Communications giant Verizon (VZ) has scrapped its DEI programs in an attempt to win U.S. Government approval for its $9.6 billion acquisition of Frontier Communications.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Long Running Deal

According to a Reuters report Verizon has written a letter to Federal Communications Commission chair Brendan Carr, stating that it was removing its “Diversity and Inclusion” website and removing references to DEI from employee training. It is also making other changes to hiring, career development, supplier diversity and corporate sponsorship practices.

This followed comments back in February from Carr criticizing Verizon for promoting DEI and declaring that it could be a factor in the long-running Frontier acquisition.

It was in 2024 when Verizon made the announcement with the hope of boosting its fiber network. It would allow it to better compete against rivals such as AT&T (T) by providing premium broadband services.

In the letter, Verizon added that it would also scrap workforce diversity goals and management bonuses linked to them.

DEI Discrimination

“Verizon recognizes that some DEI policies and practices could be associated with discrimination,” said Verizon chief legal officer Vandana Venkatesh adding that the changes would happen with immediate effect.

Carr said he was pleased and that the move promoted equal opportunity and nondiscrimination. However, despite the move the Verizon stock was only up 0.4% in early trading.

The move against DEI in the U.S. has gathered pace since the election of President Trump, who has described these programs as being “illegal and immoral.” On his first day in office, he told federal agencies to end all “equity-related” grants or contracts and required federal contractors to certify they don’t promote DEI.

Many blue-chip corporations followed his lead such as retailer Target (TGT) and tech group Meta Platforms (META).

Is VZ a Good Stock to Buy Now?

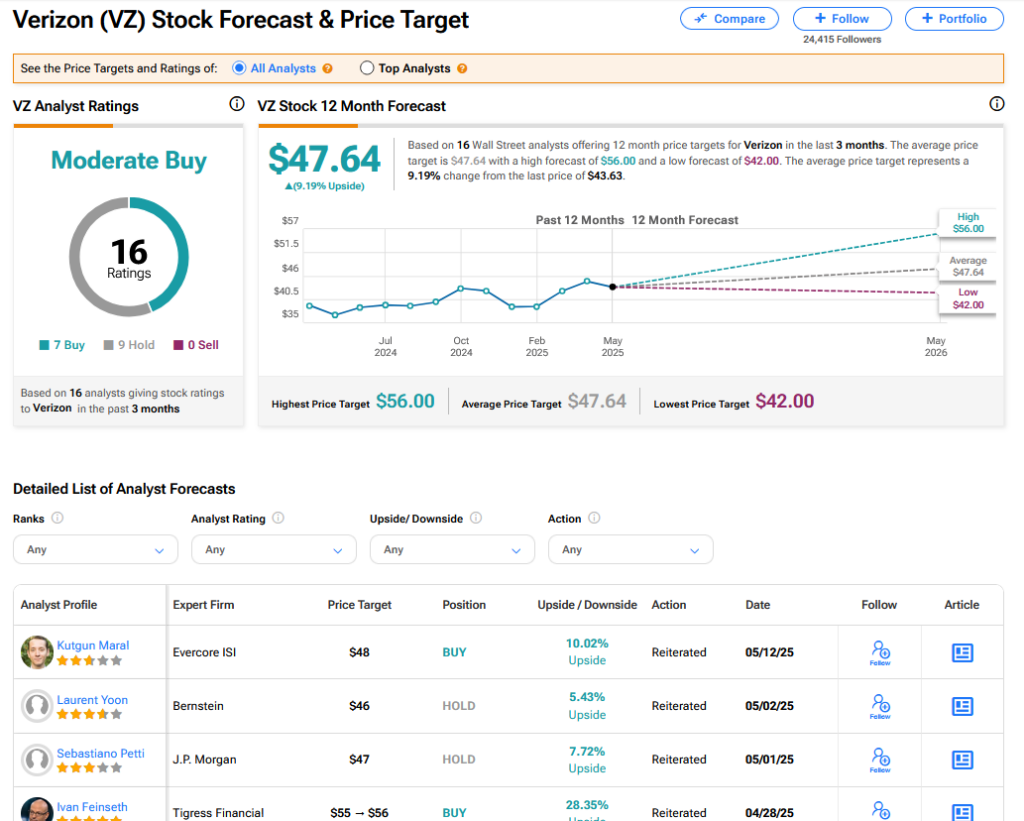

On TipRanks, VZ has a Moderate Buy consensus based on 7 Buy and 9 Hold ratings. Its highest price target is $56. VZ stock’s consensus price target is $47.64 implying an 9.19% upside.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue