Growth stocks tend to underperform during economic uncertainty, such as the ongoing high interest rate and inflation scenario. At such times, it is better to invest in growth ETFs instead of growth stocks directly as a safer investment option due to the diversification associated with ETFs. Despite the short-term noise, growth stocks are one of the best ways to boost your portfolio since they have high long-term growth opportunities and can offer share price appreciation once markets rebound.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

We used the TipRanks ETFs Comparison tool to compare three Growth Stocks ETFs: Vanguard Small-Cap Growth ETF (VBK), iShares Russell Mid-Cap Growth ETF (IWP), and American Century STOXX U.S. Quality Growth ETF (QGRO) to discover the ETF with the highest upside potential, as per analysts.

Vanguard Small-Cap Growth ETF (VBK)

The Vanguard Small-Cap Growth ETF seeks to replicate the performance of the CRSP US Small Cap Growth Index, an index featuring over 600 small capitalization ($300 million to $2 billion) companies in the U.S. VBK is a passively managed fund that fully replicates the tracking index. It pays a regular quarterly dividend of $0.40 per unit, reflecting a dividend yield of 0.68%.

The VBK ETF has a vast diversified portfolio of small-cap stocks from different industries and carries a very low expense ratio of 0.07%. The top three sector exposures are Technology (26.1%), Industrials (18.8%), and Healthcare (16.57%).

As of date, VBK has 622 holdings and $17 billion in assets under management (AUM), with the top ten holdings accounting for 9.87% of the total portfolio. The top three holdings are Targa Resources Corp. (TRGP), Axon Enterprise (AXON), and Deckers Outdoor (DECK).

Is VBK a Good Buy?

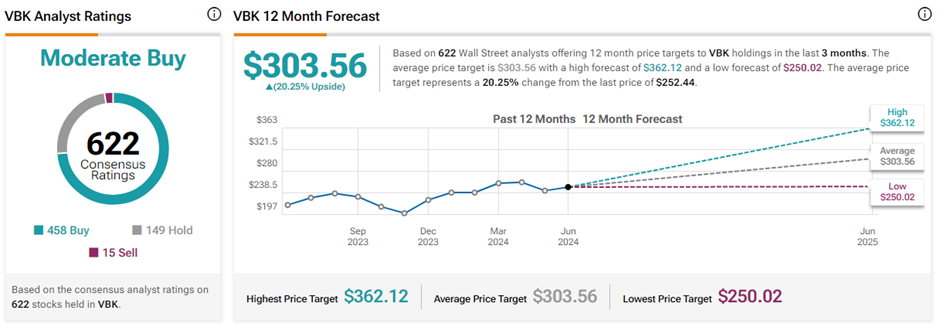

Based on the individual ratings of all the stocks in its portfolio, VBK has a Moderate Buy consensus rating on TipRanks. This rating is backed by 458 Buys, 149 Holds, and 15 Sell recommendations received in the last three months. The average Vanguard Small-Cap Growth ETF price target of $303.56 implies 20.3% upside potential from current levels. Year-to-date, VBK has gained 3.2%.

iShares Russell Mid-Cap Growth ETF (IWP)

The iShares Russell Mid-Cap Growth ETF seeks to track the performance of the Russell MidCap Growth Index, which is composed of mid-capitalization ($2 billion to $10 billion) U.S. equities that exhibit growth characteristics. The earnings of these companies are expected to grow at an above-average rate compared to the broader market. IWP also pays regular quarterly dividend of $0.10 per unit, carrying a yield of 0.48%.

At 0.23%, the expense ratio of IWP is slightly higher than that of VBK. Meanwhile, the top three sectors for this ETF are Technology (27.2%), Industrials (18.44%), and Healthcare (17.17%).

IWP has 332 holdings, of which the top 10 companies constitute 18.44% of the overall portfolio. As of date, IWP’s AUM stands at $14 billion. The ETF’s top three companies are CrowdStrike Holdings (CRWD), Apollo Global (APO), and Cintas (CTAS).

Is IWP a Good Investment?

On TipRanks, IWP has a Moderate Buy consensus rating based on 256 Buys, 67 Holds, and nine Sell recommendations. The average iShares Russell Mid-Cap Growth ETF price target of $124.45 implies 12.4% upside potential from current levels. IWP ETF has gained 6.2% so far in 2024.

American Century STOXX U.S. Quality Growth ETF (QGRO)

The American Century STOXX U.S. Quality Growth ETF seeks to track the performance of large and mid-cap U.S. companies that display attractive quality, growth, and valuation fundamentals. The benchmark index is the American Century U.S. Quality Growth Index. QGRO has a dividend yield of 0.32%, while it pays the lowest quarterly dividend of $0.06 among the three ETFs discussed in this article.

The QGRO ETF seeks to strike a balance between high-growth and stable-growth companies by employing a risk-adjusted returns strategy instead of selecting on the basis of just price movement. Its expense ratio is the highest among the three at 0.29%. Currently, its top sector exposures are Technology (37.3%), Consumer Cyclicals (17.83%), and Industrials (15.66%).

As of date, QGRO has 183 holdings, with the top ten accounting for 24.52% of the total portfolio AUM of $852.1 million. The ETF’s top three holdings are Alphabet Class A (GOOGL), Booking Holdings (BKNG), and ServiceNow (NOW).

Is QGRO a Good Buy?

Based on 146 Buys versus 37 Hold ratings, QGRO has a Moderate Buy consensus rating on TipRanks. The average American Century STOXX U.S. Quality Growth ETF price target of $93.59 implies 9.6% upside potential from current levels. QGRO has gained 12.4% so far this year.

Concluding Thoughts

Analysts forecast the highest share price appreciation potential in the Vanguard Small-Cap Growth ETF than the other two growth ETFs. Interestingly, the VBK ETF is primarily focused on small-cap companies that show higher growth potential compared to mid-cap and large-cap companies in times of economic expansion.