Verizon Communications (NYSE:VZ) collapsed in 2022 and continued to collapse into late 2023. After a deep analysis of the company’s competitive position, I began buying at around $40/share and continued purchasing all the way down to $30/share. Verizon provides mobile and broadband services to businesses and consumers across the United States. I remain bullish on VZ. As subscription prices increase, Verizon’s financial and operating leverage (a.k.a. fixed costs) could amplify profits and returns.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

How Leverage Can Boost Verizon’s Returns

For a long time, I had a negative association with the word “leverage.” In my mind, leverage meant debt, and debt was bad. This changed when I studied corporate finance and learned about financial and operating leverage. Financial leverage refers to the use of debt (especially fixed-rate debt), and operating leverage refers to the use of fixed operating costs. These fixed costs amplify risk when revenues fall but also amplify profits when revenues rise.

Let’s examine some of Verizon’s costs. Verizon has a lot of fixed-rate debt and infrastructure. Interest rates on Verizon’s debt change slowly as the debt rolls over. The company even has some debt maturities stretching all the way out to 2060. In other words, Verizon has a substantial amount of “financial leverage.” The nice thing about Verizon’s infrastructure is it typically doesn’t ask for a raise. This is “operating leverage.”

Verizon’s employee count has been in steady decline. Despite high energy costs in recent years, Verizon’s operating expenses have barely grown at all since 2014. Unfortunately, this was accompanied by very modest revenue growth.

Verizon has a very strong competitive position in the United States after spending tons of money acquiring C-Band spectrum. Verizon grew its 2023 total wireless retail connections (0.4% year-over-year) and its total broadband connections (14.6% year-over-year). Meanwhile, the company is also increasing prices alongside AT&T (NYSE:T) and T-Mobile (NASDAQ:TMUS). I think the industry has consolidated nicely and that these price hikes have room to run in the decade ahead.

If Verizon grows its revenue ($134 billion) at 3.5% per annum for 10 years, it will result in 2033 revenue of $189 billion. I think Verizon’s pre-tax expenses ($117 billion) will grow at a slower pace, at around 2% per annum, reaching $143 billion in 2033 as employee counts fall, energy prices normalize, and debt levels decrease.

The one-off $5.8 billion impairment taken in 2023 should also disappear. This would increase Verizon’s pre-tax income from $17 billion in 2023 to $46 billion in 2033, a 270% increase. And it’s all because the company has leverage/fixed costs.

With Verizon trading a just 10x its 2023 pre-tax income, growth like this would likely send the stock soaring. While I understand there are a range of possible outcomes, this upside keeps me bullish on VZ.

Verizon’s Debt Isn’t as Bad as It Looks

At first glance, Verizon’s $150.7 billion of total debt looks daunting, but CEO Hans Vestberg and the team locked in a lot of low-rate debt in 2020 and 2021. Verizon’s 2023 interest expense was only $5.5 billion, which is covered 5x over by the company’s $28.7 billion pre-impairment operating income.

While I expect the interest rate on Verizon’s debt to increase in the years ahead, I also expect management to pay down the debt using the company’s excess free cash flow. In the Q4-2023 earnings call, CFO Tony Skiadas said, “Overall, we expect a strong free cash flow profile that will support our capital allocation priorities and position us for meaningful unsecured debt reduction in 2024.”

5G Spend Is Likely Over

In recent years, Verizon hasn’t exactly gushed cash. It had to spend a lot of money on wireless licenses and capital expenditures to strengthen its competitive position in 5G. I think that’s likely over now, as the company has blazing-fast 5G in major cities and, according to Forbes, the best 5G home internet in the nation. This only bolsters Verizon’s competitive position; its network has been the most awarded by J.D. Power 32 times in a row.

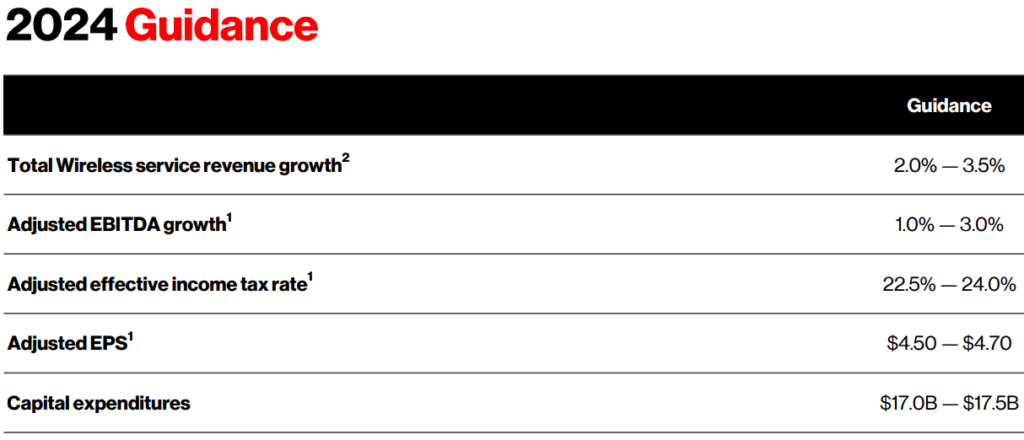

Verizon’s competitors, T-Mobile and AT&T, are also strapped for cash and carrying a lot of debt. I think the bulk of 5G spend is likely over. Verizon plans to decrease its capital expenditures again in 2024, as you can see below (CapEx was $18.77 billion in 2023).

Is VZ Stock a Buy, According to Analysts?

Currently, nine out of 17 analysts covering VZ give it a Buy rating, seven rate it a Hold, and one analyst rates it a Sell, resulting in a Moderate Buy consensus rating. The average VZ stock price target is $44.71, implying upside potential of 7.6%. Analyst price targets range from a low of $34 per share to a high of $50 per share.

The Bottom Line on VZ Stock

Verizon’s competitive position is strong, its interest expense is well covered by operating income, and it has significant fixed costs. Verizon, AT&T, and T-Mobile are beginning to increase prices, which could result in an everyone-wins situation as industry revenues outgrow expenses. In Verizon’s case, 3.5% compounded revenue growth and 2% expense growth would result in a 270% surge in pre-tax income by 2033.