The Vanguard Total Stock Market ETF (VTI), which provides broad exposure to the entire U.S. stock market, declined by 0.38% on Monday. Wall Street’s major indexes closed lower on Monday, as heavyweight technology stocks pulled back after last week’s gains.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

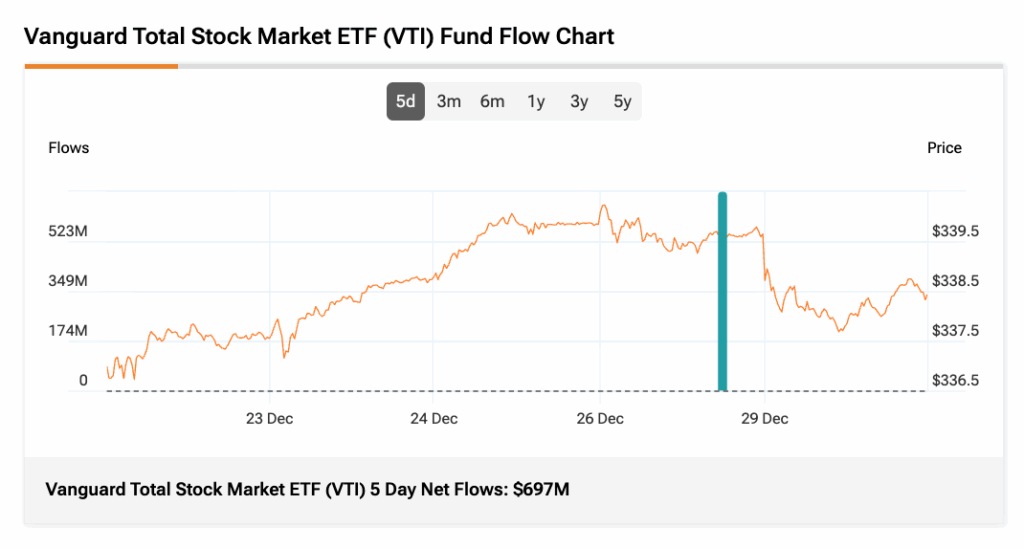

Overall, the VTI ETF is up by 0.43% over the past five days and by 18.64% year-to-date.

More Details on VTI ETF

VTI’s three-month average trading volume is 4.14 million shares. Meanwhile, its 5-day net flows were $697 million.

VTI’s Top Holdings

Currently, VTI holds 3,484 stocks with total assets worth $577.70 billion. Its top positions are:

- Apple (AAPL) – 6.28%

- Nvidia (NVDA) – 6.20%

- Microsoft (MSFT) – 5.55%

- Amazon (AMZN) – 3.40%

- Broadcom (AVGO) – 2.88%

VTI’s Price Forecasts and Holdings

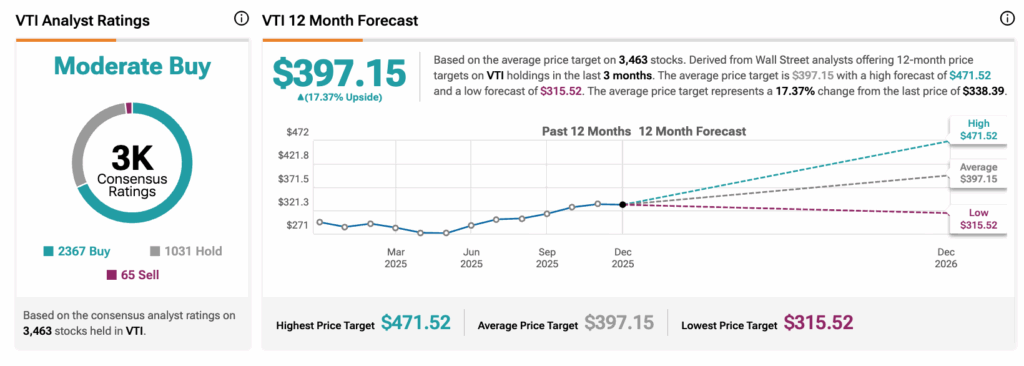

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VTI is a Moderate Buy. The Street’s average price target of $397.15 implies an upside of 17.37%.

Currently, VTI’s five holdings with the highest upside potential are:

- Direct Digital Holdings (DRCT)

- Jupiter Neurosciences (JUNS)

- Reviva Pharmaceuticals Holdings (RVPH)

- Aemetis Inc. (AMTX)

- Adicet Bio Inc (ACET)

Meanwhile, its holdings with the greatest downside potential are:

Notably, VTI ETF’s Smart Score is eight, implying that this ETF is likely to outperform the broader market.

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, carefully curated based on TipRanks’ analysis.