The Vanguard Total Stock Market ETF (VTI), which provides broad exposure to the entire U.S. stock market, is falling in premarket trading on Monday. Overall, the VTI ETF is up by 0.79% over the past five days and up 18.64% year-to-date.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

VTI Sees Heavy Inflows

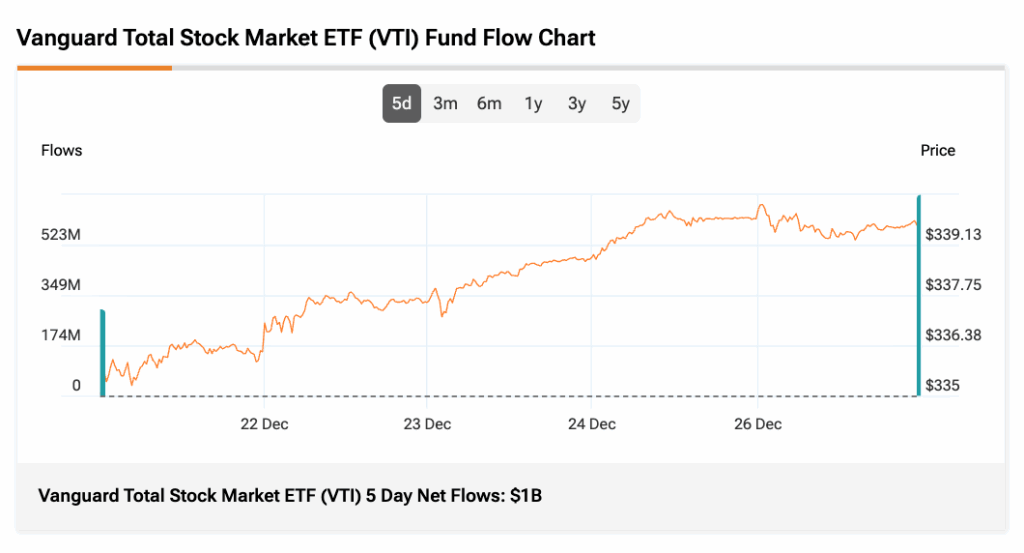

VTI’s three-month average trading volume stands at 4.14 million shares, highlighting strong liquidity. Over the past five days, the ETF has recorded net inflows of about $1 billion, signaling robust investor demand and growing confidence in broad U.S. equity exposure.

VTI’s Top Holdings

Currently, VTI holds 3,484 stocks with total assets worth $577.70 billion. Its top positions are:

- Apple (AAPL) – 6.28%

- Nvidia (NVDA) – 6.20%

- Microsoft (MSFT) – 5.55%

- Amazon (AMZN) – 3.40%

- Broadcom (AVGO) – 2.88%

VTI’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VTI is a Moderate Buy. The Street’s average price target of $395.78 implies an upside of 16.52%.

Currently, VTI’s five holdings with the highest upside potential are:

- Direct Digital Holdings (DRCT)

- Jupiter Neurosciences (JUNS)

- Reviva Pharmaceuticals Holdings (RVPH)

- Aemetis Inc. (AMTX)

- Adicet Bio Inc (ACET)

Meanwhile, its holdings with the greatest downside potential are:

Notably, VTI ETF’s Smart Score is eight, implying that this ETF is likely to outperform the broader market.

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, carefully curated based on TipRanks’ analysis.