The Vanguard S&P 500 ETF (VOO), which tracks the S&P 500 Index (SPX), is up 0.05% in pre-market trading today after all three major U.S. indexes closed higher in the previous session. The Nasdaq 100 (NDX), the S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA), finished in the green following news that the U.S. had captured Venezuelan leader Nicolas Maduro and his wife, Cilia Flores, and charged them with narco-terrorism conspiracy and other crimes.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

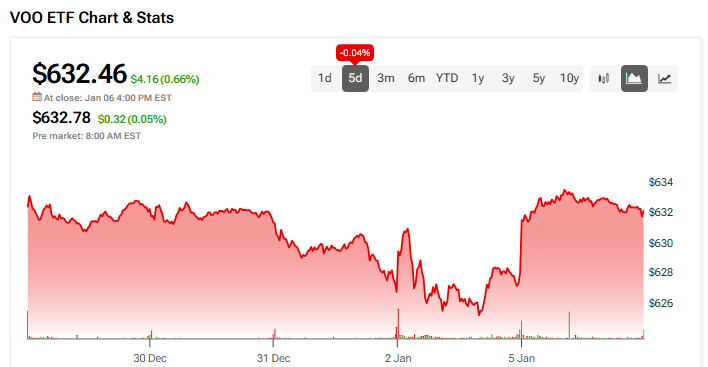

Overall, VOO has slipped 0.04% over the past five days. Even so, the ETF delivered a strong performance in 2025, gaining more than 14.7% despite the recent weakness in tech shares.

VOO’s Key Holdings with Highest Upside/Downside Potential

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VOO is a Moderate Buy. The Street’s average price target of $734.52 implies an upside of 16.14%.

Currently, VOO’s five holdings with the highest upside potential are:

- Texas Pacific Land (TPL)

- Oracle (ORCL)

- Datadog Inc. (DDOG)

- Super Micro Computer (SMCI)

- Trade Desk (TTD)

Meanwhile, its five holdings with the greatest downside potential are:

Revealingly, VOO ETF’s Smart Score is eight, implying that this ETF will likely outperform the market.

Does VOO Pay Dividends?

Yes, VOO pays dividends. These payments come from the dividends paid by the companies in the S&P 500, and VOO distributes them to shareholders every quarter. The payout amount can change from quarter to quarter because company dividends vary. Investors can receive the dividend as cash or choose to automatically reinvest it into more shares through a dividend reinvestment program.

VOO’s yield as of today is 1.12%.

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, carefully curated based on TipRanks’ analysis.