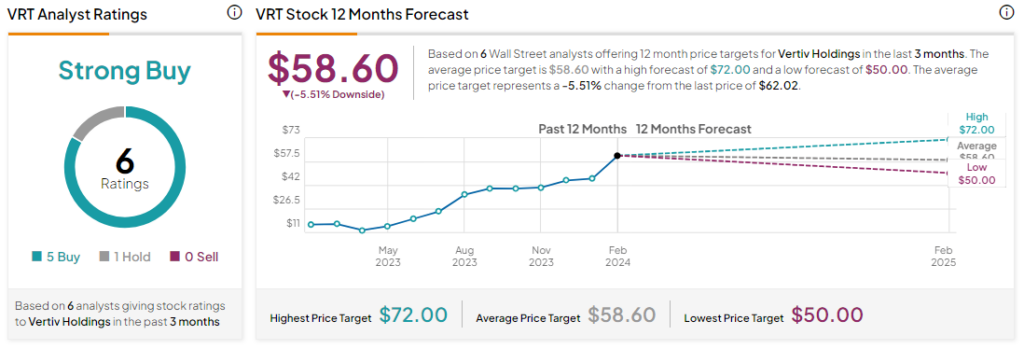

Analysts remain bullish about VRT with a Strong Buy consensus rating based on five Buys and one Hold. Over the past year, VRT stock has skyrocketed by more than 300%, and the average VRT price target of $58.60 implies a downside potential of 5.5% at current levels. However, it is important to note that the analyst ratings will likely change in reaction to VRT’s earnings.