Biotechnology company Vertex Pharmaceuticals (VRTX) reported mixed results for the fourth quarter of 2024. While revenue surpassed analyst expectations, driven by strong demand for its cystic fibrosis (CF) treatments, earnings fell short of estimates. Further, Vertex provided an upbeat 2025 revenue guidance, which beat analyst projections.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Revenue for the quarter reached $2.91 billion, reflecting a 15.6% increase year-over-year and beating the consensus estimate of $2.78 billion. However, adjusted earnings per share fell 5.2% to $3.98 and came below analyst expectations of $4.02. The lower-than-expected EPS was due to higher research and development expenses, along with an increase in selling, general, and administrative costs.

Strong CF Demand and New Treatments to Support Revenue Growth

Looking ahead, Vertex anticipates strong revenue growth. The company expects full-year 2025 revenue to be between $11.75 billion and $12.0 billion, exceeding analyst expectations of $11.85 billion. VRTX expects to benefit from robust demand for CF treatments and new revenue from the recently approved non-opioid painkiller Journavx and the CF treatment for individuals aged six and above, Alyftrek.

Further, the company plans to launch five new treatments by 2028, boosting its position in the CF treatment market. Also, it aims to expand into new therapeutic areas such as diabetes and pain management.

Moreover, Vertex is making efforts to increase patient access to its treatments, including its gene therapy, Casgevy, through collaborations with the Centers for Medicare & Medicaid Services. This bodes well for its revenue growth.

VRTX Announces Executive Shake-up

Along with Q4 earnings, Vertex revealed some changes in executive positions. The company said that Stuart Arbuckle, its chief operating officer (COO), will retire on July 1, 2025.

Further, Chief Financial Officer Charlie Wagner will assume the additional role of COO, while Duncan McKechnie, head of North American commercial operations at Vertex, will become chief commercial officer.

Is VRTX a Good Stock to Buy?

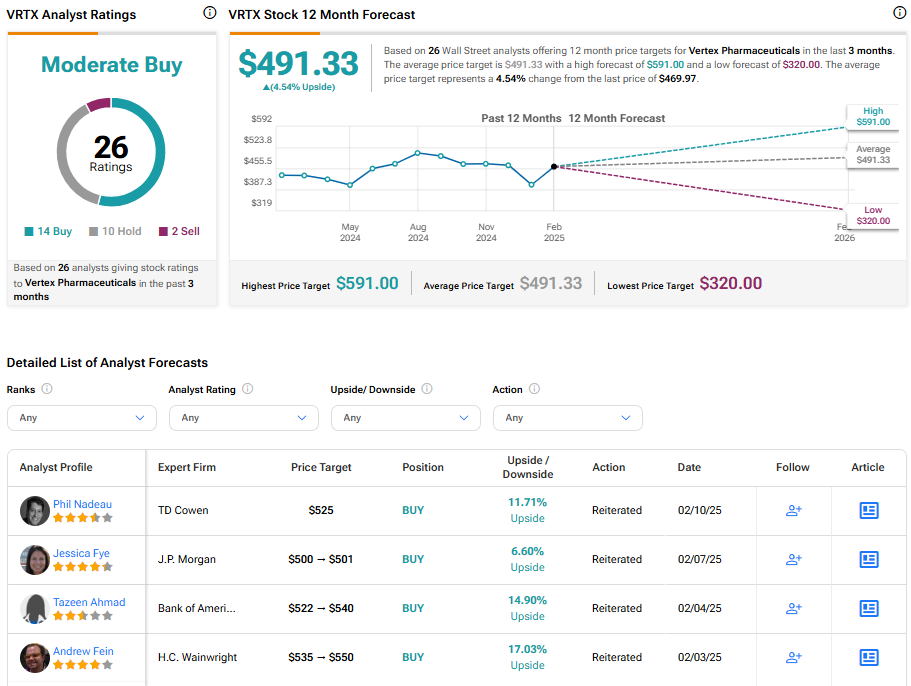

Turning to Wall Street, Vertex stock has a Moderate Buy consensus rating based on 14 Buys, 10 Holds, and two Sells assigned in the last three months. At $491.33, the average Vertex stock price target implies 4.54% upside potential. Shares of the company have declined 6.33% in the past three months.