Veeva Systems (VEEV) just delivered the kind of quarter Wall Street didn’t see coming — and investors are racing to price it in. The cloud-software firm, best known for serving the life sciences sector, posted a massive earnings beat and raised its full-year outlook. The result? A 22% surge that sent shares flying to their highest close since late 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Viva Beats the Street, Then Raises the Bar

In its Fiscal Q1 earnings, Veeva posted adjusted earnings of $1.97 per share, crushing the $1.74 analysts had expected. Revenue also beat consensus, coming in at $759 million versus the $728 million forecast.

But Veeva didn’t stop there. Management hiked full-year EPS guidance to $7.63, up from a prior forecast of $7.32. CEO Peter Gassner called it “our best first quarter ever” and pointed to steady pipeline strength despite macro headwinds. “We’re executing well and staying focused on long-term growth,” he told investors on the call.

Oppenheimer Cheers, Morgan Stanley Shrugs

Oppenheimer’s Kenneth Wong wasted no time calling the quarter “arguably Veeva’s best in recent memory.” The firm boosted its price target to $325 from $280 and praised Veeva’s early steps toward diversifying beyond life sciences. The company plans to launch a CRM product for other industries in 2025, and analysts say it could be a sleeper growth catalyst.

Stifel also raised its target to $295, citing strong subscription momentum and performance in Veeva’s Crossix segment.

But not everyone’s buying the breakout. Morgan Stanley analysts kept their Underweight rating, warning that industry challenges — like FDA budget pressure and Trump’s drug pricing plan — could weigh on Veeva’s core customers. Their price target? $210.

Investors Pile In as VEEV Hits a 3-Year High

The market didn’t hesitate. Veeva stock jumped 22% to $285.24, its highest close since November 2021. Trading volume exploded, and momentum shows little sign of fading — especially with sentiment shifting on cloud profitability.

Is Veeva a Good Stock to Buy?

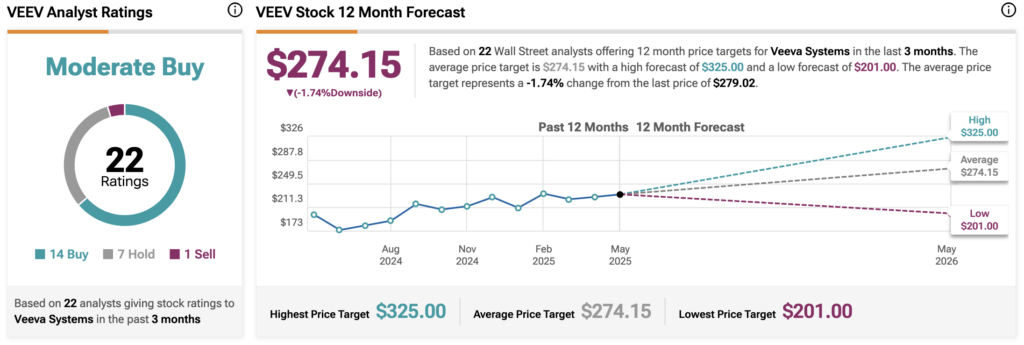

Even with Veeva stock roaring after earnings, Wall Street isn’t entirely sold on runaway upside. According to TipRanks, 22 analysts covering the stock in the past three months give it a Moderate Buy rating — with 14 Buys, seven Holds and just one Sell

The average 12-month VEEV price target is $274.15, a hair below current levels.